E&P | NGI All News Access | NGI The Weekly Gas Market Report

Continental Thrilled With Trio of Meramec Wells, Keeps Capex at $920M

Executives with Continental Resources Inc. raved about the performance of three new wells targeting the Meramec formation within Oklahoma’s stacked reservoirs. They said the company stands to benefit from the region’s over-pressured oil window, coupled with enhanced completion techniques.

During an earnings conference call Thursday to discuss 4Q2015 and full-year 2015, COO Jack Stark said the three wells targeting the Meramec — Boden 1-15-10XH, Compton 1-2-35XH and Blurton 1-7-6XH — “are delivering some the best rates of return in the company and rank among the best performing wells I’ve ever been involved with.” The Meramec is part of the STACK (Sooner Trend of the Anadarko Basin in Canadian and Kingfisher counties).

According to the Oklahoma City-based exploration and production (E&P) company, the Boden well had a 24-hour initial production (IP) rate of 3,508 boe/d (28% oil) at 5,400 pounds per square inch (psi) of forward casing pressure. The Compton well had 24-hour IP of 2,547 boe/d (71% oil) at 2,850 psi, and the Blurton well had 24-hour IP of 2,328 boe/d (78% oil) at 2,775 psi.

“The performance of these three wells continues to support our observation that wells completed in the over-pressured window of STACK produce at rates three times higher than what was completed in the normally-pressured window of STACK during the first 90 days on a normalized 9,800-foot basis,” Stark said. “This bodes well for Continental, as approximately 95% of our 155,000 net acres of STACK are located in the over-pressured window.”

Stark added that based on the early time performance of 14 wells targeting the Meramec — completed by Continental and other E&Ps in the over-pressured oil window of the STACK — the company’s estimated ultimate recovery (EUR) for a 9,800-foot lateral well was 1.7 million boe/well, a 55% rate of return (ROR) at a completed well cost of $10 million, assuming a West Texas Intermediate (WTI) crude oil price of $40/bbl and $2.25/Mcf for natural gas. Stark said about 30% of Continental’s acreage in the STACK overlies the over-pressured oil window.

In Oklahoma’s SCOOP (South Central Oklahoma Oil Province), Stark said that over the past year the company’s technical teams have tested various completion techniques at 15 wells over a broad area of the play. Seven of the wells with 90-180 days of production history showed a 30-35% increase in production, compared to legacy offset wells.

Consequently, the company increased its economic model — from 1.7 to 2 million boe/well — for a 7,500-foot well targeting the condensate window of the SCOOP’s Woodford Shale. At a targeted cost of $9.6 million, an enhanced well would generate a 25% ROR, assuming $40/bbl WTI and $2.25/Mcf for gas.

“Going forward, all SCOOP wells will be completed using enhanced completions,” Stark said. “Testing of these [wells] in higher proppant volumes will be conducted during the year as we continue to seek the optimal completion design. Recent test using these higher proppant volumes are showing promising results.”

Capex Plans Confirmed

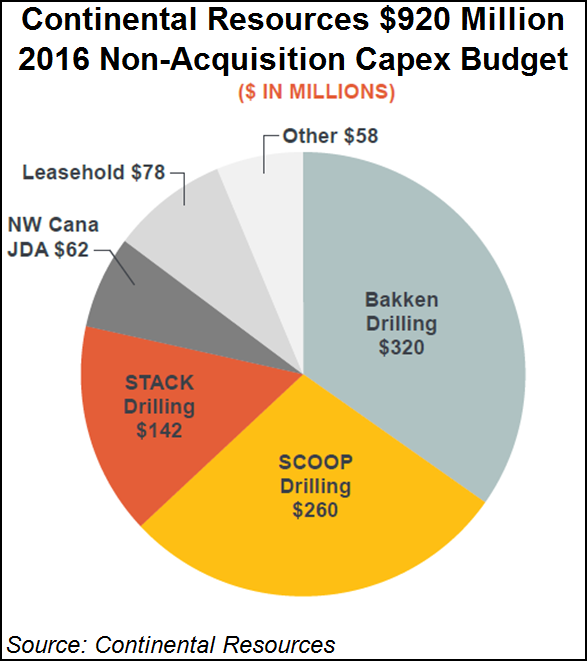

Continental confirmed its plans, announced last month, to spend $920 million on non-acquisition capital expenditures (capex) in 2016, a 66% decrease from the $2.7 billion allocated in 2015 (see Shale Daily, Jan. 27). The company in January estimated that it actually spent $2.5 billion on non-acquisition capex in 2015, coming in under budget by $200,000.

The largest piece of the capex pie, $320 million (34.8%), will go toward drilling in the Bakken Shale. Drilling in the SCOOP will receive $260 million (28.3%) in funding, followed by the STACK at $142 million (15.4%). Continental will also spend $62 million (6.7%) to develop acreage in the northwest Cana-Woodford Shale, where it has a joint development agreement (JDA) with SK E&S, a subsidiary of South Korea’s SK Group (see Shale Daily, Oct. 27, 2014).

The remaining $136 million (14.8%) of the capex budget is to be spent on other costs, including routine leasing and renewals ($78 million), workovers and facilities.

Continental plans to average 19 operated drilling rigs in 2016. It would deploy four rigs in the Bakken; five to six rigs in the SCOOP; four to five rigs in the northwest Cana JDA; and four to five rigs in the STACK. The company has reduced its operated rig count to 19 by dropping four rigs in the Bakken, something it hinted at doing last November (see Shale Daily, Nov. 6, 2015).

The company expects to complete 71 net wells, both operated and non-operated, in 2016 — 26 in the Bakken, 25 in the SCOOP, 11 in the Cana and nine in the STACK. Continental said most of the Bakken wells are to be deferred this year, which should increase its inventory of drilled but uncompleted (DUC) wells in the Bakken to 195 gross, up from 135 at the end of last year. Another 50 wells in Oklahoma will be DUC at the end of 2016, up from 35.

COO Jack Stark said there were four reasons for deferring the Bakken completions.

“One, we don’t want to bring on more barrels [of oil] in this low price environment,” Stark said. “Two, we have the flexibility to defer completions, since our acreage is essentially held by production. Three, it reduces capex. And four, it leaves us with a significant inventory of high-quality wells to complete as prices improve.

“This DUC inventory will have an average EUR [estimated ultimate recovery] of approximately 850,000 boe per well, and represents a valuable asset for the company that will be a strong catalyst for future growth.”

Company ‘Disappointed’ by Credit Downgrades

CFO John Hart said that while the company was “disappointed” that its credit rating was recently downgraded by Standard & Poor’s Ratings Service (S&P) and Moody’s Investors Service (see Shale Daily, Nov. 30, 2015; Daily GPI, Nov. 6, 2015), the downgrades would not significantly impact the company.

“The only change is to the interest rate on the revolver and term-loan,” Hart said. “We anticipate this downgrade will increase the interest expense by approximately $3-4 million annually. Otherwise, our credit facility structure is unchanged. The terms of our other long-term debt are also unchanged.

“We are and will remain in regular communication with both agencies. We will continue to manage our business in a prudent and thoughtful manner as our long-term view for operating the company is unchanged. We continue to have ample liquidity and no near-term debt maturities.”

Hart said that at the end of December, Continental had $853 million borrowed against its unsecured revolving credit facility. That figure fell to $830 million last Friday, giving the company $1.9 billion in available borrowing capacity.

Continental produced 224,936 boe/d during 4Q2015, and averaged 221,715 boe/d for the full-year 2015, a 27.3% increase over 2014 (174,189 boe/d). The company issued production guidance of 200,000 boe/d for 2016, and projected that operating expenses will range from $4.25-4.75/boe.

In the SCOOP, Continental holds 214,000 net acres in the emerging Springer Shale and 440,000 net acres in the Woodford Shale. The company also holds 155,000 net acres in the STACK and 38,600 net acres in the JDA area in the northwest Cana-Woodford Shale. But the company’s largest asset in terms of net acreage is the Bakken, where it holds about 1.05 million net acres.

The E&P reported a net loss of $139.7 million (minus 38 cents/share) in 4Q2015, and a net loss of $353.7 million (minus 96 cents/share) for the full-year 2015. By comparison, Continental had net income of $114 million (31 cents/share) in 4Q2014 and $977.3 million ($2.64/share) in 2014. Revenue for 4Q2015 was $575.5 million and EBITDAX (earnings before interest, taxes, depreciation, amortization, and exploration expenses) was $420.2 million. For the full-year 2015, revenue was $2.7 billion and EBITDAX was $1.98 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |