Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

As Marcellus Shale Costs Fall and Volumes Rise, Operators Want More

The Marcellus Shale has for some time now been touted for its low finding and development costs, and even as natural gas volumes in the formation are expected to surpass 16 Bcf/d this month, exploration and production (E&P) companies are bent on getting more for less.

The technological and operational gains the play has witnessed in recent years have come not only at the drillbit, but above the surface as well.

Drilling efficiencies, better completions, cost reductions and streamlined operations have aligned behind the headlines of the nation’s largest producing gas formation. But further innovations, representatives from two of the play’s leading operators say, will continue to drive growth into the formation’s marginal areas and help recreate the Pennsylvania story in developing horizons, such as the Upper Devonian and Utica shales.

“Our teams continue to find ways, where typically, at four years into a play, you don’t see a lot of improvement from that point forward,” Chesapeake Energy Corp. Vice President Jason Ashmun of the Appalachian North business unit, told a Pittsburgh crowd at last week’s Shale Insight conference. “What you see today is a spectacular improvement, even with 700 wells already in the ground. We’re seeing greater and greater wells. With these improvements, we will absolutely be able to take some of the more marginal areas and turn them into profit centers and be here for decades to come.”

Chesapeake operates primarily in northeast Pennsylvania’s dry-gas window, widely regarded as some of the toughest terrain in the U.S. onshore. It has roughly 230,000 net acres in Bradford, Susquehanna, Sullivan and Wyoming, some of the play’s top-producing counties each year. With production of about 900 MMcf/d, and 753 horizontal wells drilled to date, gross operated production at Chesapeake has increased by 300% in the last four years, Ashmun said.

Chesapeake was Pennsylvania’s top producer in the first half of this year, according to state data, but it still has 2,000 wells left to drill in the state “and that’s the decades of drilling that the opportunity places if front of us,” Ashmun added. He said the company has reduced the time it takes to drill its Marcellus wells by 40%, with a significant chunk of that coming in the last year.

“This is ultimately due to a change in the way our organization behaves,” he said. “We have a culture of continuous improvement, we have team collaboration, and I know that doesn’t sound like rocket science, but so often in these plays the drillers will focus on their needs; the geologists will focus on their needs; the completion guys will focus on their needs, and what we did was say everybody get in the rig and let’s find what the best result is for the company. Collaboration is not a novel concept, but it works.”

Geosteering, fracture and completion design, cluster spacing and longer laterals are a few of the techniques that have reduced Chesapeake’s well costs by $1 million in the last year, he said.

State production data shows that, on the whole, Chesapeake is not alone. In the first half of this year, operators produced 1.94 Tcf of natural gas, nearly as much as the 2.04 Tcf produced during 2012 (see Shale Daily, Aug. 19; March 6, 2013). E&Ps are on track to surpass the 3.3 Tcf produced in the state last year (see Shale Daily, Feb. 20).

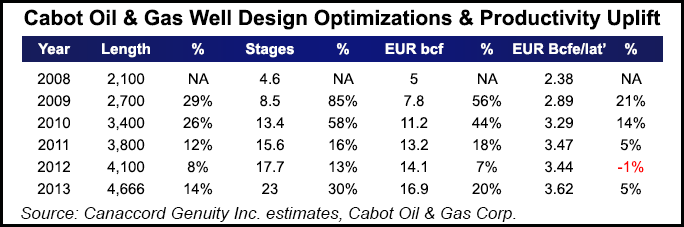

In July, Canaccord Genuity Inc. released a report on efficiency gains in the Marcellus (see Shale Daily, July 17). Similar to other shale plays across the country, analysts found that lateral length, fracture stages and estimated ultimate recoveries (EUR) all shared a correlation. In a case study, Canaccord found that longer laterals on wells drilled by Cabot Oil & Gas Corp. — currently the state’s second largest producer — had led to a 52% increase in EURs between 2008 and 2013. The report showed that Cabot wells drilled with a 2,100 foot lateral had a 2.38 Bcf EUR in 2008, while wells drilled with a 4,666 foot lateral increased the EURs to 3.62 Bcf in 2013.

“Cabot’s Susquehanna acreage is one of the very best assets in the U.S.; the company’s drilling and [hydraulic fracturing] design efficiencies have increased stated EUR per lateral foot, while at the same time relentlessly lowering cash cost structure,” Canaccord said. “While part of this is due to the power of the resource, the drill and completion [D&C] has changed significantly in terms of lengths and stages.”

Dennis Degner, director of completions engineering at Range Resources Corp., said many of the technologies being applied in the Marcellus are not new or novel. Instead, he said the formation’s reception to those techniques has driven gains below the surface, while operators have focused heavily on increasing production and cutting costs above it. For example, he said in 2013 Range moved away from multiple separators and vapor destruction units at its wells in Pennsylvania, choosing to install equipment that captured more vapor from the well.

“Success begets success. We got to a place where we started drilling longer laterals and understanding our landing target better,” Degner said. “Completion design improved and we started to generate better well results. Along with that came more condensate and more vapors to manage off the condensate.”

A six-well pad brought online earlier this year without vapor destruction units and more efficient surface equipment led to more than 1 MMcf/d of tank vapors that were previously lost, he said. Other commonplace techniques, such as automated choke systems, 24/7 remote control centers that allow real-time monitoring and switching from solar panels at well sites to thermal electric generators powered by natural gas from the pad have led to immense gains.

Degner and Ashmun both said remote operation centers have helped their companies to get ahead of problems before they occur, mitigate weather-related production issues and better allocate manpower to sites that need the most attention. Degner added that Range’s electric generators have saved $670,000 in capital expenditures this year. “For a multi-million dollar development budget, that might not move the needle for some folks, but every dollar counts.”

Degner and Ashmun told NGI’s Shale Daily that D&C techniques in the Marcellus will continue improving, while the same success is likely to occur in the Utica and Upper Devonian shales in Pennsylvania, albeit at a slower pace as development is only just beginning in those formations.

“Every team is doing very similar work. There are different parameters driving different things,” Ashmun said. “The subsurface of the northern Marcellus is clearly different than the Utica, so there are different drivers. I will tell you my team believes we’re only in the third inning of our optimizations. So, if that’s where you are after four years, then our teams are still on the front end of the opportunities.”

Degner said the Utica is thousands of feet deeper than the Marcellus, and with a higher pressure regime, finding similar efficiencies will be difficult.

“I think there’s a lot of pieces that we have to figure out, asking ourselves what’s going to be the difference in when we drill the well and how it affects the completion,” Degner said. “It’s going to take a multidisciplinary approach. Our geology team has made tremendous strides in the Marcellus, but I think we’re in the first inning of the Utica and Upper Devonian.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |