Markets | NGI All News Access | NGI Data

Futures Post Lackluster Rally Following EIA Storage Stats

Natural gas futures rose modestly following the release of government storage figures that were somewhat less than what traders were expecting.

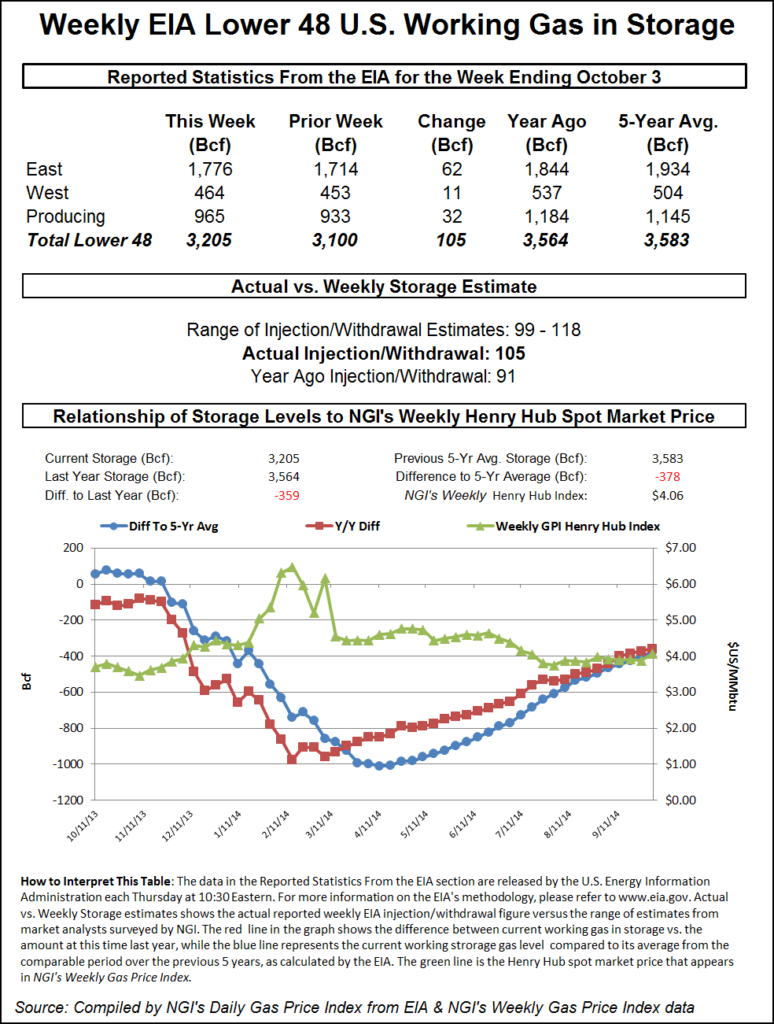

The injection of 105 Bcf was about 3 Bcf less than trader expectations, which hovered around a 108 Bcf increase. For the week ended Oct. 3, the Energy Information Administration (EIA) reported an increase of 105 Bcf in its 10:30 a.m. EDT release. November futures rose to a high of $3.900 soon after the number was released, and by 10:45 a.m. November was still trading at $3.900, up 4.5 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for a build of about 108 Bcf. A Reuters survey of 23 traders and analysts revealed an average increase of 108 Bcf with a range of 99-118 Bcf. IAF Advisors of Houston was looking for a build of 109 Bcf, and Bentek Energy’s flow model anticipated an injection of 106 Bcf.

“The idea that traders were looking for 109 to 110 Bcf and it came out 105 Bcf is not really all that much of a bullish indication,” said a New York floor trader. “We’re still at $3.75 to $4.00, and I don’t think this number will break us out of that range.”

Analysts at Citi Futures Perspective pegged the report as “slightly bullish.”

Inventories now stand at 3,205 Bcf and are 359 Bcf less than last year and 378 Bcf below the five-year average. In the East Region 62 Bcf was injected and the West Region saw inventories increase by 11 Bcf. Stocks in the Producing Region rose by 32 Bcf.

The Producing region salt cavern storage figure added 12 Bcf from the previous week to 260 Bcf, while the non-salt cavern figure rose by 20 Bcf to 705 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |