Markets | NGI All News Access | NGI The Weekly Gas Market Report

EIA Projects Milder Temps, Lower Heating Bills This Winter

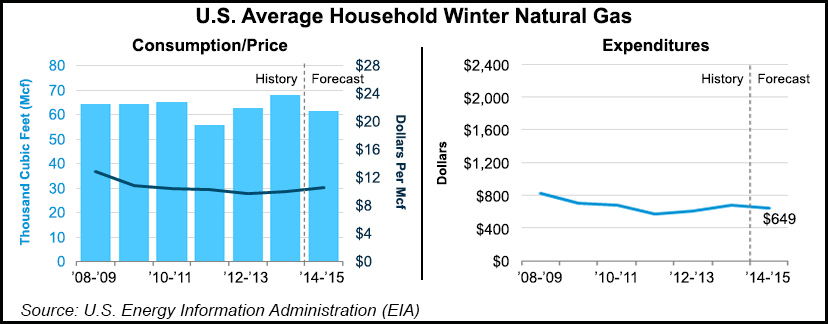

U.S. households should expect lower heating bills this winter compared to last, thanks in large part to less severe temperatures, but also due to lower natural gas spot prices and significantly higher winter gas production, according to the U.S. Energy Information Administration (EIA).

According to EIA’s “Short-Term Energy and Winter Fuels Outlook,” released Tuesday, the average heating bill for a home heated primarily with natural gas will be $649 during the current winter season, which began in October and runs through March. That price is 4.6% ($31) lower than last winter, when the average price was $680.

“U.S. households in all regions of the country can expect to pay lower heating bills this winter because temperatures are forecast to be warmer than last winter and that means less demand for heat,” said EIA Administrator Adam Sieminski. “U.S. natural gas inventories have recovered from their big drawdown last winter and are expected to exceed 3.5 Tcf at the start of this year’s heating season.”

EIA said working inventories of natural gas totaled 3.1 Tcf on Sept. 26, an 11% (0.37 Tcf) decrease from inventories at the same time last year, and 11% (0.40 Tcf) below the previous five-year average covering 2009-2013. The agency added that inventories were projected to reach 3.53 Tcf by Oct. 31 — still lower than one year ago (down 7.3%, 0.28 Tcf) but closing the gap from the Sept. 26 figures.

“The injection season began somewhat slowly in April, but has continued at a strong pace, with injections above the five-year (2009-2013) average throughout most of the injection season,” EIA said. The agency added that heading into next summer, in March 2015, it projects inventories will be 122 Bcf below the five-year (2010-2014) average.

EIA said the Henry Hub natural gas spot price averaged $3.92/MMBtu in September, a slight increase from August. “[We expect] spot prices to remain below $4.00/MMBtu through November, before rising with winter heating demand,” the agency said. “Projected Henry Hub natural gas prices average $4.45/MMBtu in 2014 and $3.84/MMBtu in 2015.”

The agency added that at this point — the five-day period ending Oct. 2 — natural gas futures prices for January 2015 delivery averaged $4.19/MMBtu.

“Current options and futures prices imply that market participants place the lower and upper bounds for the 95% confidence interval for December 2014 contracts at $2.96/MMBtu and $5.94/MMBtu, respectively,” EIA said. “At this time last year, the natural gas futures contract for January 2014 averaged $3.83/MMBtu and the corresponding lower and upper limits of the 95% confidence interval were $2.91/MMBtu and $5.04/MMBtu.”

Sieminski added that higher domestic gas production this year, coupled with a mild summer that resulted in less demand for electricity to power air conditioning units, combined to form a record build in gas inventories.

“Even if this winter is as cold as last year’s, the net withdrawal from natural gas inventories over the heating season would not be as large as last winter’s drawdown because domestic gas production this winter is expected to be significantly higher than it was last winter,” Sieminski said.

EIA cited the latest forecast from the National Oceanic and Atmospheric Administration (NOAA), which said temperatures were expected to be warmer this winter than last.

Natural gas marketed production is expected to grow by an annual rate of 5.4% in 2014 and 2.0% in 2015, according to EIA. The agency added that its “Short-Term Energy Outlook” projects that the strong production increase seen in the Lower 48 will continue in 2014, offsetting lower production in the Gulf of Mexico.

The agency said marketed production in July, the most recent month with data available, was 4.2 Bcf/d greater than July 2013. Last week, EIA also reported total production through the first seven months of 2014 was 18.26 Tcf, an increase of nearly 5% from the same period last year (see Daily GPI, Oct. 1a).

“Growing domestic production is expected to continue to put downward pressure on natural gas imports from Canada and spur exports to Mexico,” EIA said. “Exports to Mexico, particularly from the Eagle Ford Shale in South Texas, are expected to increase because of growing demand from Mexico’s electric power sector and flat Mexican production.

“LNG [liquefied natural gas] imports have fallen over the past four years because higher prices in Europe and Asia are more attractive to sellers than the relatively low prices in the United States. LNG exports are still a very small part of the total picture, however, and overall the United States will remain a net importer of natural gas because of pipeline imports from Canada.”

In a separate report issued last week, the Natural Gas Supply Association (NGSA) also predicted lower prices for natural gas this winter, citing a return to normal temperatures; increased domestic production; and adequate storage (see Daily GPI, Oct. 1b).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |