Shale Daily | E&P | NGI All News Access

Continental’s Hamm Calls for Probe of Crude Futures for Market Manipulation Following WTI Rout

The Covid-19 pandemic has led Midcontinent heavyweight Continental Resources Inc. to pull out all the stops, as it shuts in most of its oil production in North Dakota’s Bakken Shale.

Reportedly, the Oklahoma City-based independent also has declared a force majeure on at least one oil delivery contract.

The Bakken’s top producer during 2019 averaged 194,156 boe/d in the play, up 16% from 2018, with oil output alone climbing 14% to 148,416 b/d.

Executive Chairman Harold Hamm on Tuesday sent a letter to the Commodity Futures Trading Commission (CFTC) to probe crude futures for possible market manipulation or system failures following the rout in West Texas Intermediate prices on Monday (April 20).

“The sanctity and trust in the oil and all commodity futures markets are at issue as the system failed miserably and an immediate investigation is requested and, we submit, is required,” Hamm wrote.

Continental also filed a complaint with CME, which operates the U.S. crude futures benchmark.

CFTC declined to comment, but CME said Hamm’s allegations were “factually inaccurate” and said “prices reflect fundamentals in the physical crude oil market driven by the unprecedented global impacts of the coronavirus, including decreased demand for crude, global oversupply, and high levels of U.S. storage utilization.”

Continental plans to honor its transport contracts. However, “this pandemic has brought about conditions under which force majeure applies,” the company said.

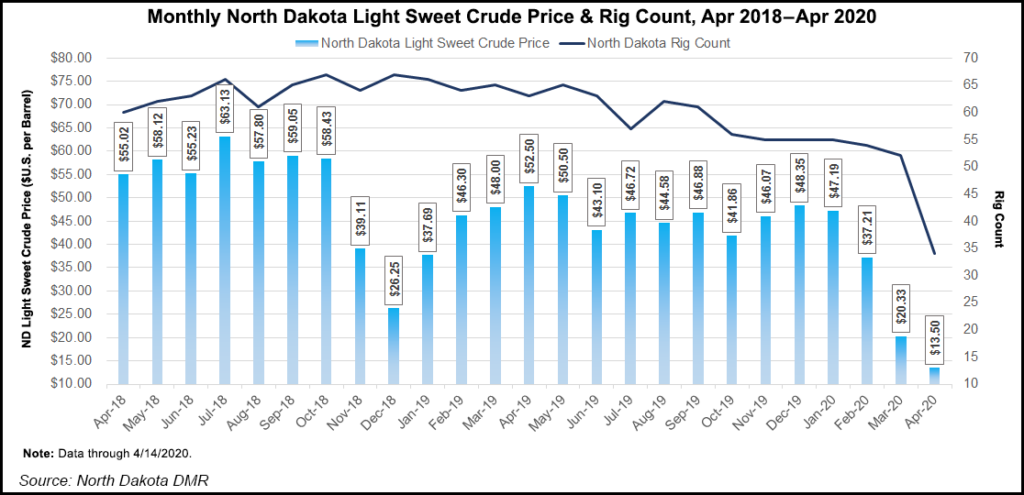

North Dakota overall produced more than 1.4 million b/d last year, second only to Texas, but the state has seen output drop by around 300,000 b/d. Denver-based Whiting Petroleum Corp., whose largest projects are in the Bakken and Three Forks formations, recently filed for Chapter 11 protection.

Continental, which last month reduced its capital expenditures by 55% from 2019, earlier this month also said it would reduce oil production during April and May by 30% in light of the pandemic.

The independent is particularly exposed to the oil markets because it has not hedged its production this year, according to Tudor, Pickering, Holt & Co. (TPH). The firm’s model shakes out output at 148,000 b/d for 2Q2020, taking into account well shut-ins and deferred turned-in-line wells from mid-March through mid-June.

TPH expects the shut-ins to come back online sometime in June with Continental’s 3Q2020 oil output rising by 12% sequentially.

“While curtailing production output is the right move from an economic perspective, the lack of hedging in place and some exposure to wide near-term Bakken differentials makes the equity one of the worst positioned within our coverage to withstand a lower-for-longer oil price scenario,” the TPH analysts said of Continental. “With a $1.5 billion revolver and minimal free cash flow generation, the near-term debt maturity wall is approaching,” with $1.1 billion due 2022, $1.5 billion due 2023 and $1 billion due 2024. The maturities are “something to keep an eye on with debt trading at 13% “yield to worst,” which is the lowest potential yield received from a bond, assuming the issuer does not default.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |