NGI Archives | NGI All News Access

NiSource Spins Off Columbia Pipeline Group To Unlock Growth Opportunities

In yet another sign of rising shale gas production and corresponding growth opportunities in the midstream sector, one of the nation’s largest utilities companies, NiSource Inc., announced a plan Sunday to spin-off its Columbia Pipeline Group (CPG) into a separate publicly traded company that would form a master limited partnership (MLP).

Under the plan, expected to be completed sometime next year, NiSource would retain its regulated gas utilities, which serve more than 3.4 million customers in seven states and continue providing electric distribution, generation and transmission services in northern Indiana. CPG, meanwhile, will form an MLP and retain significant control that will enable it to raise cash for its midstream assets.

NiSource said Monday that it has filed a registration statement with the U.S. Securities and Exchange Commission for the MLP, which will be called Columbia Pipeline Partners LP and trade under the symbol CPPL on the New York Stock Exchange (NYSE).

The MLP’s initial assets are expected to consist of a 14.6% interest in CPG, which will own substantially all of NiSource’s current natural gas transmission, midstream and storage assets, or 15,000 miles of interstate natural gas pipeline, 300 Bcf of natural gas storage capacity and a portfolio stuffed with related plans for growth.

CPG will also be traded on NYSE. NiSource did not provide guidance on an offering date or share price for that company or units in the MLP.

“As an independent company, CPG will be well-positioned to execute on a significant number of value-creating growth opportunities resulting from the expansion of natural gas drilling in its geographic territories, its landmark system modernization program as well as increased demand associated with liquefied natural gas exports and gas-fired electric generation — all of which is expected to benefit our customers, investors and other key stakeholders,” said NiSource CEO Robert Skaggs, Jr. “We are committed to unlocking significant value and enabling even greater investment to fuel growth in the CPG business that would not have been possible without the CPG separation and associated MLP.”

Financial analysts agreed, saying the MLP model offers an attractive alternative financing solution for billions of dollars in planned upgrades to NiSource’s assets. The company’s stock on NYSE was up more than 5% in early morning trading on Monday.

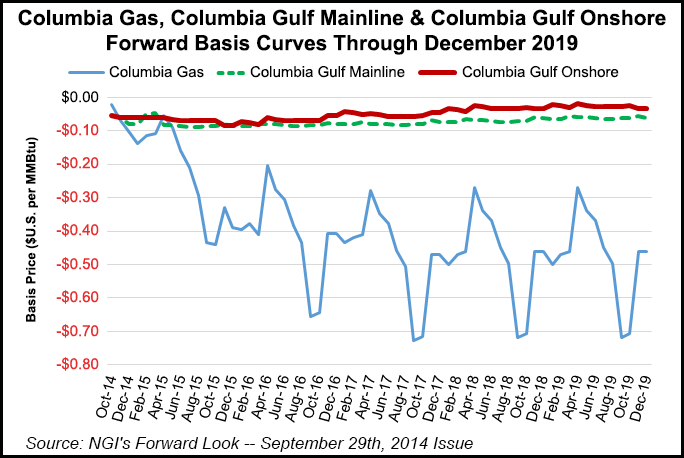

“A move to an MLP might especially help in Columbia’s case, since NiSource barely has an investment grade rating,” said Patrick Rau, NGI Director of Strategy & Research. Standard & Poor’s currently has a BBB- bond rating on NiSource, the lowest S&P rating that is still investment grade. MLPs tend to have lower costs of capital than regular C Corporations, since MLPs generally do not pay federal income taxes, and because the assets within the MLPs typically generate relatively steady cash flows. “Having a lower cost of capital, if that turns out to be the case, certainly won’t hurt Columbia in its quest to upgrade and expand its facilities, and that may help improve the staggering basis differentials that have been dogging Appalachian production in recent quarters,” Rau said.

Some of CPG’s system is already in the midst of advanced stages of development, while a long-term plan to upgrade its infrastructure and storage network is also expected to require $12-15 billion over the next decade driven by a rapidly growing supply of natural gas and the future demand that has had the midstream sector plotting a course for growth with a series of initial public offerings, expansion announcements and investments (see Daily GPI, Sept. 26; July 31; Feb. 25).

CPG has said it plans to spend up to $10 billion alone to serve rising natural gas production in the Appalachian Basin. While natural gas production is expected to keep surging in the next decade, the U.S. Energy Information Administration said in its Short-term Energy Outlook that marketed natural gas production will grow at an annual rate of 5.3% this year and another 2.1% in 2015, noting that onshore development in the lower 48 states shows no signs of slowing down.

NiSource itself also has plans to spend up to $30 billion over the next two decades to make upgrades at the utilities level, including the modernization of its electric generation and natural gas distribution systems.

“Separating our regulated utilities and pipeline businesses is a significant and logical step in our proven long-term strategy that has delivered substantial value to investors and enhanced service for our customers,” Skaggs said. “As a pure-play utilities company, we expect NiSource will continue to be well-capitalized, with significant customer and rate base scale, and a deep inventory of infrastructure investment opportunities.”

Before the separation occurs, NiSource plans to reduce its net debt with proceeds from a one-time cash distribution from CPG, which will fund the payment by issuing its own long-term debt. CPG then plans to fund its investments with a combination of that debt and proceeds from its public offering and the MLP.

NiSource shareholders who retain their NiSource and CPG shares are expected to receive separate common stock dividends from both companies. NiSource also said that separating both companies will not affect its current workforce. CEOs for both companies are expected to be announced by the end of the year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |