Markets | Infrastructure | LNG | NGI All News Access

Canada’s Eastern Seaboard Becomes Sabine Pass LNG Customer

*Clarification: Imported natural gas has replaced depleted offshore production on Canada’s Atlantic seaboard but the new sources do not yet include tanker deliveries from the United States as Canada’s National Energy Board and NGI originally reported.

A report by the National Energy Board about the New Brunswick and Nova Scotia markets has been corrected by dropping a previous reference to an initial liquefied natural gas (LNG) cargo from Cheniere Energy Inc.’s Sabine Pass operation in Louisiana.

Tanker deliveries to date at the Canaport LNG terminal in New Brunswick arrived from Trinidad, Norway and the Netherlands, according to the revised NEB summary. The LNG cargos supplement Atlantic Canadian imports by reversed flows on the Maritimes & Northeast Pipeline. The original, uncorrected story, is below.

Canada’s Atlantic seaboard surfaced as a customer for natural gas exports from the United States this winter to replace depleted wells that entirely ceased production offshore of Nova Scotia at the end of 2018.

Cheniere Energy Inc.’s Sabine Pass liquefied natural gas (LNG) terminal in Louisiana inaugurated the northbound U.S. tanker traffic by sending a cargo of 3.5 Bcf to the Canaport import facility in New Brunswick, according to the National Energy Board (NEB).

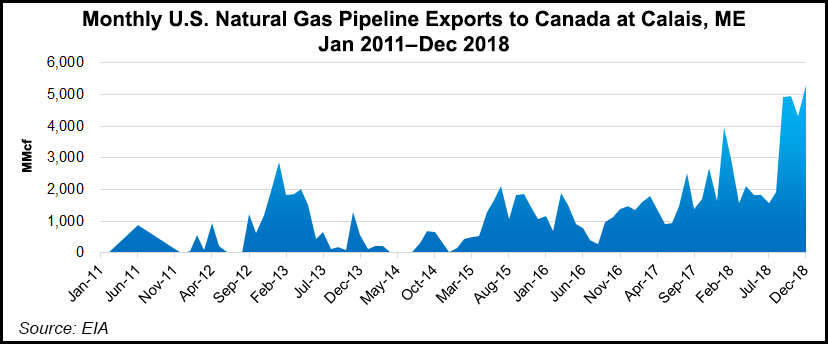

The permanent end to 19 years of production by the Sable Offshore Energy Project and the nearby Deep Panuke platform “will significantly change regional markets,” the NEB said. The Canadian Maritimes “will transform from being an exporter of domestic natural gas to being an importer of natural gas from the U.S.”

Canaport, beside Irving Oil’s New Brunswick refinery at Saint John, also received 17.5 Bcf of LNG in six cargos from Trinidad, Norway and the Netherlands during 2018 as Canada’s Atlantic offshore output went through the last stages of reserves depletion.

The LNG tops up northbound U.S. gas flows on Maritimes & Northeast Pipeline (M&NP). The line started up in 1999 for Canadian exports but was built capable of reversing its flow direction, and has since the offshore production halt.

Canadian imports of American ocean cargos turn the trade tables on two plans for tanker terminals capable of exporting up to a combined 3 Bcf/d from Nova Scotia’s Atlantic coast: Goldboro LNG and Bear Head LNG.

Over the past five years both Canadian overseas delivery proposals have secured cooperation and benefits agreements with native communities, as well as federal, provincial and local government approvals.

However, neither project has advanced into construction. Both still seek gas supplies and pipeline service from Alberta, British Columbia and the United States.

The Nova Scotia, New Brunswick and Quebec governments interrupted the Atlantic Canadian LNG export plans by enacting politically popular hydraulic fracturing bans that prevent developing nearby shale and tight gas formations.

The new Conservative government in New Brunswick promised last fall to consider partially relaxing the ban in areas that show willingness to tolerate new industry, but no action has emerged yet.

U.S. gas exports are expected to fill all the Atlantic Canadian gas supply gap until Nov. 1, the target date for new service from the Western Canada provinces to start on TransCanada Corp.’s cross-country Mainline and a U.S. link to M&NP. The package, including discount tolls and pipeline capacity additions, currently awaits NEB approval.

A U.S. affiliate of TransCanada, TC PipeLines LP, has plans to raise capacity on its American link along the roundabout route across the continent to New Brunswick and Nova Scotia, the Portland Natural Gas Transmission System.

“The Maritimes is distinct from other natural gas markets in Canada,” the NEB said. “The region has few pipeline interconnections, limited options for gas supply, no gas storage and higher natural gas prices. In the absence of east coast offshore supply, Maritimes customers have to acquire gas supply from other sources.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |