LNG | NGI All News Access | Shale Daily

Freeport LNG’s Extended Drop in Feed Gas Adds Pressure to U.S. Natural Gas Demand

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2158-8023 |

E&P

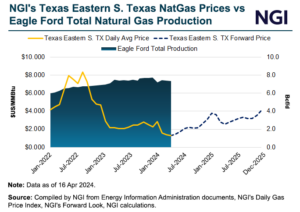

Activist investor Kimmeridge Energy Management Co. LLC has withdrawn its proposal to merge its natural gas-focused subsidiary with Eagle Ford Shale producer SilverBow Resources Inc. The New York-based investment firm, which holds a 12.9% stake in SilverBow, in March proposed a tie-up between Kimmeridge Texas Gas LLC (KTG) and the Eagle Ford producer along with…

April 17, 2024Markets

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.