Infrastructure | LNG | Markets | NGI All News Access

Cheniere Ops Overcoming ‘Relative Softness’ in Global LNG Market, CEO Says

Cheniere Energy Inc. is weathering near-term softness in global liquefied natural gas (LNG) markets through the strength of its operational performance, management said Thursday, with the exporter continuing to grow cargoes and revenues during the second quarter.

The Houston-based U.S. LNG vanguard said that as of July 31 it has produced, loaded and exported more than 750 cumulative LNG cargoes.

“Cheniere’s spot volumes in our portfolio this year are increased due to our success and construction execution,” CEO Jack Fusco said during a conference call Thursday to discuss the company’s 2Q2019 results. This includes “an excellent operating performance at our facilities, which has resulted in trains entering service ahead of schedule, volumes ramping up ahead of schedule and better than expected production.

“We are starting to see a light at the end of the short-term market tunnel with some attractive winter spreads in the market, though our results and our outlook for the rest of the year have been impacted by the lower pricing environment.”

During the quarter the operator produced the first LNG at Train 2 of its Corpus Christi Liquefaction Project and exported the first commissioning cargo from the facility’s second train.

Also during the quarter, Cheniere made a final investment decision (FID) to move forward with Train 6 at the Sabine Pass LNG terminal, giving Bechtel Oil, Gas and Chemicals Inc. full notice to proceed with construction in June. Trains 1-5 at the facility are currently operational.

As for its Corpus Christi LNG terminal, Cheniere earlier this year reached an integrated production marketing deal with Apache Corp. to purchase 140,000 MMBtu/d of gas for a roughly 15-year term at prices based on international LNG indexes.

Train 1 at Corpus Christi is operational, while Train 2 is undergoing commissioning and Train 3 is under construction, management said. Corpus Christi Train 2 is on track for substantial completion during the third quarter, with Train 3 expected to start up in the second half of 2021. Cheniere is guiding for a 1H2023 completion date for Sabine Pass Train 6.

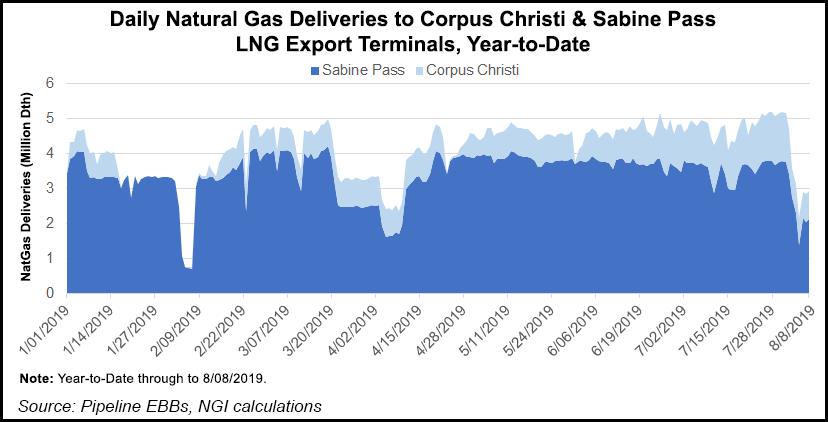

As Cheniere’s export operations have grown, its facilities, particularly the Sabine Pass terminal, have become an increasingly important component of the demand outlook for a domestic natural gas market struggling under the weight of surging production.

Earlier this week, reports of a drop-off in feed gas demand due to turnaround maintenance at Sabine’s Trains 3 and 4 prompted declines in the futures market. That maintenance also coincides with a period of uncertainty over weakness in the global LNG market.

Chief Commercial Officer Anatol Feygin acknowledged that a “continued run of strong supply growth” going back to late 2018 has depressed prices.

“Since 4Q2018, new LNG supply coupled with warmer than average winter weather in both Asia and Europe have placed downward pressure on prompt LNG prices,” Feygin said. “In 2Q2019, weather in Asia was closer to average temperatures, but still a bit warmer than usual.” Weather during the quarter in Europe “was warmer than average, limiting the potential for heating demand in Northern Europe.”

This resulted in significant decreases for both JKM (Japan Korea Marker) and Dutch TTF (Title Transfer Facility) prices, the executive said.

“Looking beyond the current shoulder season, however, Asian and European benchmarks are both trading in steep contango, indicating demand is expected to pick up again going into the winter season,” Feygin said.

Throughout the second quarter, LNG imports into Europe “remained at historically high levels,” coming in more than double 2Q2018 levels, according to Feygin.

“Strong LNG receipts, moderate weather and high injections into underground storage have resulted in very high storage inventories. European storage levels were 73% full at the end of 2Q2019, a much higher level compared to a year ago when 2Q2018 ended at 49% full. These patterns have placed downward pressure on European prices, incenting stronger European gas power generation in 2Q2019 compared to the same time period a year ago,” Feygin said.

“In 2Q2019, French gas power generation more than doubled, Italian gas generation nearly doubled, and both Spain and Germany saw more than a 60% increase in gas power generation compared to 2Q2018.”

Cheniere exported 104 LNG cargoes from its liquefaction projects during the quarter, including one commissioning cargo. That’s up from 61 cargoes during 2Q2018. LNG exported volumes totaled 361 trillion Btu, up from 219 trillion Btu in the year-ago period.

Revenues were up year/year for the quarter, totaling $2.292 million, versus $1.543 million in 2Q2018.

Cheniere reported a quarterly net loss of $114 million (minus 44 cents/share), versus a net loss of $18 million (minus 7 cents/share) in 2Q2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |