Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Bakken Natural Gas Flaring High Priority for North Dakota, Industry

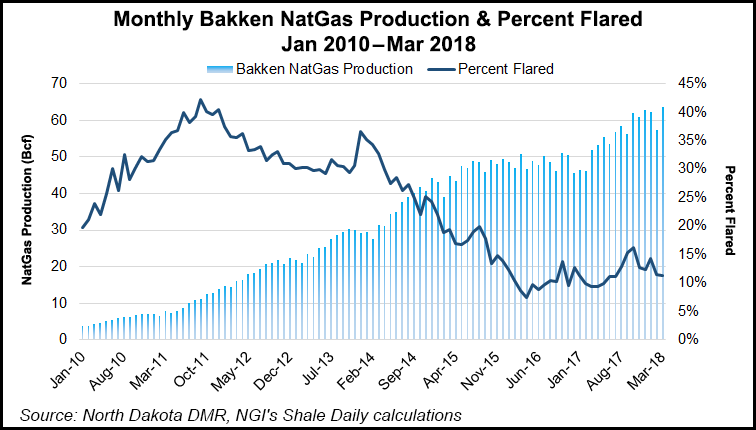

Record associated natural gas production from the Bakken Shale’s continuing oil boom in North Dakota remains a top concern for both the industry and the state, executives said last week.

At the Williston Basin Petroleum Conference (WBPC) in Bismarck, officials expressed both concern and optimism about how to capture flared gas during a panel discussion about new technologies being deployed in the play. Earlier this year, state officials hinted that the four-year-old phased-in goals to capture 90% of gas flared in the next 18 months may be altered.

North Dakota Pipeline Authority (NDPA) Director Justin Kringstad registered his concerns about ensuring there is enough gas processing capacity. Production this summer may exceed processing capacity, as the state awaits the ramp-up of five more plants.

“On the longer-term outlook for gas processing, the five new plants will meet the needs for a couple of years, but if production grows as predicted, we’ll continue to see additional plants needed,” Kringstad said.

He is unsure that expansions by the region’s principal interstate pipelines, Alliance and Northern Border, would be enough to move gas out adequately from the region.

“They move both Canadian and Bakken gas to the Midcontinent, but the one fact to understand about Northern Border is that it always leaves the Bakken 100% full,” Kringstad said.

Crestwood Midstream Partners, which operates in many U.S. basins, last year invested $165 million in the Bakken to loop its gathering pipeline system and build more gas processing plants. Crestwood opened one skid-mounted processing facility last November, and it is building a second plant that should be ready in the second half of 2019.

“For us, our relationship starts within individual communities,” said Crestwood’s Diaco Aviki, senior vice president of business development and commercial operations. He noted that the privately held firm has 20 gas capture projects underway this year.

Crestwood’s gas capture projects are a $22 million smorgasbord, featuring three pump stations, two compressor stations, produced water storage facilities and what Aviki called “massive amounts” of pipelines. For the next two years, the operator has committed $419 million for various oil, gas and water gathering and processing projects.

GTUIT CEO Brian Cebull’s Billings, MT-based company offers remote gas capture, which he called “a bandage when needed.” Remote capture, a technology that’s been around for about a decade, is an option when existing gathering and processing infrastructure is full, and production has exceeded capacity.

“The remote capture industry essentially takes the place of that gathering and processing capacity on a temporary basis,” Cebull said.

The technology is dominated by wellsite mechanical refrigeration and compression, relying on the cooling of gas through compression. The remote technology is designed to help producers meet state standards, but Cebull said many customers signed their contracts before North Dakota established its phased gas capture goals.

Need for the technology fell during the commodity price downturn, but remote capture available capacity this year is 2.5 times larger than it has been historically, he said. “It represents a capital investment collectively of more than $100 million.”

Remote capture is not in competition with the midstream operators, Cebull said, his industry is “simply in business to be there when the midstream can’t be; we’re an enhancement to their services.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |