E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Genscape Predicts Large Growth in Permian NGL Production

The production of natural gas liquids (NGL) in the Permian Basin will take off over the next several years as producers shift focus to liquids-rich shale plays and midstream companies follow their lead and build the necessary infrastructure to process and transport the liquids, according to an executive with Genscape Inc.

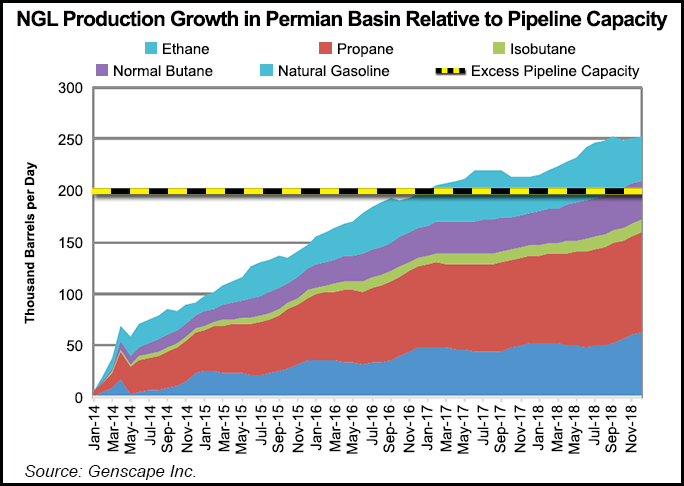

In a five-page white paper, Bob Simmons, Genscape NGL product manager, said the firm believes NGL production in the Permian is on pace to increase by about 50,000 b/d in 2014, and by about 250,000 b/d by the end of 2018. Propane is expected to account for the largest share of the growth and is forecast to be 39% higher by the end of 2018.

“New published information not only continues to support the growth trend forecasted but has led to Genscape revising the forecast higher over the past couple of months,” Simmons said. But he added that ethane rejection “is expected to persist into 2017 due to the lack of infrastructure to consume the molecule. The timing for when ethane’s production growth rate is expected to increase is dependent upon the completion of ethylene cracker projects and [U.S. Gulf Coast] export terminals.”

Simmons said there has been strong producer and midstream activity in the Permian this year, with the former deploying an additional 141 horizontal rigs in the play so far this year, a 76% increase from the year prior. He said horizontal rigs now make up more than 60% of the rigs targeting the basin.

“Producers are targeting numerous stacked shale plays with their horizontal drilling programs, which are yielding a high liquids content,” Simmons said. “Initial well tests that have been published have resulted in 5-6 gallons/Mcf of NGL. Historically, yields are 2-3 gallons/Mcf.”

With producers pursuing NGLs, midstream companies are expanding their gas processing capacity in the region. According to Simmons, total gas processing capacity is projected to grow 35% by the end of 2016, when it will reach 8.5 Bcf/d. He added that processing capacity began to grow in 2013, when 715 MMcf/d was added. Another 1.1 Bcf/d will have been added in 2014.

“Midstream companies have indicated that additional processing capacity will need to be added every 12-18 months to support the current level of producer drilling,” Simmons said. The most recent example, he said, was last month’s announcement by Enterprise Products Partners LP to add 200 MMcf/d of processing capacity to its plant in Eddy County, NM (see Shale Daily, Sept. 30).

Simmons cited 21 processing projects — 17 in Texas and four in New Mexico, including Enterprise — that collectively will add about 2.74 Bcf/d in capacity by July 2016. They include:

Simmons said that while current takeaway capacity is sufficient to move NGLs out of the Permian, additional pipeline capacity will be needed within the next few years. He said expansions began in late 2013, when 400,000 b/d of capacity was added.

“Genscape estimates that pipeline capacity is approximately 200,000 b/d more than current NGL production from the basin,” Simmons said. “However, the expected production growth rate could lead to pipeline constraints by the end of 2016. The constraints can be alleviated by midstream companies expanding current pipeline capacity in the Permian Basin, or by connecting NGL production in other basins to existing pipelines in those areas.

“For example, NGL production in the Barnett Shale could be diverted to existing pipelines such as Texas Express or Oneok’s Sterling pipeline system. This would allow more Permian Basin NGL production to be moved out of the region on existing pipeline capacity,” (see Shale Daily, April 23).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |