Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Gastar Switching Focus to Oklahoma’s Hunton Oil Play Next Year

Gastar Exploration Inc. is poised to spend heavily in its Hunton Limestone oil play next year after approving a $257.3 million capital budget that mostly would go toward drilling, completion and infrastructure in Oklahoma.

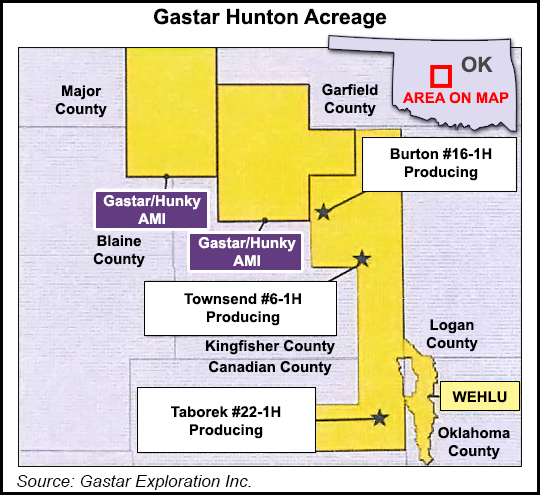

The company said it would likely spend nearly all of the budget, $222.7 million, to cover those costs for the burgeoning Hunton program in north-central Oklahoma, where it expects to drill 44 of the 54 gross wells it has planned across all its leasehold in 2015.

Gastar acquired the Midcontinent acreage last year and has slowly been ramping up its program since then (see Shale Daily, Sept. 9, 2013; April 2, 2013). It also has plans to drill two gross wells in a nearby area that includes the Mississippian Lime formation and the Woodford Shale, which it calls its Stack Play after the liquids-rich pay zones there.

The course is a bit of a deviation from years past. Gastar had been heavily focused in the Appalachian Basin, where the Marcellus Shale of northern West Virginia and southwest Pennsylvania accounted for 71% of the company’s proved reserves at mid-year (see Shale Daily, July 23; Feb. 1, 2012). It has plans to drill six gross wells in the Marcellus next year and two in the Utica Shale, including one low-cost vertical well.

But while a long-awaited test of the Utica Shale in West Virginia, released earlier this month, looked promising after a 48-hour gross sales rate of 29.4 MMcf/d (see Shale Daily, Sept. 8), the company has reported significant progress in the Midcontinent. The day the Utica test was released, Gastar said two of its Hunton wells in Kingfisher County, OK, reached a combined peak production rate of 1,528 boe/d, with a 92% oil cut.

Gastar joins a group of small and large exploration and production companies working to crack the code of the Hunton, referred to as CNOW, Stack or SCOOP, by others (see Shale Daily, June 25; April 11). Full-scale commercial development is thought to be years away there. Oil from the Hunton, though, moved the value of Gastar’s reserves from $592.5 million at the end of 2013 to $826.3 million in June.

The company also expects its horizontal Hunton wells to cost $5.5 million on average next year, while its Marcellus Shale wells are expected to cost $7.8 million and its horizontal Utica wells to cost $16 million. Gastar will operate 74% of its budgeted drilling and completion capital.

With its Appalachian program in full swing and its Hunton program ramping-up, Gastar set 2015 full-year guidance at 15,500-18,000 boe/d, up from 9,700-11,000 boe/d this year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |