NGI Archives | NGI All News Access

BP to Separate Lower 48 Onshore Business

To improve its innovation and react more swiftly, BP plc plans to separate its U.S. onshore Lower 48 business.

Upstream chief Lamar McKay explained the decision during an investor day presentation Tuesday. While the U.S. Gulf of Mexico is one of BP’s four main producing hubs worldwide, the U.S. onshore has gotten little attention. That will change with the spinoff, he told analysts.

“We have studied how competitive we are and how that compares to others,” McKay said. “We concluded that we have significant potential to improve performance further.” A competitive environment “requires speed of innovation, faster decision making and shorter cycle times. We are changing the business as a separate business to focus on unlocking value from the existing portfolio.”

BP’s U.S. onshore “is key to our upstream strategy because we believe the region will remain at the forefront of innovation and drive global learning in unconventional resources,” McKay said.

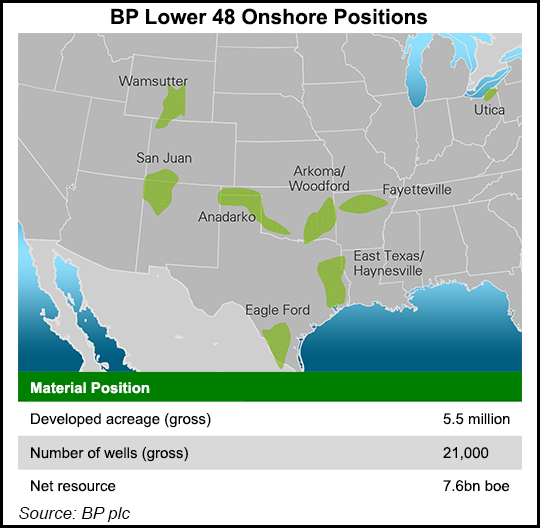

There’s a lot of potential for the London-based major in the U.S. onshore, with about 7.6 billion boe spread across 5.5 million acres and 21,000 wells, he said. “We have decades of experience and the necessary technology” to make the onshore assets world-class.

“We have studied how competitive we are and how that compares to others. We concluded that we have significant potential to improve performance further.” The U.S. onshore offers a “competitive environment that requires speed of innovation, faster decision making and shorter cycle times. We are changing the business as a separate business to focus on unlocking value from the existing portfolio.”

Most of BP’s onshore portfolio consists of leaseholds in the Fayetteville, Woodford and Eagle Ford shales.

The new business will operate separately from the rest of BP and will be designed to adapt to the rapidly changing and competitive energy landscape in the region. This move is expected to help unlock the value associated with BP’s extensive resource position in the U.S. Lower 48 onshore, which BP currently oversees through its Houston-based North America Gas group.

In the last few years, “we have fundamentally reshaped our North America gas portfolio,” McKay said. “BP has done so by divesting noncore assets and focusing development in leading U.S. unconventional plays like the Eagle Ford Shale in South Texas. “Now it’s time to reshape the way we run the business…”

BP would own the business, led by a separate management team and housed in Houston as part of BP’s Westlake campus. It would have “separate governance, processes and systems designed to address the unique competitive and operating environment…”

Separate financials for the new business would be disclosed beginning in 2015.

“Our overriding goal is to build a stronger, more competitive and sustainable business that we expect will be a key component of BP’s portfolio for years to come,” McKay said.

BP said it will “enhance efforts to develop industry-leading technology that will be a critical part of BP’s global strategy in unconventional oil and gas resources going forward.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |