E&P | NGI All News Access | Permian Basin

Athlon Charms Again With Midland Basin Magic

About 15 months since its initial public offering, Fort Worth, TX-based Athlon Energy (ATHL) has continued to win praise from analysts who follow the company. The latest results from a trio of Midland Basin wells brought the company more of the same.

“In total, ATHL’s initial eight horizontal wells are outperforming their type curves by nearly 70% with the wells tracking more than 90% rate of returns on average at $90/bbl oil, above the company’s type curve average of 36%,” Topeka Capital Markets analyst Gabriele Sorbara said in a note Wednesday.

Sorbara reaffirmed a “buy” rating on Athlon shares and raised third quarter and full-year 2014 projection forecast, as well as the production growth forecast for next year and 2016. Athlon shares closed up nearly 5% at $47.32 Wednesday. The stock’s 52-week high is $51.63.

Tuesday’s operations update was on three wells in which the company has 100% working interest and was “…yet another positive step in the ATHL story,” wrote Wells Fargo Securities analyst David Tameron.

On Tuesday Athlon reported what Sorbara said is the best publicly disclosed well in the eastern Midland Basin, a subbasin within the Permian Basin. The company also shared details on a “top-tier” Wolfcamp B well in Midland County, TX, and reported on an “above average” initial Lower Spraberry well in Martin County, TX.

Athlon’s Howard County horizontal well, Tubb 39 #5H — its third Wolfcamp A well in the county — was drilled and completed using a 30-stage hybrid fracture stimulation over a perforated lateral length of 6,705 feet. The well flowed naturally prior to installing artificial lift and achieved a peak three-phase 24-hour initial production (IP) rate of 2,351 boe/d (77% oil) and a peak three-phase 30-day rate of 1,594 boe/d (73% oil).

The production rate on the Tubb 39 #5H is tracking “well above” Athlon’s previously disclosed Howard County horizontal Wolfcamp type curve estimated ultimate recovery (EUR) of 625,000 boe for a 7,500-foot lateral, the company said. Additionally, the Tubb 39 #5H is performing similar to Athlon’s second Howard County well, the Williams 17 #3H, with about 1,000 feet less lateral length. The company said it believes the well represents the highest normalized 30-day IP rate of any reported horizontal Wolfcamp well on the east side of the basin.

Tameron wrote that this well was being watched closely because it is farther south of prior Athlon and industry wells in Howard County. The “…news could help to de-risk additional Howard County acreage,” Tameron wrote, “although we note the majority of ATHL’s acreage in the county is further to the north. Initial results came in a bit less oily than wells to the north of Big Spring, but management had noted this could be expected as you move from north to south.”

Continuing the good news, Athlon said the Midland County horizontal well Davidson 37B #8H was drilled and completed using a 30-stage hybrid fracture stimulation over a perforated lateral length of 7,744 feet in the Wolfcamp B zone. The well achieved a peak three-phase 24-hour IP rate of 2,425 boe/d (76% oil) and a peak three-phase 30-day rate of 1,680 boe/d (74% oil). Both the production rate and percentage oil on the well are tracking above Athlon’s previously increased Midland “Pegasus” horizontal Wolfcamp type curve EUR of 880,000 boe (68% oil) for a 7,500-foot lateral, the company said.

With the performance of the Tubb and Davidson wells, Athlon might be moved to raise its published type curves, Tameron wrote.

The company’s first Lower Spraberry well was completed in Martin County. The Dorothy Faye K #2H was completed using a 32-stage hybrid fracture stimulation over a perforated lateral length of 7,922 feet. The well achieved a peak three-phase 24-hour IP rate of 1,279 boe/d (73% oil) and a peak three-phase 30-day rate of 1,076 boe/d (74% oil). The company said it believes the normalized 30-day initial production rate compares “very favorably” with other reported Lower Spraberry horizontal wells on the west-side of the basin.

Topeka Capital raised its third quarter Athlon production forecast to 27,500 boe/d from 26,800 boe/d, putting its outlook at the top end of management guidance. The firm also raised this year’s production forecast to 25,200 boe/d from 25,000 boe/d, exceeding company management guidance of 25,000 boe/d.

“We are revising up our 2015 and 2016 production growth to 74.6% and 32.1% (versus 72.7% and 31.0% previously), ahead of the consensus of 63.3% and 40.5% growth, respectively,” Sorbara wrote. “Despite our above average production growth, we remain convinced the bias to our estimates is upward.”

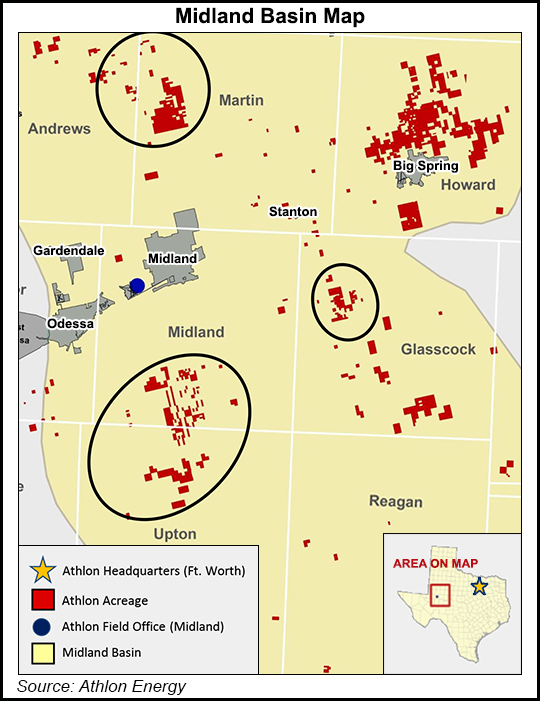

Athlon went public around the middle of last year (see Shale Daily, June 7, 2013) and earlier this year added acreage in Martin, Upton, Andrews and Glasscock counties in Texas (see Shale Daily, April 9). Another acreage addition followed, and robust production has so far been the norm (see Shale Daily, Aug. 13; April 16).

Analysts at Tudor, Pickering, Holt & Co. called Athlon a “top pick” among small cap companies when commenting on the “gangbuster group of well results” in a note Wednesday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |