E&P | NGI All News Access | NGI The Weekly Gas Market Report

Cimarex, Parsley Expecting Price Advantages by Delaying Some Permian Output

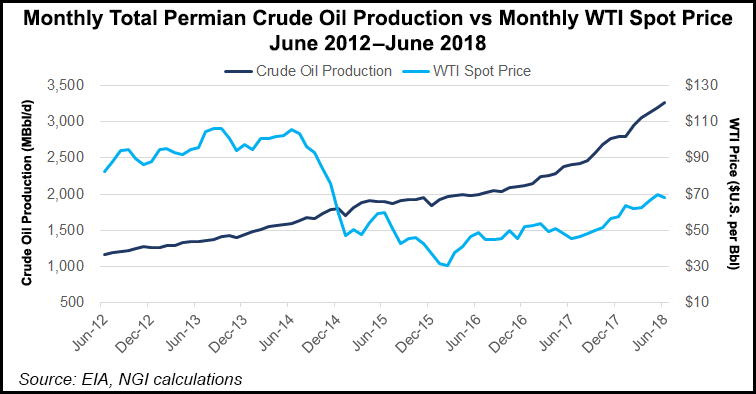

Cimarex Energy Co. said it plans to increase crude oil production up to 25% year/year (y/y) while Permian pure-player Parsley Energy Inc. has increased its spending plans and year-end production guidance to reflect shorter cycle times not seen since a wave of asset integrations.

Denver-based Cimarex, which operates in the Permian and the Midcontinent, said it expects to close the sale of 28,657 net acres in Ward County, TX, to a subsidiary of Callon Petroleum Co. for $570 million by the end of the month. Minus the assets, the company expects total production to average 206,000-215,000 boe/d in 3Q2018 and 214,000-221,000 boe/d for the full year. Meanwhile, oil production is expected to average 61,500-64,500 b/d in 3Q2018 and 66,000-68,000 b/d for the full year.

“What we’re going to end up seeing is the ramp starting in September and really starting to materialize itself as you get into November and December,” COO Joe Albi said during a second quarter earnings call last week. “As far as what we’re talking about for 2018, we’re still going to be increasing according to our modeling our equivalent oil production as we enter into December…

“The bulk of our completions are forecast to transpire between August and October and then, for this year’s program, it kind of tapers off as you go into December. If you were to [ask if] we are projecting a huge completion ramp into December, I’m going to tell you ‘No, it’s happening in late 3Q2018 and early 4Q2018.’ This is no different than we’ve been talking about all year, and to date our cadence has been relatively tight with what we’ve projected.”

CEO Tom Jorden said next year the company plans to “time any acceleration in our Permian program so that flush production takes place in the second half of the year when Midland-Cushing differentials should narrow as new oil pipelines come online.

“Getting this right could have a significant impact on our cash flow and on our returns. We will also remain opportunistic for asset purchases or consolidation opportunities that make sense.”

Albi said on a realized price basis, Cimarex “will still be exposed to the El Paso and Waha basis differentials in the Permian, and the Panhandle, ANR and OGT differentials in the Midcontinent.”

During 2Q2018, Cimarex saw increased production across the board, both in terms of commodity type and source basin. Total production averaged 211,424 boe/d, a 9.7% increase y/y. Natural gas production climbed 4.4% y/y to 539.5 MMcf/d, crude oil production averaged 61,651 b/d, up 6.5%, and natural gas liquids (NGL) production was almost 23% higher at 59,857 b/d.

Permian production was 13% higher at 121,744 boe/d, while Midcontinent production was 88,864 boe/d, up 4.8%. In the Permian, natural gas production rose 9.4% y/y to 240.5 MMcf/d, while oil production increased 6.5% to 48,797 b/d and NGL production went up 31.5% to 32,865 b/d. Meanwhile, Midcontinent natural gas production increased 0.5% y/y to 297 MMcf/d while oil production was up almost 5% to 12,473 b/d) and NGL production rose 13.5% to 26,894 b/d.

Cimarex spent $375 million on exploration and drilling costs in 2Q2018, nearly flat from a year ago, with most (59%) directed to the Permian and 41% to the Midcontinent. The company brought 89 gross (23 net) wells online during the quarter, including 32 gross (13 net) in the Permian and 57 gross (10 net) in the Midcontinent.

The company said it had 141 gross (57 net) wells awaiting completion at the end of the quarter. Of those, 45 gross (32 net) were in the Permian and 96 gross (25 net) were in the Midcontinent. Cimarex also said it was running 13 drilling rigs (10 Permian, three Midcontinent) and had six completion crews deployed (five Permian, one Midcontinent).

Cimarex reported net income of $141 million ($1.48/share) in 2Q2018, compared with net income of $97.3 million ($1.02) in the year-ago quarter. Revenues totaled $556.3 million in 2Q2018, up 21.9% from 2Q2017.

Parsley Raises Production Guidance, Capital Spend

Austin, TX-based Parsley said it was raising the midpoint of its full-year production guidance by 5% (to 106,000-111,000 boe/d) and crude oil production by 3% (68,000-70,500 b/d). The company also increased its capital spending for the year by 17.2%, to $1.65-1.75 billion. Cycle times were at a level last seen in early 2017, management said, before it acquired and integrated several assets.

“Coming into this year, we simplified our development program in an effort to reignite operational momentum,” COO Matthew Gallagher said during a quarterly earnings call last week. “At this point, we’re ready to declare that simplified program a success. This means we’ll be transitioning back toward larger pads on average.

Like Cimarex, Parsley saw production increases among all commodities. Total production rose almost 67% from a year ago and 15% sequentially to 107,813 boe/d. Natural gas production was up 70% y/y and 8% from the first quarter at 9,235 MMcf, while NGL production almost doubled from a year ago (97%) and 28% sequentially to 2,106 bbl. Oil output increased from a year ago by 57% and it was 15% higher sequentially to 6,165 bbl.

The company spud 43 wells and placed 45 gross (44 net) wells into production in 2Q2018, of which 37 gross wells were in the Midland sub-basin of the Permian and the remaining eight in the Delaware sub-basin. Parsley said it expects development activity for the rest of the year will be weighted toward the Midland.

“Our current activity profile is well distributed across our footprint,” CEO Bryan Sheffield said. “We’re favoring our Delaware acreage given the associated mineral interests. But even there, we have more than a decade of remaining inventory.

“On the Midland side, we’re not leaning on any particular area to drive the volume growth we’re generating. This means we’re likely to have a fairly stable geographic mix going forward. And this supports our ability to deliver consistent production growth over time.”

COO Matthew Gallagher said Parsley currently is drilling two- or three-well pads, with the majority of its program envisioning three- or four-well pads, with a handful of six-well pads under consideration. He said “now is the perfect time” to implement a change because it delays wells placed on production (POP).

“If you look at it that way, versus running a two- to three-well pad program, [this] delays POPs during the foreseen tightness period in the Midland pricing on the largest differentials forecasted,” Gallagher said. “So, it does bring them on later, versus Q12019 or something like that. But it’s not a light switch where every program is flipped over and going to six-well pads. We’re feathering these things in.”

Parsley reported net income of $141 million (44 cents/share) in 2Q2018, compared with net income of $55.8 million (17 cents) in the year-ago quarter. Total revenues were $467.8 million in 2Q2018, more than double from a year ago ($213.7 million).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |