Markets | NGI All News Access | NGI Data

Futures Dive Following On-Target Inventory Report

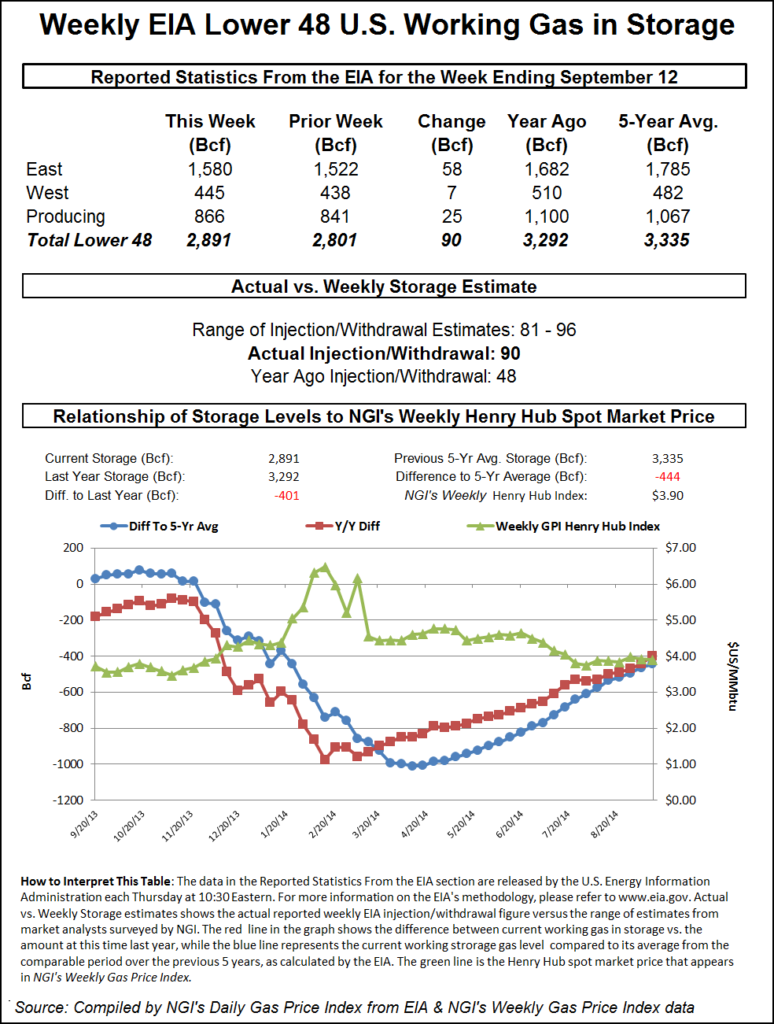

Natural gas futures spiraled lower Thursday morning following the release of government storage figures that were about what traders had expected. The injection of 90 Bcf was about equal to the average of analyst estimates, which ranged from 81 Bcf to 101 Bcf.

For the week ended Sept. 12, the Energy Information Administration (EIA) reported an increase of 90 Bcf in its 10:30 a.m. EDT release. October futures fell to a low of $3.897 soon after the number was released and by 10:45 a.m. October was trading at $3.917, down 10.6 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a build of just about 90 Bcf. A Reuters survey of 29 traders and analysts revealed an average increase of 90 Bcf with a range of 81-96 Bcf. United ICAP was looking for a build of 89 Bcf, and Bentek Energy’s flow model anticipated an injection of 88 Bcf.

Traders noted that the market’s recent excursion above $4 was short lived. “We are now back in the [$3.75-4.00] range,” said a New York floor trader. “I think we will settle under $4.”

Tim Evans of Citi Futures Perspective said “there’s no particular shock or surprise. However, the build was still bearish compared with the 71 Bcf five-year average level and leaves the door open to larger storage injections in the weeks ahead, as air-conditioning demand fades further.”

Inventories now stand at 2,891 Bcf and are 401 Bcf less than last year and 444 Bcf below the five-year average. In the East Region 58 Bcf was injected, and the West Region saw inventories up by 7 Bcf. Inventories in the Producing Region rose by 25 Bcf.

The Producing region salt cavern storage figure added 6 Bcf from the previous week to 222 Bcf, while the non-salt cavern figure rose by 20 Bcf to 644 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |