Infrastructure | LNG | NGI All News Access

Canada Seen Long on LNG Supply, Short on Global Markets to Take It

Canada can produce as much liquefied natural gas (LNG) as overseas markets can take, according to the latest request to the National Energy Board (NEB) for an extended 40-year export license.

“The capability of the resource will not be the limiting factor on the supply of gas,” said a report prepared by former NEB Chairman Roland Priddle to support the expanded application by Woodfibre LNG, a project originally filed for 2.6 Tcf over 25 years, which received environmental approvals earlier this year (see Daily GPI, March 22).

“On the contrary, the limitation on gas supply will continue to be the availability of economic markets available to Canadian gas producers.”

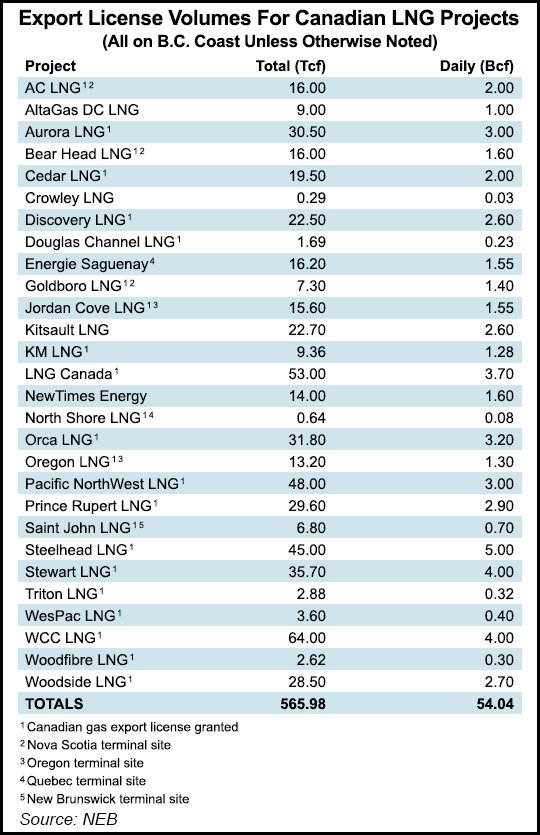

The Woodfibre application raises the volume earmarked for export by the new generation of 40-year licenses, made possible by federal legislation last year, to 170 Tcf (see Daily GPI, Oct. 14). The NEB has already granted the extended authorizations to three consortiums: Pacific NorthWest LNG (48 Tcf), WCC LNG (64 Tcf) and LNG Canada (53 Tcf).

Counting older 20- to 25-year permits held by others or awaiting approval in the 25-entry lineup to build export terminals on the Pacific and Atlantic coasts, the potential Canadian LNG supply commitment is 565 Tcf.

If all the projects succeeded, tanker shipments would eventually swell from zero today to 54 Bcf/d, or more than triple the nation’s current production of about 15 Bcf/d for all markets in Canada and the United States.

The astronomical total of ambitions for overseas sales is eight times the size of the nation’s officially recognized current gas inventory, which pegs remaining marketable established reserves at 70 Tcf: 35 Tcf in British Columbia and 32 Tcf in Alberta, with the rest scattered in Saskatchewan, Ontario, New Brunswick and offshore.

But the official total, compiled by provincial and federal regulatory agencies, does not include the endowment of shale resources unlocked but not yet brought into production by horizontal drilling and hydraulic fracturing.

“The assumption…that demand will drive production rather than that production will be constrained by the resource is made essentially because of the great size and early stage of exploitation of the Western Canadian Sedimentary Basin [WCSB] unconventional gas resource,” Priddle wrote.

Estimates of the shale mother lode vary. The NEB’s current 25-year WCSB outlook is 855 Tcf, based on limited reviews of only a fraction of the deposits by government earth sciences agencies. The Canadian Association of Petroleum Producers uses a wider range of industry projections to come up with a national total of 1,087 Tcf.

Predictions that LNG exports will not strain Canadian gas supplies, or even drive up consumer prices by much, also rely on expectations that the long project lineup will only have a severely limited success rate in the 10% area. The “high case” forecast by Priddle and the NEB — of high prices and eager reception of Canadian supplies overseas — anticipates maximum tanker shipments of 6 Bcf/d.

The intimately interconnected North American gas trade provides further assurance of adequate supplies, Priddle said. Even if Canadian producers are slow to develop production north of the border, domestic consumers and LNG merchants will have access to the immense gas stockpiles developed by fracking in the United States.

And in fact, one of three Atlantic Coast projects proposed for northeastern Nova Scotia, Pieridae Energy’s $8.3 billion export facility for Goldboro, Guysborough County, would rely mainly on shale gas from the United States. Sponsors are also looking to sign up some supplies from Ontario and Western Canada. There may be a decision around the end of the year on whether to go ahead with the Pieridae project, although right now its exports might not measure up price-wise to gas being offered in Europe by Qatar (see Daily GPI, Nov. 3).

“The market is large, open, growing, transparent, liquid, integrated, efficient, flexible and price-responsive,” said Priddle, who as NEB chairman was an architect of continental free trade in energy.

“There is no reason to think that these conditions will be significantly different over a 50-year time horizon.” Despite political attacks on effects of free trade, Priddle describes a return to pre-1980s closed borders as an “unthinkable” disruption of integrated North America-wide commerce and employment.

Woodfibre LNG stands out as a contender to start putting Canadian gas on overseas markets as a compact, economy-model project with big connections.

The project seeks a relatively modest 40-year total supply commitment of 4.7 Tcf to ship 300 MMcf/d from a Pacific Coast terminal proposed on a former wood products mill site near Vancouver.

Costs have not been announced but informal forecasts are C$1.4-1.6 billion (US$1-1.2 billion) or little more than one-tenth the tabs estimated for larger BC terminals alone, excluding jumbo pipelines proposed to reach remote northern sites.

Engineering contracts have been awarded and work has begun since federal and provincial regulatory approval, supply arrangements, and pipeline agreements were assembled earlier this year.

Woodfibre LNG’s owner — Singapore-based Pacific Oil & Gas Ltd., an arm of Indonesian paper, palm oil, construction, specialty fibres and energy conglomerate Royal Golden Eagle International — is a partner in a Chinese import terminal.

The new NEB application for an extended commitment of Canadian gas supplies said, “a 40-year export license would strengthen the global competitiveness of Woodfibre LNG Export’s contemplated project.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |