Markets | NGI All News Access | NGI Data

Big Bullish EIA Storage Miss Helps Natural Gas Futures Bounce Back Following Sell-Off

The Energy Information Administration (EIA) on Thursday reported a net withdrawal from natural gas inventories that missed to the bullish side of estimates, helping futures claw their way back in a market expecting surging production to make up for storage deficits.

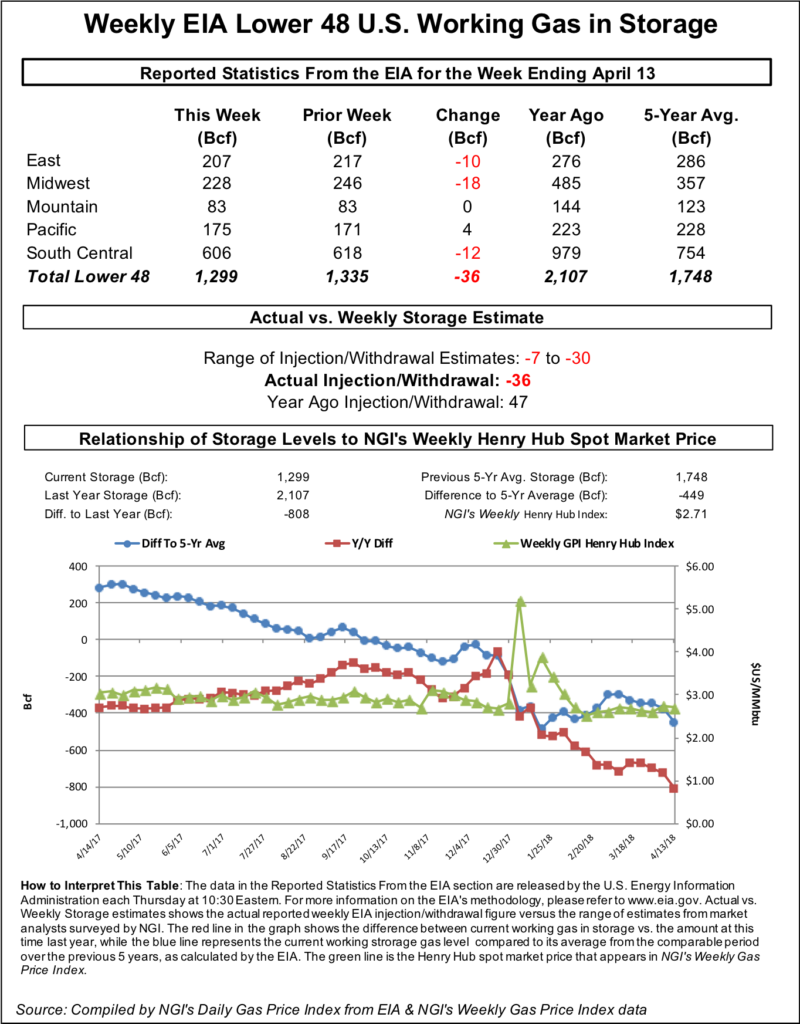

EIA reported a 36 Bcf withdrawal from Lower 48 gas stocks for the week ending April 13, an unusual pull from inventories during injection season thanks to uncharacteristically cold weather during the period. Last year, 47 Bcf was injected, and the five-year average is a build of 38 Bcf.

Immediately after the number reached trading desks at 10:30 a.m. ET, the May contract added close to 3 cents, gaining back a chunk of what it lost after selling off to as low as $2.676 earlier in the session. By 11 a.m. ET, May was trading around $2.730, down about a penny from Wednesday’s settle.

Prior to the report, the market had been looking for a withdrawal about 10 Bcf looser than the actual figure. A Reuters survey of traders and analysts had on average predicted a 23 Bcf withdrawal for the week, with responses ranging from minus 7 Bcf to minus 30 Bcf. A Bloomberg survey had produced a median withdrawal of 26 Bcf, with responses ranging from minus 11 Bcf to minus 30 Bcf.

OPIS By IHS Markit had called for EIA to report a 24 Bcf withdrawal for the period. IAF Advisors analyst Kyle Cooper had predicted a 27 Bcf withdrawal, while Intercontinental Exchange EIA storage futures settled Wednesday at a withdrawal of 26 Bcf. Bespoke Weather Services had called for a 23 Bcf pull and viewed the actual figure as “quite bullish.”

“This is the second consecutive bullish miss to our estimate, though this one was quite larger,” Bespoke said. “Shoulder season data is notoriously noisy, but this data does confirm that in the short-term the natural gas market is not quite as loose as some other data may have indicated.”

The price reaction immediately following the report was “muted, however, as expectations of further production coming online have smothered the impacts of shoulder season demand tightening,” the firm said. “Prices already tested our $2.65-2.68 range and may not have much interest in retesting after a bullish print.”

Total working gas in underground storage stood at 1,299 Bcf as of April 13, versus 2,107 Bcf last year and five-year average inventories of 1,748 Bcf. The year-on-year deficit widened week/week from 725 Bcf to 808 Bcf, while the year-on-five-year deficit increased from 375 Bcf to 449 Bcf, EIA data show.

By region, the Midwest saw the largest net withdrawal for the week at 18 Bcf, while 10 Bcf was pulled in the East. The Mountain region finished flat week/week, while 4 Bcf was injected in the Pacific. The South Central saw 12 Bcf pulled from storage for the week, including 11 Bcf from salt and 1 Bcf from nonsalt.

“Some natural gas storage operators have reported net withdrawals from base gas, beginning with the week ending April 6,” EIA noted in this week’s report. “The cumulative net withdrawals of base gas were treated as negative working gas stocks and are reflected in the working gas inventories. As a result, a small portion of this week’s reported net change includes flows from base gas.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |