Natural Gas Prices | NGI All News Access | Shale Daily

As Temperatures Climb and Heating Demand Fades, May Natural Gas Futures Slump

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 2158-8023 |

LNG

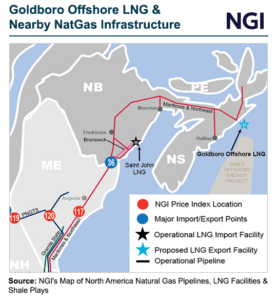

Pieridae Energy Ltd. could be looking to sell its abandoned Goldboro LNG project in Nova Scotia to an Irish energy firm, according to a recently published regulatory filing. Calgary-based Pieridae asked Nova Scotia’s utility and review board for permission to transfer its approvals for the potentially 1.3 Bcf/d export project to Simply Blue Group, a…

April 16, 2024Natural Gas Prices

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.