Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

Chesapeake Sues McClendon Over Trade Secrets

American Energy Partners LP (AELP) and its founder, Aubrey K. McClendon, said they intend to “respond vigorously” to a lawsuit filed Tuesday by Chesapeake Energy Corp. that alleges the former Chesapeake CEO stole trade secrets during his final months at the helm to benefit the partnership.

The lawsuit, filed in Oklahoma County District Court, alleges that McClendon “misappropriated highly sensitive trade secrets” and then used them to benefit AELP and affiliates, which he and his partners founded in 2013 [Chesapeake Energy Corp. vs. American Energy Partners LP et al, No. CJ-2015-933]. The actions were discovered through a forensic analysis of McClendon’s Chesapeake email account, according to the lawsuit.

Because of “the concealed nature of McClendon’s conduct, Chesapeake did not discover McClendon’s misappropriation until long after he had separated.”

McClendon asked his personal assistant to print maps and data about unleased acreage during his final months at Chesapeake, the lawsuit says. McClendon was forced to resign in January 2013; his exit date was April 1, 2013 (see Daily GPI, Jan. 31, 2013).

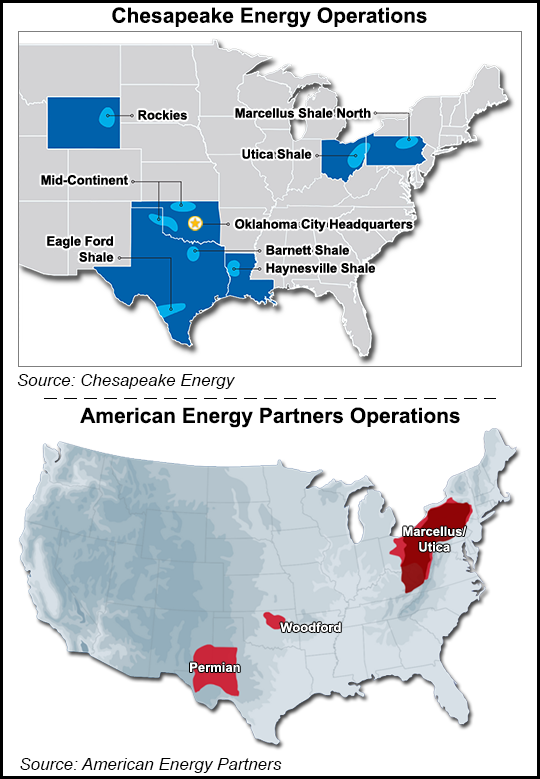

During the tumultuous final months at the company, McClendon allegedly sent himself blind copies of the printed documents to a personal email address. The information then was used by AELP to acquire drilling rights on land in the Utica Shale in four separate transactions, the lawsuit claims.

“Approximately 36 hours after the announcement of his departure and unbeknownst to Chesapeake, McClendon began misappropriating confidential information and trade secrets…On Jan. 31, 2013, McClendon located an email chain which was over a year old and included a report and a map of ‘open’ acreage unleased by Chesapeake or its competitors in the Utica Shale play at the time. The report and map not only showed open acreage, but also delineated Chesapeake’s confidential and proprietary analysis of the wet, dry and oil windows of the play and its grading of ‘tier 1’ and ‘core’ open acreage.”

The acreage in question involves the August 2013 purchase of 72,000 total acres (see Shale Daily, Aug. 21, 2013); a joint venture formed in October 2013 to develop land in Ohio’s Guernsey and Harrison counties (see Shale Daily, Oct. 10, 2013); the acquisition of 130,000 net acres from three landowners in February 2014 (see Shale Daily, Feb. 3, 2014); and the purchase last June of 27,000 net acres in Monroe County, OH (see Shale Daily, June 9, 2014).

Chesapeake, which claims the defendants’ actions were “willful and malicious, is seeking its actual loss and the amount by which each of the defendants were enriched. Alternatively, the plaintiffs are seeking a “reasonable royalty” for the defendants’ “unauthorized disclosure and use of Chesapeake’s trade secrets.”

Within weeks of his forced retirement, McClendon had set up office space across town in Oklahoma City and registered AELP and several company names (see Daily GPI, April 17, 2013).

Under a noncompete agreement with Chesapeake, McClendon’s contract barred him from using for one year confidential information that he acquired. He also was prohibited from acquiring, or from helping someone else acquire, oil and natural gas interests immediately adjacent to Chesapeake holdings while he continued to receive severance payments.

However, McClendon then and now owns interests in thousands of Chesapeake wells under the shareholder-approved Founder Well Participation Program (FWPP), which had given him for years the sole contractual right to receive a 2.5% stake in every well the company drilled. The FWPP was restructured in 2012 and is to end this year (see Daily GPI,April 27, 2012).

“It is beyond belief that the company that I co-founded 25 years ago and where I worked tirelessly to build it into one of America’s largest and most successful oil and gas producers has now decided to add insult to injury almost two years to the day after my resignation by wrongly accusing me of misappropriating information,” McClendon said Tuesday. “Under my agreements with Chesapeake, I am entitled to possess and use the 20 terabytes of information I own. It is a sad day to see Chesapeake stoop so low as to sue its co-founder for having information that was earned, paid for and provided through my contracts with Chesapeake.”

Chesapeake’s lawsuit is baseless, according to McClendon and AELP.

“When Mr. McClendon agreed to leave Chesapeake in January 2013, the company made a deal with him,” AELP said. “First, the company promised he would be paid his compensation benefits as provided for in his employment agreement and second, the company promised he would be provided with an extensive array of information about the more than 16,000 wells, and the related leasehold acreage and future wells, he jointly owns with Chesapeake.

“That information includes land, well, title, accounting, geological, engineering, reservoir, operating, marketing and performance data. The deal further gave Mr. McClendon the right to own and use this information for his own purposes, including sharing it with his employees, contractors, advisers, consultants and affiliated entities.”

The agreement with McClendon, said AELP, “to share this information was well-documented and very clear — and it was a critical part of a detailed and extensively negotiated set of documents that were approved by Chesapeake, its attorneys, and its board,” which were filed with the Securities and Exchange Commission in April 2013.

“Now it appears that Chesapeake wishes it had not agreed to the deal it made with Mr. McClendon and has sued to break those promises. However, a deal is a deal and Mr. McClendon and AELP will be vindicated in this dispute, and Mr. McClendon’s contractual rights to keep and use the information he received in the deal will be affirmed.”

AELP also noted that McClendon paid Chesapeake “nearly $2.5 billion in connection with the jointly owned properties and is still a working interest owner in more than 16,000 Chesapeake wells, making him the company’s single largest partner.”

“Further, Chesapeake has refused to provide over 1,000 assignments of leases to Mr. McClendon for interests in wells for which he has been billed and for which he has paid more than $100 million on a net basis to Chesapeake. It has also converted to its own use revenue due him that has been paid to Chesapeake by third parties on at least 63 other wells. Mr. McClendon will enforce his rights under the agreements.”

McClendon and AELP are represented by Matthew A. Taylor with Philadelphia-based Duane Morris LLP and Emmet T. Flood with Washington, DC-based Williams & Connolly LLP.

The filings, including McClendon’s separation agreements from Chesapeake, “will show that any information in Mr. McClendon’s possession is rightfully his pursuant to the terms of the agreements entered into between the parties,” Taylor said. “In fact, the separation agreement between the parties makes explicit and repeated reference to the data and services owed to Mr. McClendon, recognizing that the sharing of information is ”essential’ and in fact ‘beneficial to the company.’ We are 100% confident that Mr. McClendon and AELP will prevail in this dispute.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |