Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Cogent to Expand Permian Midland Natural Gas Processing

Dallas-based Cogent Midstream LLC said Wednesday it plans to expand its natural gas processing capacity in West Texas with an additional 200 MMcf/d refrigerated cryogenic processing plant at the Big Lake Plant in Reagan County.

Big Lake II in the Midland sub-basin of the Permian is scheduled to be in service by late 2019. Once the new plant is in operation, Cogent’s total gas processing capacity in the Midland is expected to be 510 MMcf/d.

“Our investment in the Big Lake II Plant is another example of the commitment Cogent has to this area and the growth opportunities presented by our customers’ robust drilling programs,” said Cogent CEO Dennis J. McCanless, who was named CEO in June.

McCanless, who also serves as an operating partner at EnCap Flatrock, previously was the president and CEO of Gas Solutions Holdings Inc. and from 2002-2007 also served as Enbridge Energy’s director of commercial assets in Houston.

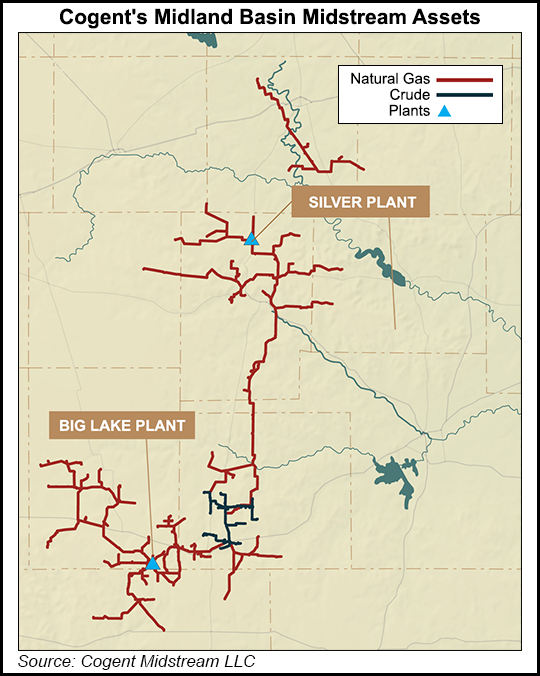

Cogent’s Midland assets formerly were operated under the Lucid Energy Group I brand. Cogent provides the same oil and gas midstream services in the Midland, with more than 650 miles of pipeline in operation and three active gas processing plants.

Current services include low-pressure gas gathering, compression and processing; crude oil gathering by pipeline and third-party condensate stabilization. Gas processing capacity available now totals 310 MMcf/d, with crude oil gathering system capacity of 80,000 b/d.

The systems serve West Texas operators working in Coke, Crockett, Glassock, Irion, Mitchell, Reagan, Schleicher, Sterling and Tom Green counties.

Cogent is backed by capital commitments from EnCap Flatrock Midstream. It is not affiliated with Lucid Energy Group, which owns and operates Permian assets in the Delaware sub-basin of southeastern New Mexico.

The management team at Cogent also includes COO Stan Golemon, who joined the former Lucid company in 2016 as senior vice president (SVP) of engineering and operations. Prior to Lucid, he was SVP of operations services at EnLink Midstream. CFO Bradley K. Alford, who joined the company in July, previously was financial chief for EagleClaw Midstream through the sale in 2017 to affiliates of Blackstone Capital Partners.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |