E&P | NGI All News Access | NGI The Weekly Gas Market Report

Chesapeake Resets 2015 Spending Even Lower, Reduces Rig Count

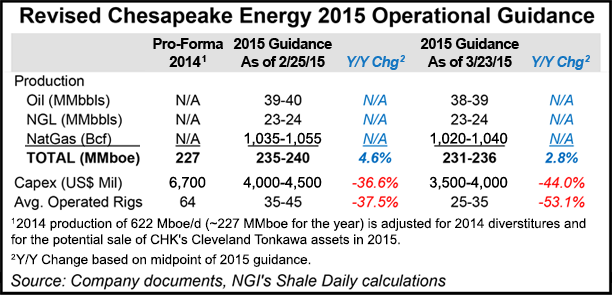

Chesapeake Energy Corp. on Monday reduced its 2015 capital budget by $500 million to $3.5-4.0 billion and now expects production to increase by only 1-3% from 2014, versus an original forecast of 3-5% growth.

The onshore rig count has been reduced by 55% from last year’s levels, with plans to operate an average 25-35 rigs, versus 64 in 2014.

“We entered 2015 with a strong liquidity position and we intend to manage it prudently,” said CEO Doug Lawler. “In response to continued weak commodity prices, we are further reducing capital expenditures and associated drilling activity. As a result, we now forecast ending 2015 with approximately $6 billion in combined cash and borrowing capacity under our credit facility. With this budget revision we anticipate being free cash flow neutral by the end of 2015.”

Only one month ago, Chesapeake announced it would trim 2015 capital spending plans from 2014 by more than one-third and cut the rig count to the lowest level in 11 years (see Shale Daily,Feb. 25). The original capital spending plan of $4.0-4.5 billion already was 37% lower than 2014’s $6.7 billion and from 2013’s $7.8 billion. Production this year was expected to be 3-5% higher than last year, averaging around 645,000-655,000 boe/d, adjusting for asset sales. Last year production averaged 706,000 boe/d total, before asset sales.

All of those figures are out the window.

In the revised guidance issued late Monday, production growth has been slashed to 1-3% over 2014, adjusting for asset sales. Production now is expected to be 231-236 million boe, or 635,000-645,000 boe/d. The operator expects to spud 520 gross operated wells and connect 650, versus 1,175 spud and 1,150 connected last year. Output this year now is expected to include 1,020-1,040 Bcf, as well as 38,000-39,000 bbl of oil and 23,000-24,000 bbl of natural gas liquids (NGL).

Based on strip prices as of March 20, estimated realized hedging effects are 34 cents/Mcf for natural gas, with oil at $21.11/bbl. Estimated differentials to the New York Mercantile Exchange priced natural gas at $1.70-1.90/Mcf, with oil at $7.00-9.00/bbl and NGLs at $48.00-52.00/bbl.

Chesapeake management in recent weeks “had made it clear that the budget was in line for additional cuts if commodity prices remained challenged,” wrote analysts with Wells Fargo Securities Tuesday. “So, no surprise” that the producer reined in plans to address its material outspend. “Nonetheless, the new midpoint of production guidance at 3.84 Bcfe/d falls below our/Street’s 3.91 Bcfe/d; crude midpoint down 2.5% to 105,500 b/d, gas midpoint down 1.4% and NGLs unchanged.” The news “had been priced to some extent in our view as shares have underperformed gassy peers in March…”

Tudor, Pickering, Holt & Co. saw the move as a positive — and expected. However, the cuts “came earlier than we thought as management revises capital budget closer to cash flow…Importantly, the exit rate guidance on rig count implies much steeper decline than headline average as the company plans to operate 14 rigs entering 2016,” which is down 80% from the 2014 average. Production for this year is “relatively unaffected,” with gas down 1% from previous guidance and oil off 3%. “2016 numbers, however, are coming down.”

In a filing late Monday, corporate raider Carl Icahn disclosed that his active interest in Chesapeake has increased to 10.98% from 9.98% in December. His investment firm now controls 73 million shares, versus 66 million at the end of 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |