Marcellus | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Shell’s Utica NatGas Wells Extend Play into North-Central Pennsylvania

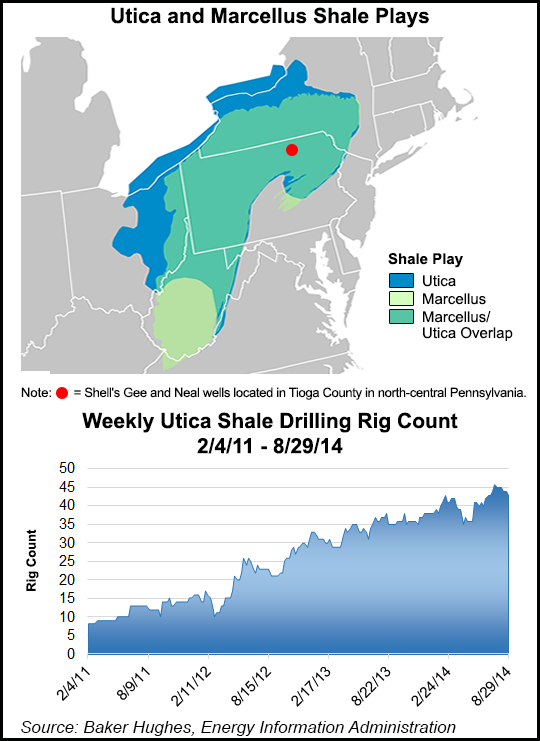

A unit of Royal Dutch Shell plc has drilled two natural gas wells into the Utica Shale in Pennsylvania near the New York border, 100 miles-plus from most of the current activity, news that suggests a much bigger potential for the far-reaching formation.

The Gee and Neal wells are in Tioga County in north-central Pennsylvania, and “extend the sweet spot of the Utica formation beyond Southeast Ohio and Western Pennsylvania, where previous discoveries have been located, and into an area where Shell holds a major leasehold position of approximately 430,000 acres,” the operator noted on Wednesday.

Gee was drilled to a measured depth of 14,500 feet and a lateral length of 3,100 feet, while Neal was drilled to 15,500 feet and a lateral length of 4,200 feet.

“These results are comparable to the best publicly announced thus far in the emerging Southeast Ohio Utica dry gas play,” said management. Although most of the tests to date are in Ohio, the massive formation extends from Quebec along the St. Lawrence River Valley into the Lower 48 states into Michigan to the west and as far south as Tennessee. Not all of the area has been tested for commercial oil and gas.

The Gee well, more than 100 miles to the northeast of the nearest horizontal Utica producer, had an initial flowback rate of 11.2 MMcf/d and has been on production for almost a year. Neal ramped up in February, with observed peak flowback rates of 26.5 MMcf/d.

“This successful discovery is the result of solid technical work in our onshore business,” said Upstream Americas Director Marvin Odum. “Last year, we refocused our resources plays strategy to select fewer plays with specific scale and economic characteristics to best suit our portfolio. The Appalachian Basin is one of those areas, and these two high-pressure wells both exhibit exceptional reservoir quality.”

Shell is awaiting results from four additional wells drilled in Tioga County, which are expected to begin producing later this year.

Despite several costly write offs and asset sales to right its portfolio, Shell isn’t giving up its exploration opportunities in the U.S. onshore, CEO Ben van Beurden said Tuesday. He was keynote speaker at Columbia University’s Center on Global Energy Policy in New York.

Van Beurden admitted that Shell had been slow to recognize the value of the unconventionals in North America before it jumped in with its pocketbook. Among other things, Shell in 2010 spent $4.7 billion to buy 650,000 acres in the Marcellus Shale and more than $1 billion to buy land in the Eagle Ford Shale in South Texas. Some of the purchases in the onshore didn’t always prove to be as good a deal as management would have liked.

“Fundamentally, it will only work if you sit on the right geology,” van Beurden said.

Since he came aboard in January, Shell has reassessed its entire U.S. portfolio, selling off big chunks of acreage and writing off more than $3 billion since last year (see Shale Daily, Oct. 2, 2013; Sept. 25, 2013; Aug. 2, 2013). Van Beurden said last month that Shell continued to be opportunity-rich but capital-constrained in the United States (see Daily GPI, Aug. 4).

“The speed at which we had done it and the volume has been giving us a bit of indigestion, to be quite honest,” he said Tuesday of the unconventional buildup. “You can be too greedy and too hungry when it comes to looking at opportunities.”

Asset sales over the past few months have helped narrow the focus and put Shell back in the game to compete with smaller producers that now dominate the U.S. onshore, he noted.

“It’s a different type of game, but it’s not best left to the independents,” the CEO said. “There’s no reason we can’t be cost efficient in the same way that independents are…We can play and win at it as well.”

The global producer has its hand in unconventional development elsewhere, but there’s no place like the United States and Canada, said van Beurden.

“I think it’s going to be predominantly a North America phenomenon,” he told the audience. “We’ve tried very, very hard in places like China and Ukraine.” In China, “there are much less advanced systems, less advanced supply chains, market mechanisms…” Longer-term potential exists for unconventionals elsewhere, he said, in Russia, Algeria and Argentina.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |