Background Information about the Barnett Shale

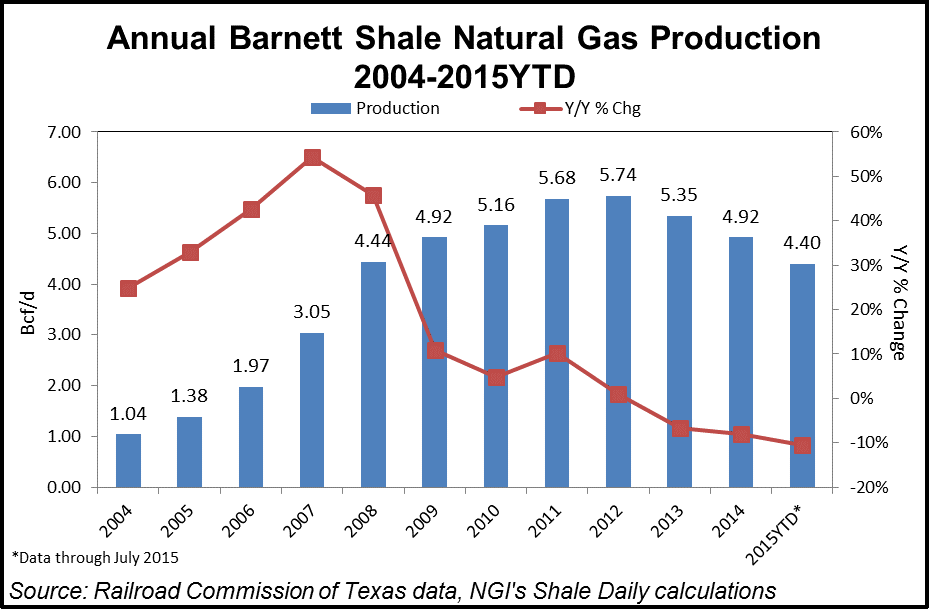

The Barnett Shale is considered to be the “granddaddy” of all U.S. shale plays as it was the formation in which Mitchell Energy & Development first successfully implemented the technology necessary to unlock shale gas in the early 1990s. The North Texas shale basin is widely believed to be one of the most prolific natural gas fields in the United States, but it yielded the top producer role to the Marcellus Shale in 2012 when its annual production average topped out at 5.74 Bcf/d and the Marcellus rose to an annual average of 7.66 Bcf/d.

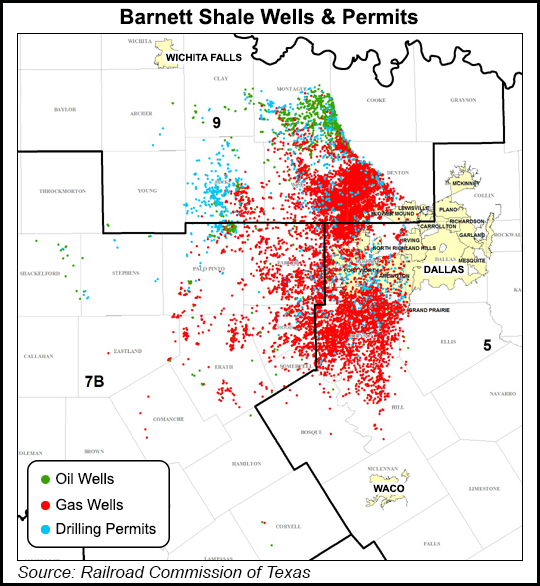

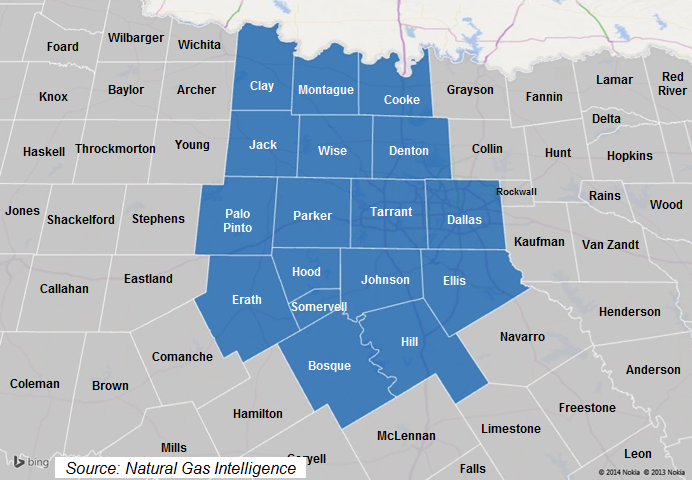

The core area of the Barnett Shale is in Denton, Johnson, Tarrant and Wise counties, and is largely dry gas, although Wise County is generally oilier. Much of the more recent activity in the Barnett has been in the more liquids-rich portions of the play, particularly in Montague, Cooke, Jack and Wise counties. Jack and Palo Pinto counties have also seen an uptick in drilling in recent quarters for the Marble Falls horizontal tight oil play, a formation that lies directly above the Barnett Shale.

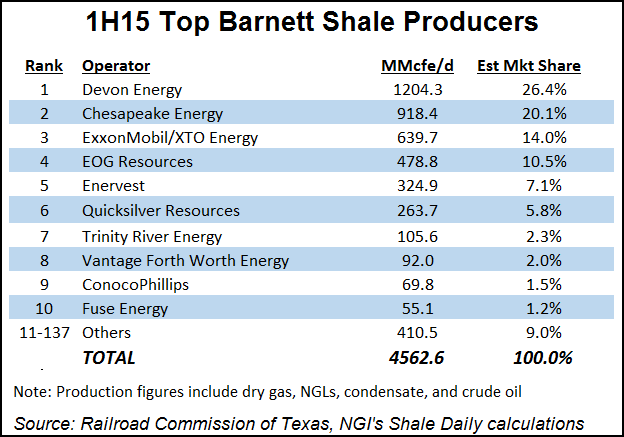

But activity in the Barnett Shale is still dominated by natural gas, and recent evidence suggests that the play may have reached its decline phase. After posting double-digit year-over-year growth rates in every year but one between 2003 when it produced 0.834 Bcf/d and 2011 when it was 5.68 Bcf/d, total estimated Barnett natural gas and liquids production increased just 1.1% in 2012. In 2013, Barnett natural gas production fell by 6.8% to 5.35 Bcf/d. In 2014 production of 4.92 Bcf/d marked an 8.0% decline, and through July 2015, the decline pro-rated to approximately 10.6% at 4.4 Bcf/d. Production declines, of course, correspond with lower prices for natural gas and crude during the period, but the more recent reduction in output may have been exacerbated by the March 2015 bankruptcy filing of Quicksilver Resources, the sixth largest Barnett producer in 2014. As of this writing, Quicksilver was going through the Chapter 11 process, and was scheduled to receive bids for the sale of its assets by the end of November 2015.

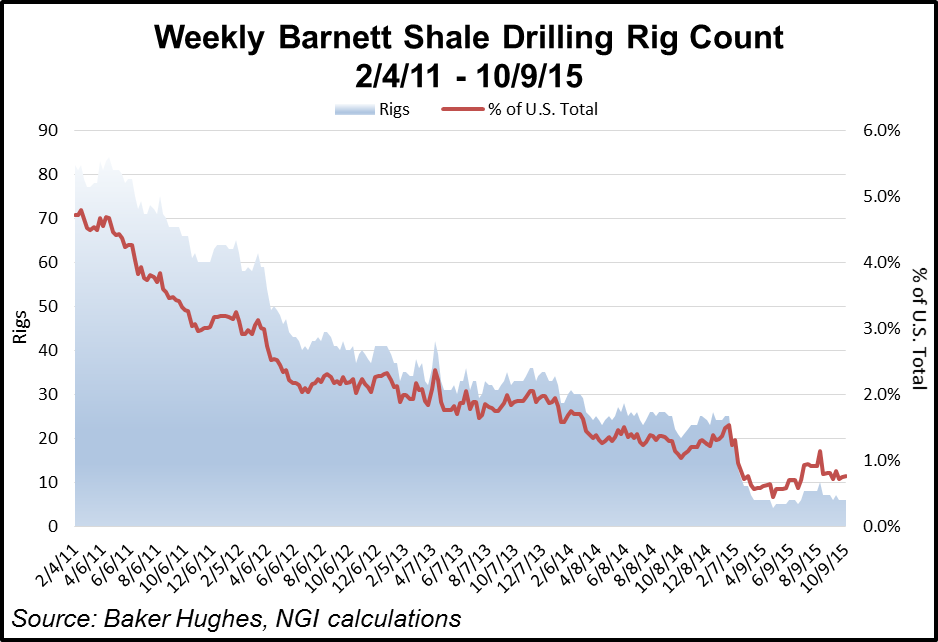

The Barnett Shale rig count has also plummeted over the last several years, falling from 82 rigs in February 2011 to a mere six in early October 2015. Three of those rigs were targeting oilier areas, most likely the Marble Falls.

Based on August 2015 data, the Railroad Commission of Texas ranked Barnett Shale counties Tarrant, Johnson, Wise and Denton as the first, fifth, eighth and ninth, respectively, top total natural gas (gas well gas and casinghead gas) producing counties. No Barnett counties cracked the top-10 for oil production. In Texas the play is clearly overshadowed by the Permian Basin and Eagle Ford Shale when it comes to crude output.

One thing that may revive production gains in the Barnett — or at least slow its rate of decline — is the potential to refrack older wells that were completed using shorter laterals, and less advanced technology. In fact, Enlink Midstream opined on its 3Q15 conference call that refracking has “tremendous opportunity for its customers” in the Barnett, and will help ENLK stem volume declines in its Barnett midstream systems, which in October 2015 were falling at 6.5% year-over-year pace. Devon Energy, the leading producer in the Barnett and the major sponsor of Enlink, estimates that it costs $1.2 million to refrack a horizontal Barnett well, but that doing so would add 2 Bcf to the per well reserve potential. Devon planned to refrack 25 horizontal Barnett wells in 2015, and was in the process of assessing the results from vertical refracks in the areas as well.

Increasing exports to Mexico, along with emerging LNG exports in the Gulf Coast, could also help support Barnett producers, either directly through increased production, or indirectly through higher netbacks.

The Barnett Shale region has experienced numerous small earthquakes and minor seismic events over the last couple of years, and many residents and municipal leaders have blamed these on drilling waste injection wells operated for the benefit of Barnett Shale producers. A 2015 investigation by the Railroad Commission of Texas, however, did not find any definitive link between injection wells and seismic activity (see Shale Daily, Sept. 11, 2015).

Also during 2014 and 2015, the Barnett was home to the nation’s first successful — albeit temporary — municipal ban of hydraulic fracturing. In 2014, voters in the Barnett Shale town of Denton, TX, overwhelmingly voted in favor of a fracking ban in their city (see Shale Daily, Nov. 5, 2014). However, the move was met by a quick response from industry and state lawmakers. Legislation was enacted to limit the ability of municipalities to ban fracking and interfere with the oil/gas industry in general. The Denton ban was essentially outlawed (see Shale Daily, May 26, 2015).

Counties

Texas: Bosque, Clay, Cooke, Dallas, Denton, Erath, Hamilton, Hill, Hood, Jack, Johnson, Montague, Palo Pinto, Parker, Somervell, Tarrant, Wise

NOTE: The Railroad Commission of Texas also includes Archer, Clay, Comanche, Coryell, Eastland, Ellis, Shackelford, Stephens, and Young counties as being prospective (albeit noncore) for the Barnett, but we do not include these counties in our definition, either because the majority of those counties are not prospective, they are not commercially viable, and/or they have yet to be developed.

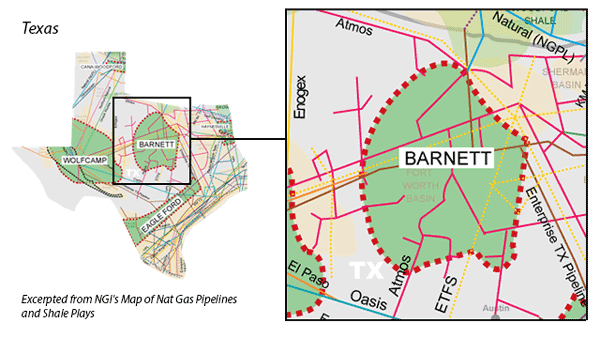

Local Major Pipelines

Natural Gas: Atmos, Crosstex N. Texas, Energy Transfer, Enterprise Products, Gulf Crossing, NGPL, OkTex Pipeline, Tolar Hub

Crude Oil*: Amdel (Sunoco), Basin, BP Pipelines, BridgeTex, Central Texas (Sunoco), CK Red River (Plains Pipeline), Enterprise Crude Pipeline, North Texas (ConocoPhillips), NuStar, Pegasus (ExxonMobil), Permian Express II (Sunoco), Phillips 66 Pipeline, Seaway, Sunoco Pipeline, SXL, Texas (Sunoco), West Texas Gulf (Sunoco)

NGLs: Arbuckle, Cowtown, Energy Transfer, Enterprise Products, NGL Parker (EnLink), Southern Hills, Sterling I, Sterling II, Texas Express NGL, Tolar (DCP), West Texas LPG (Chevron)

*The Barnett is not nearly as prospective for crude oil as it is for natural gas, although certain sub-formations within the Barnett, such as the Marble Falls, do produce some crude oil. These pipelines underlie the counties that make up the Barnett, although not all of them may receive crude production in this area.

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily