Shale Daily | E&P | Eagle Ford Shale | Haynesville Shale | NGI All News Access

Chesapeake Cleared for Reverse Stock Split to Lift Share Price

Chesapeake Energy Corp. shareholders have authorized a reverse stock split allowing the company to combine 200 shares into one.

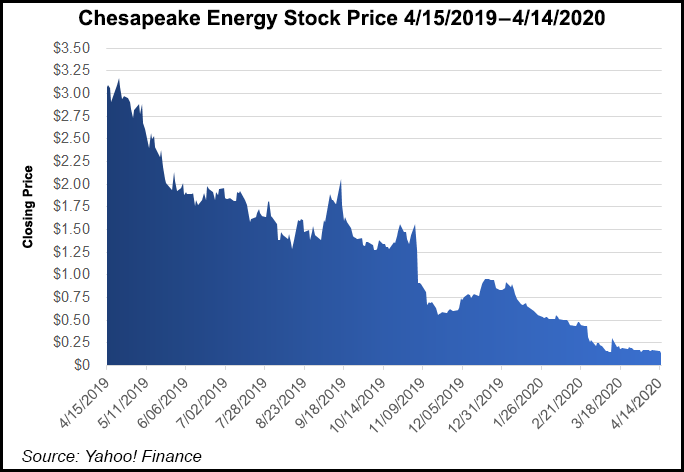

The common stock is scheduled to begin trading on Wednesday as a split-adjusted basis after shareholders approved it in a special meeting on Monday. The move is aimed at lifting the stock price, which has traded at a 52-week low of 12 cents/share, and regaining compliance with a NYSE delisting notice issued in December.

The 1-for-200 split doesn’t require any action from shareholders. Chesapeake also said no fractional shares would be issued, with any shareholder entitled to them instead paid cash. Once effective, the number of outstanding common shares would be cut to about two million from nearly two billion. The number of shares to be issued also would be reduced to 22.5 million from three billion.

The reverse stock split is one in a series of moves that Chesapeake has executed since last year to better manage financial woes. While it retracted a warning issued last November that it could ultimately file for bankruptcy, the company still has $9 billion of debt, some of which is set to mature this year as oil and gas demand plummets because of the coronavirus.

Questions of Chesapeake’s solvency resurfaced last week after the Wall Street Journal reported that global investment firm Franklin Resources Inc. is taking steps to prepare for a debt restructuring or bankruptcy filing by the company.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |