Markets | E&P | NGI All News Access | NGI The Weekly Gas Market Report

BP, Shell Surprise to Upside as Cost Cutting, Efficiencies Kick In

Battered by a two-year rout in oil prices, Royal Dutch Shell plc and BP plc fought back, posting surprising improvements to the bottom line in the third quarter by clobbering costs and honing efficiencies in a sustained period of lower commodity prices.

The oil price rout has forced the European-based Big Oil companies, like their U.S. peers, to defer final investment decisions, reduce workforces and make cost costs across the board. For BP and Shell, the results showed a stark improvement from a year ago.

Shell returned to profit in 3Q2016, posting the equivalent of $1.4 billion net from a year-ago net loss of $6.1 billion. BP’s net earnings of $1.7 billion were up from $1.2 billion a year earlier. Shell’s underlying replacement cost profits (RCP), which strips out one-time items, rose 18% year/year to $2.8 billion, beating analyst consensus forecasts of $1.7 billion. BP’s RCP came in at $933 million for the three months, off 49% year/year but also ahead of consensus forecasts of $780 million.

“With oil prices likely to remain unsettled for a while yet, we will continue to judge our cash outgoings according to the environment, including optimization of capital expenditure and taking further advantage of deflationary opportunities if oil prices remain below expectations,” BP CFO Brian Gilvary said during a conference call. “In short, we will work to balance at the prevailing oil price. Any take up of our scrip as an undiscounted alternative to our cash dividend provides an additional source of flexibility near term.”

BP continues “to make good progress in adapting to the challenging price and margin environment,” Gilvary said. “We remain on track to rebalance organic cash flows next year at $50-55/bbl, underpinned by continued strong operating reliability and momentum in resetting costs and capital spending. At the same time we are investing in the projects, businesses and options to deliver growth in the years ahead.”

The “environment is moving slowly toward a more balanced position, but we are not relying on this going forward. Our plan is to execute effectively to bring on growth while sustaining discipline on capital and costs.

“You will have heard our upstream refer to this as ‘making it stick.’ This will steadily bring us into a balanced cash position at the prevailing oil price. In the meantime, our balance sheet remains sufficiently resilient to deal with any ongoing volatility.”

BP is the largest North American natural gas marketer (see Daily GPI, Sept. 2), and Gilvary was asked if the company has increased its exploration activity as prices have improved slightly.

“In terms of Lower 48, we’re now running about five rigs the last time I looked,” which is down from around 11 in the year-ago period, Gilvary said. “We’re continuing to reduce costs in that business, which is bringing the breakeven prices down. The key is really about what we learn about technology and how we run the business.”

BP is running its Lower 48 operations within “a different financial frame to the rest of the group…and it is continuing, as you’ll see from the various quarterly numbers that we now start to release, get to be more and more profitable going forward…

“Lower 48 really is about testing new zones, looking at innovative well designs. It’s really experimenting with that business and getting more comfortable with how we run the Lower 48 and reducing costs over time and the amount of capital that’s going in…”

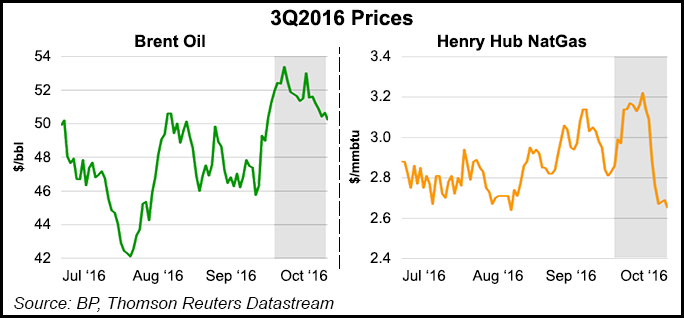

Forward prices from crude oil “continue to point a modest upper trajectory,” Gilvary said. “Henry Hub gas prices recovered in the third quarter, averaging $2.80/MMBtu…well above the average of $2.10 we saw in the second quarter, as prices responded to combination of declining production and increased demand from gas-fired power generation, which in the third quarter was at record level in the United States.

“Looking forward, rising seasonal demand should support some firming in Henry Hub gas prices,” he said. “We expect a stronger outlook for both oil and gas prices to support improved realizations in our upstream businesses into next year.”

BP’s underlying replacement cost profits totaled $933 million, versus $720 million in 2Q2016 and $1.8 billion in the year-ago period. The latest quarter was impacted by a weaker price and margin environment as well as one-off and noncash items in the upstream division. However, results also included benefits from lower cash costs across the operations and a positive one-time tax credit.

BP’s underlying operating cash flow, which excluded pre-tax Gulf of Mexico payments related to the Macondo blowout in 2010, was $4.8 billion.

BP’s cash costs over the past four quarters were $6.1 billion lower than in 2014, continuing its progress toward 2017 cash costs being $7 billion lower than in 2014.

Also on the bright side are lower-than-expected capital expenditures (capex). BP reduced its 2016 organic capex to around $16 billion, compared with original guidance of $17-19 billion. Capex in 2017 to now forecast to be $15-17 billion.

Both of BP’s main operating segments continued to demonstrate strong operational performance, with upstream plant reliability at 95% and refining availability in downstream at 95.4%. The upstream segment reported an underlying pre-tax replacement cost loss of $224 million, versus sequential profits of $29 million and year-ago earnings of $823 million.

Compared with a year earlier, BP’s upstream results reflected weaker oil and non-U.S. natural gas prices and lower natural gas marketing and trading results, together with the impact of higher exploration write-offs and rig cancellation charges. The impacts were partially offset by cost reductions.

Shell Planning 2017 at $50/bbl

Shell improved production and posted solid quarterly profits, but it came mostly on the back of its takeover of BG Group plc, now fully integrated into operations (see Daily GPI, July 28).

The worst is not over, Shell CFO Simon Henry said during his company’s conference call Tuesday.

“We’re planning next year on $50/bbl oil,” he told investors. “We’re planning the balance sheet for potentially even lower than that, and were building the portfolio to be robust at anything above $50/bbl.”

Global liquids realizations were 11% lower year/year while global natural gas realizations fell 31% from 3Q2016.

Oil and gas production rose 25% year/year to 3.6 million boe/d, but most of the gains were the result of BG’s operations, which contributed 806,000 boe/d. Excluding the impact of several items, Shell’s output increased by 28% year/year, or in line with last year excluding BG.

Liquefied natural gas (LNG) volumes rose 45% from a year ago to 7.70 million metric tons (mmt), with BG contributing 2.19 mmt. LNG sales volumes jumped year/year to 15.23 mmt, reflecting the larger portfolio. Meanwhile, oil product sales were up 1%.

“Lower oil prices continue to be a significant challenge across the business, and the outlook remains uncertain,” said Shell CEO Ben van Beurden.

“Our investment plans and portfolio actions are focused firmly on reshaping Shell into a world-class investment case at all points in the oil-price cycle, through stronger returns and improved free cash flow per share. We are making good progress toward this aim in spite of current challenging market conditions.”

Shell’s 2016 organic capex, which includes $3 billion in noncash items, is expected to be about $29 billion. Capex for 2017 is expected to be around $25 billion, at the low end of the $25-30 billion range. Shell also is “actively working” on 16 material asset sales as part of its planned $30 billion divestment program.

“Cash flow will be further boosted by new projects,” van Beurden said. “When fully ramped up, projects started up in 2016 are expected to add more than 250,000 boe/d. Cash flow from new projects started up between 2014 and 2018 is expected to total $10 billion in 2018, at an average $60/bbl oil price.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |