Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

Analysts Warn Additional Russian Sanctions Could Harm U.S. Energy Interests

A bill calling for additional sanctions against Russia is picking up support in the U.S. Senate, in part due to electioneering before the November vote. It would bar American companies from investing in and supporting projects in the Russian deepwater, Arctic offshore and shale oil production.

According to the Senate Foreign Relations Committee, a meeting is scheduled for Thursday to discuss pending legislation. The first item on the agenda is the Ukraine Freedom Support Act of 2014, which was introduced Wednesday by Sens. Robert Menendez (D-NJ) and Bob Corker (R-TN), the committee’s chairman and ranking member, respectively.

The committee said its meeting would be held after Ukrainian President Petro Poroshenko addresses a joint session of Congress.

In a statement, Menendez said Russian President Vladimir Putin “has upended the international order and a slap on the wrist will not deter future Russian provocations. In the face of Russian aggression, Ukraine needs our steadfast and determined support, not an ambiguous response. We are left with no choice but to apply tough sanctions against Russia, coupled with military assistance to Ukraine.”

Corker concurred, adding, “now is the time to increase the pressure on Putin and help strengthen Ukraine’s leverage. At a critical moment for Ukraine’s future, this bill, if implemented, would both demonstrate our solidarity with the Ukrainian people and our commitment that Russia will pay an increasingly heavy price for its invasion of Ukraine.”

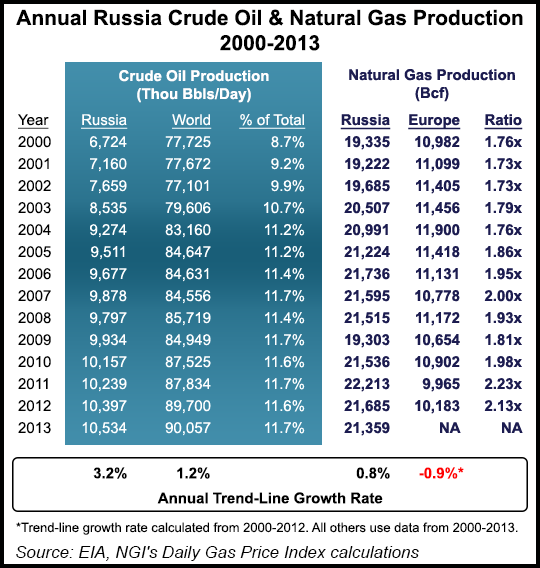

The 35-page bill would require President Obama to impose within 45 days of the bill’s passage at least three sanctions, from a list of nine, against any person that “knowingly makes a significant investment in a special Russian crude oil project.” It also calls on the president to punish Russia’s state-owned production company OAO Gazprom if he determines the company “is withholding significant natural gas supplies from member countries of the North Atlantic Treaty Organization [NATO], or further withholds significant natural gas supplies from countries such as Ukraine, Georgia or Moldova.”

Analysts with ClearView Energy Partners LLC said U.S. election year politics could create a “stampede” — where lawmakers would rush to embrace additional sanctions against Russia as punishment for its role in the Ukrainian crisis — a stampede that could not be stopped by the Obama administration.

In a note Wednesday, ClearView analysts Kevin Book, F.Chase Hutto III, Christi Tezak, Timothy Cheung and Timothy Fox said the bill “would also provide for U.S. strategic planning and assistance aimed at reducing Ukrainian dependence on Russian natural gas, but it would not provide for expedited LNG [liquefied natural gas] export authorizations — and we still believe an LNG exports bill faces long odds in the current Congress.

“We reiterate that further escalations in the Russia-Ukraine conflict and the political imperative for both parties to look tough on foreign policy ahead of the midterm elections could lead to a Congressional ‘stampede,’ making it very hard for many members in either chamber to vote against the sanctions,” the ClearView analysts said.

The analysts held out the prospect the Congress would be able to override a presidential veto, and that Putin could retaliate by cutting gas deliveries to Europe.

Concerns over Europe’s energy security began in February when pro-Russian forces took control of the Crimean peninsula from Ukraine. After a controversial referendum in Crimea to determine the peninsula’s status, Russia annexed the territory in March.

The unrest in Crimea touched off fighting between pro-Russian separatists and Ukrainian forces in parts of eastern Ukraine. In response, the United States and the EU have leveled sanctions against Russia for allegedly fomenting the crisis (see Daily GPI, March 18).

Last March, based on estimates it received from Russia’s Gazprom and Eastern Bloc Energy, the U.S. Energy Information Administration (EIA) said 16% of the natural gas consumed in Europe in 2013 was transported through pipelines that traverse Ukraine (see Daily GPI, March 14).

According to EIA, at least 10 NATO countries in Europe — Bulgaria, Denmark, France, Germany, the Netherlands, Norway, Poland, Romania, Spain and the United Kingdom — have shale resources. In May 2013, EIA estimated that Poland’s risked, technically recoverable shale resources totaled 146 Tcf of gas and 1.8 billion bbl of oil.

Additional sanctions imposed last Friday by the Obama administration already threatened to choke billions in joint development agreements between Russia’s OAO Rosneft to drill for Arctic and unconventional oil and gas with ExxonMobil Corp. (see Daily GPI, Sept. 12). Other U.S.-based operators that could be impacted by the Russian sanctions include Chevron Corp. and ConocoPhillips.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |