E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Linn Energy Sells Texas Assets for $2.3B

Linn Energy LLC struck two deals to sell assets in Texas for gross proceeds of $2.3 billion, which will be used to pay for a recent acquisition, the company said Friday.

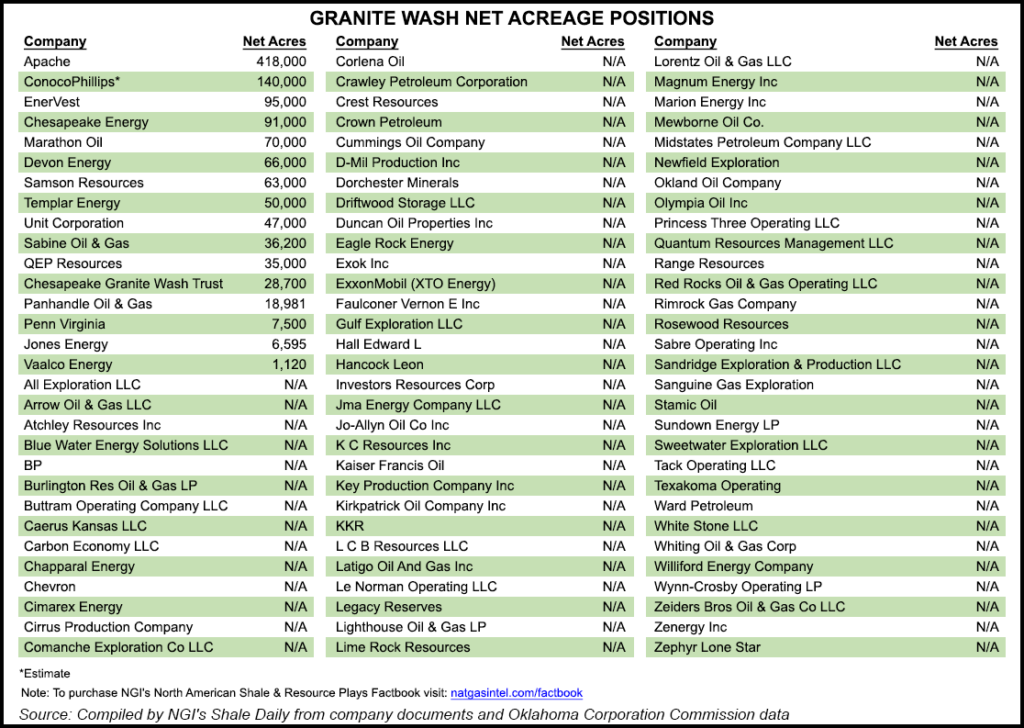

Houston-based Linn is selling its entire position in the Granite Wash and Cleveland plays in the Texas Panhandle and western Oklahoma to affiliates of EnerVest Ltd. for $1.95 billion. Linn also agreed to sell its Wolfberry positions in Ector and Midland counties in the Permian Basin for $350 million to Fleur de Lis Energy LLC (FDL).

Sale proceeds are to be used to finance Linn’s $2.3 billion acquisition of assets from Devon Energy Corp., which closed in August, the company said. In the Devon deal, Linn acquired properties that are 80% weighted to gas and include 4,500 producing wells in the Rockies, East and South Texas, Louisiana and the Midcontinent (see Shale Daily, June 30).

The Granite Wash and Cleveland properties sold include 145,000 net acres, 195 MMcfe/d of production, 755 Bcfe of year-end 2013 proved reserves and related midstream facilities. Linn has been running a four-rig drilling program and has planned to spend $210 million on the assets this year.

The Permian Basin properties sold include 7,200 net acres, 4,600 boe/d of production and 19 million boe of year-end 2013 proved reserves. LINN has been running a two-rig vertical drilling program and has planned to spend $95 million on these assets in 2014.

Linn now will have remaining production of about 8,000 boe/d and 6,600 net acres in the Midland Basin that is prospective for horizontal Wolfcamp drilling. The company said it continues to see “strong interest in the market for a trade or sale of these assets.”

“One of our goals for 2014 was to maximize value for our Midland Basin and Granite Wash assets in order to reduce the capital intensity and decline rate within our portfolio. We believe today’s announcements largely accomplish this goal,” said CEO Mark E. Ellis. “When considered in light of the accretive acquisitions and trades we’ve announced this year, we are very excited about our business as we move into 2015.”

The Granite Wash and Cleveland sale is expected to close in the fourth quarter with an effective date of Sept. 1. The Permian Basin sale is expected to close in the fourth quarter with an effective date of Aug. 1.

FDL was formed in March with backing from Kohlberg Kravis Roberts & Co. LP (KKR) to pursue investments in producing oil and gas properties in North America. The partnership is part of KKR’s natural resources platform. EnerVest has more than 34,000 wells in 15 states, 5.5 million acres under lease and $10 billion in assets under management, according to the company.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |