NGI All News Access | Infrastructure | LNG

Chevron Preparing to Ship More Australian LNG with Wheatstone Ramp Up

Chevron Corp. has ramped up liquefied natural gas (LNG) production at the Wheatstone Project in Western Australia, with the first cargo on track for shipping in the coming weeks.

“First LNG production is a significant milestone and is a credit to our partners, contractors and the many thousands of people who collaborated to deliver this legacy asset,” said CEO John Watson. “Wheatstone adds to our legacy gas position in Australia that will be a significant cash generator for decades to come.”

At full capacity, Wheatstone’s two-train facility is expected to supply 8.9 million metric tons/year (mmty) of LNG for export to customers in Asia.

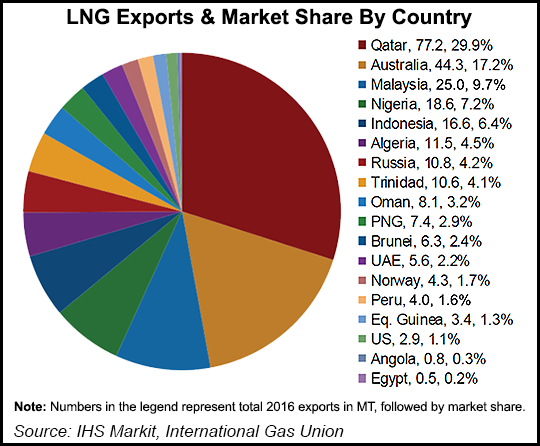

A plethora of LNG projects is in the works or underway in Australia as it vies to become the world’s leading gas exporter, potentially overtaking Qatar. Australia overtook Qatar in 2013 as Japan’s top LNG supplier, and in 2015 it became the second-leading LNG exporter. The country is poised to overtake Qatar in 2020.

Chevron’s other Australian LNG project, Gorgon, which is considered one of the largest gas export facilities ever built, began operations last year. It is designed to export up to 15.6 mmty of LNG from Barrow Island, with contracts secured with Asia Pacific buyers. A carbon dioxide injection project and a domestic gas plant with the capacity to supply up to 300 terajoules/day to Western Australia also are part of the project.

Wheatstone is a joint venture between Australian subsidiaries of Chevron (64.14%), Kuwait Foreign Petroleum Exploration Co. (KUFPEC) (13.4%), Woodside Petroleum Ltd. (13%), and Kyushu Electric Power Co. (1.46%), together with PE Wheatstone Pty Ltd., part owned by JERA (8%).

Wheatstone is 7.5 miles west of Onslow and processes gas from the Chevron-operated Wheatstone and Iago fields. Chevron holds an 80.2% interest in the offshore licenses containing the Wheatstone and Iago fields.

With Wheatstone and Gorgon fully online by mid-2018, Chevron should see significant free cash flow improvement, according to Tudor, Pickering, Holt & Co.

“We see high cash margins out of these LNG projects as we see estimated total cash costs to deliver LNG to Asia of less than $2.50/MMBtu, which implies $5.00/MMBtu ($30/bbl) cash margin at $55/bbl Brent, given little or no tax payable due to accelerated depreciation,” said analysts.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |