Chaparral Shutting in Most Midcon Oil Production, Exploring ‘Strategic Alternatives’

Oklahoma pure-play Chaparral Energy Inc. has released rigs contracted to drill new wells, halted completion activities and increased storage in hopes of better oil prices following the historic plunge in demand in the wake of the coronavirus pandemic.

The Oklahoma City-based producer also warned that price pain could persist for the foreseeable future.

“We are shutting in substantially all nonessential oil production, which excludes only wells associated with water floods and those with well-specific mechanical or other risks,” CEO Charles Duginski said during the first quarter earnings call.

“These actions minimize our exposure to low wellhead pricing for crude oil and preserve value for a more favorable pricing environment.” The actions will “significantly decrease our operated production in the second quarter and potentially longer.”

Chaparral reported stronger-than-expected production and lower costs in the first quarter, with output of 30,700 boe/d, exceeding the high end of guidance of 28,500-30,0000 boe/d.

Even with its solid performance on the production side, the operator is in some financial jeopardy, the second time in four years after it filed for bankruptcy in 2016.

Duginski said financial and legal advisers are exploring “strategic alternatives,” a phrase often used to warn about potential asset sales, mergers or ability to continue as a going concern.

“We are looking at multiple options that may enhance Chaparral’s value,” Duginski told analysts on the call. “We won’t be talking about or making any future announcements concerning this process until we have something material to announce.”

At the end of March, the independent had $13.3 million in cash and $145 million drawn on its $325 million borrowing base. To bolster liquidity, it borrowed an additional $105 million at the start of April. In the spring redetermination, however, the borrowing base was reduced to $175 million from $325 million, leaving the company $75 million overdrawn. It agreed to return that cash via six monthly installments.

“I want to stress that Chaparral is not in violation of any of the covenants in our credit agreement and no premium or penalty will be charged,” Duginski said.

However, in an April regulatory filing the company indicated the reduced redetermination put it on the verge of default. If the company were unable to repay the overdrawn amount within six months, “an event of default would occur,” it said.

In April, the company also announced retention bonuses worth $2.15 million total would be awarded to Duginski and four other senior executives to remain for another year. Special retention pay is typically viewed as a warning sign of distress.

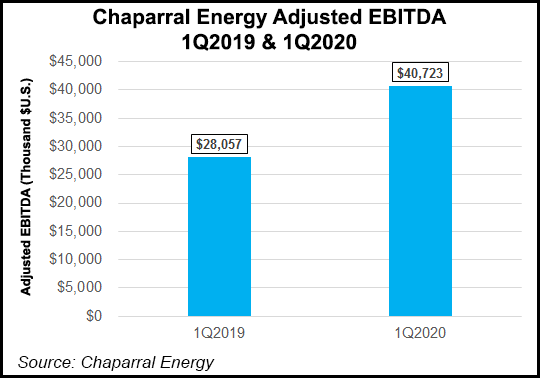

Chaparral reported net income of $4.9 million (11 cents/share), compared with a $103.5 million loss (minus $2.28) a year earlier. General/administrative expenses decreased 25% during the quarter to $8.1 million, driven by reductions in severance costs.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2158-8023 |