NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

Constitution Pipeline Finally Scrapped as NatGas Prices Tank and Opposition Pushes Up Costs

The Constitution Pipeline project has been canceled, capping an eight year battle that ends at a time when gas prices have hit historic lows and there’s little need for more natural gas in the Northeast from a greenfield system.

Williams, along with partners Altagas Ltd., Cabot Oil & Gas Corp. and Duke Energy Corp., said Monday that “the underlying risk-adjusted return for this greenfield pipeline project has diminished in such a way that further development is no longer supported.”

The company added that “our existing pipeline network and expansions offer much better risk-adjusted return than greenfield opportunities, which can be impacted by an ambiguous and vulnerable regulatory framework.”

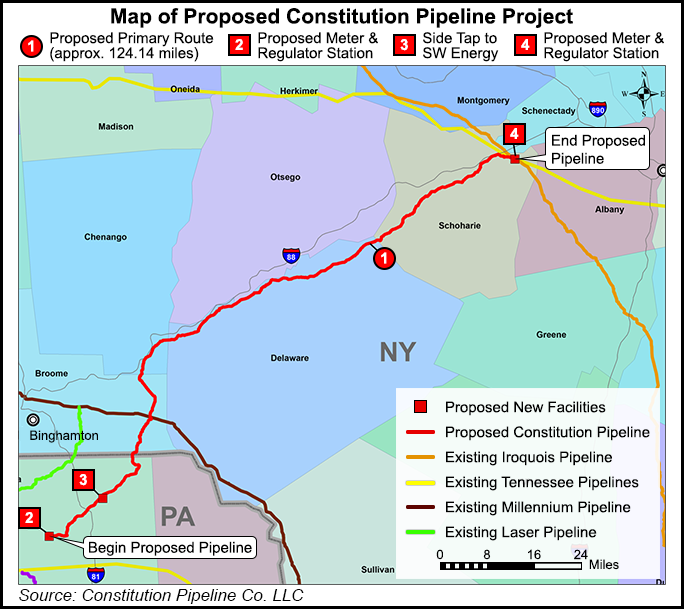

New York state regulators dealt the project what proved to be an irreversible blow in 2016 when after three years of regulatory review they denied the pipeline a water quality certificate (WQC). The decision set in motion a prolonged legal fight. Proposed in 2012, the 124-mile pipeline would have carried 650 MMcf/d of Appalachian shale gas from Northeast Pennsylvania to an interconnect with interstate lines in New York.

It was originally slated to enter service in 2015.

“Constitution’s investors just confirmed what we have been saying for the past eight years, there is no need for this project,” said Anne Marie Garti, an attorney and founding member of Stop the Pipeline, which was formed to fight Constitution.

FERC ultimately found that New York regulators took too long to issue a decision on Constitution’s WQC and last year waived the state’s regulatory authority. Another favorable outcome for the project at the U.S. Court of Appeals for the District of Columbia paved the way for the Federal Energy Regulatory Commission’s waiver. But the breakthroughs came too late for the pipeline and followed multiple defeats, including those before the U.S. Court of Appeals for the Second Circuit and the U.S. Supreme Court.

In the meantime, other pipelines came online and more demand was created in Appalachia. Cabot, an equity participant with 500 MMcf/d of capacity booked on Constitution, had been signaling behind closed doors that the project wasn’t likely to get built given how much the market has changed, said Gabriele Sorbara, an analyst at Williams Capital Group LP that covers the company.

“They were thinking that it was kind of a sunk cost and they didn’t need the project going forward, and the reason, obviously, is the industry is just sort of slowing down,” Sorbara told NGI on Monday. “There’s too much gas.”

Indeed, Cabot has slashed spending and activity to maintenance levels as gas prices remain below $2.00/MMBtu. Management said Friday on the company’s year-end earnings call that it could cut back further if warranted. Cabot has also met more in-basin demand in recent years as gas-fired power plants have come online in Pennsylvania along with other major infrastructure projects such as the Atlantic Sunrise pipeline.

“What has also changed here in the past few years is the cost to build a pipeline,” Sorbara added. “It’s much more expensive to build it today. There’s no need to bring on incremental gas either; it seems like everybody should be slowing down.”

Natural gas infrastructure projects have continued to face staunch resistance in the Northeast. New York has refused to authorize others like the Northern Access expansion and the Northeast Supply Enhancement (NESE) project, which is also backed by Williams. The company said Monday that it remains committed to NESE and other expansions like Leidy South.

Other Appalachian projects, such as the Mountain Valley Pipeline and Atlantic Coast Pipeline (ACP), are also in regulatory limbo as they’ve faced repeated legal challenges from environmental groups. The U.S. Supreme Court was scheduled on Monday to hear oral arguments for a key authorization that would allow ACP to cross the Appalachian Trail.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |