Wyoming Poised for Energy Growth, Energy Chief Says

Wyoming’s oil and natural gas sector is ready to grow, particularly on the oil side, with the increase in horizontal drilling and hydraulic fracturing (fracking), the state’s chief energy regulator told NGI‘s Shale Daily on Wednesday.

Issues plaguing other states, such as flaring of associated gas, groundwater impacts and plugging of abandoned wells, are all under control in Wyoming, said Mark Watson, supervisor of the Wyoming Oil and Gas Conservation Commission (WOGCC).

The only unresolved issue at the state level is setback distances for drilling, and the commission has a hearing scheduled for Tuesday about whether the current 350-foot rule needs to be expanded to 500 or 1,000 feet.

While admitting some state staffing shortages and possible roadblocks at the federal level hinder future growth, Watson is upbeat about the state’s industry. “The future looks pretty good as far as we’re concerned,” he said.

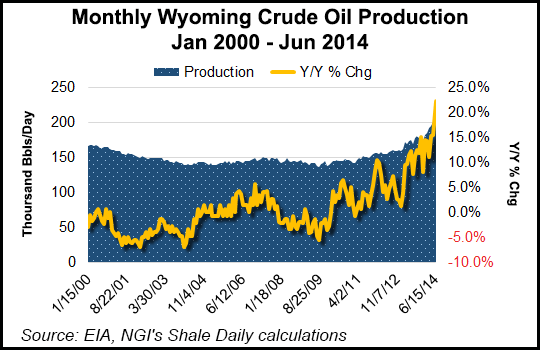

Wyoming’s oil production has hit about 200,000 b/d and is increasing steadily, Watson said. Gas production is about 5 Bcf/d currently, but it is still declining in the continuing low-price environment for burgeoning U.S. supplies.

A 31-year veteran with the WOGCC, Watson was named to the top job earlier this year when Grant Black resigned (see Daily GPI, April 1). Watson has inherited an understaffed unit that has seen 35% of the employees retire in the past year. He has hired eight people but still has three key engineering/resource management positions vacant, and as a result he said he is doing “two or three jobs.”

“These are pretty big jobs to fill because we’re looking for candidates with 10 to 20 years of experience who can work in industry for quite a lot more money,” said Watson, noting the state faces the prospects of ever-increasing oil production “as these horizontal wells keep getting drilled.” For gas, “we still have a lot of production, but it isn’t increasing right now.”

A combination of sustained lower gas prices, shuttered coalbed methane sites and no gas exploration in the Niobrara formation has contributed to the decline in gas production, he noted. Current horizontal production of oil is concentrated in the southern Powder River Basin (PRB) area, along with the northern part of the Denver-Julesburg (DJ) Basin near Cheyenne.

Rig counts are increasing — “up nine or 10 these last couple of weeks” — with the overall statewide total staying in the 50 to 55 range, according to Watson, who expects three or four more rigs being added to the Cheyenne area.

Crude oil production in the states has been trending upward since early 2010, but growth as measured on a year-over-year percentage basis has surged in recent months, according to Energy Information Administration data. For June crude production in Wyoming came in at 214,000 b/d, up 22.3% from June 2013, a gain significantly higher than the 11.0-15.5% year-over-year gains posted in January through May of this year.

The two areas of increased horizontal drilling activity remain the southern PRB and the northern DJ basins. Companies leading the charge in the DJ Basin area include EOG Resources Inc., Anadarko Petroleum Corp.and Kaiser-Francis Oil Co., and in the lower PRB it is Anadarko, Devon Energy Corp., EOG, Samson, and Powder River Energy Corp., he said.

Watson said 90% of the state’s drilling permits are for horizontal wells, aside from vertical ones in the western part of the state where there is pure gas drilling.

On another issue that has been driven by Gov. Matt Mead, a statewide effort to plug several thousand abandoned wells is proceeding ahead of schedule, and all of the wells should be closed in the next few years, Watson said (see Shale Daily, May 14) . “Based on the wells we have now, it should be done in a two- to three-year period.”

Regarding flaring, Wyoming has about 45 wells currently with exemptions to flare beyond the 15-day limits, Watson said. “That number has been pretty steady during the past year. Companies with exemptions can flare for up to six months, but then they have to get hooked up to a pipeline.”

Unlike neighboring North Dakota, Wyoming has a lot of gas gathering pipelines and related infrastructure in place from its past production booms, so there is adequate takeaway infrastructure, and there are also two processing plants coming online later this year or next, Watson said. “We’ve had the infrastructure [pipelines, compression, gas plants] for years for gas, unlike North Dakota.”

Following some meetings between the state and the U.S. Environmental Protection Agency (EPA) regarding tests for water wells for gas production well operators (see Shale Daily, June 24, 2013), Wyoming now has groundwater testing rules for pre- and post-oil/gas well drilling permits, and with 60% of its mineral resources on federal lands, the state also has a good working relationship with the U.S. Bureau of Land Management (BLM), Watson said.

In the recent past, Mead challenged areas in which he thought the state had a bigger role to play. Earlier this summer, Mead promised to shield the state from potential economic harm he saw from federal regulation in the energy and environmental sectors (see Shale Daily, June 20).

“The big issue with the BLM right now is drilling permits; it takes them more than a year to process permits,” Watson said. “In contrast, we do it in 30 to 60 days, so that has really slowed things up on the federal side.” In contrast, on proposed federal fracking rules, he doesn’t think they will be “as big an issue as everyone thinks,” particularly in Wyoming where state fracking rules have been in effect since 2010.

“Wyoming and BLM have a pretty good relationship and that has been true historically. EPA is another story; it tends to come up with rules and then ask us [the states] what we think.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |