Eagle Ford Shale | NGI All News Access

Buckeye Acquires Eagle Ford-to-Corpus Christi Asset Chain

Growing crude and condensate production from the Eagle Ford Shale was too good for Buckeye Partners LP to ignore. The partnership is buying into Gulf Coast midstream assets that serve the play and offer growth opportunities with expansion currently in progress.

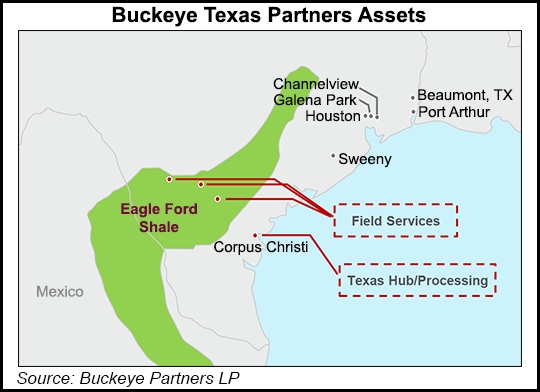

In an $860 million deal, Buckeye is acquiring an 80% stake in Trafigura Terminals LLC from Trafigura AG to create a venture called Buckeye Texas Partners with three components: Buckeye Texas Hub, Buckeye Texas Processing and Buckeye Field Services.

Buckeye is gaining a vertically integrated system of midstream assets including a deepwater, high-volume marine terminal on the Corpus Christi Ship Channel, a condensate splitter and liquefied petroleum gas storage complex in Corpus Christi, and three crude oil and condensate gathering facilities in the Eagle Ford Shale.

Upon completion of the initial development phase, the assets would form an integrated system with connectivity from production in the field to the marine terminal infrastructure in Corpus Christi, creating “a premier logistics platform” with significant flexibility and optionality, Buckeye said. With the stake in the Gulf Coast assets, Buckeye is adding a fourth North American energy hub to its portfolio, which includes Chicago, the New York Harbor and the Caribbean.

“This transaction allows Buckeye to acquire and further develop a midstream platform in the Gulf Coast with long-term committed revenues and significant potential for further growth,” said Buckeye CEO Clark C. Smith. “We expect this unique integrated system of assets will allow us to capitalize on the rapidly growing production in the Eagle Ford Shale…Substantial fee-based cash flows are expected to be generated by this investment as all of the assets are fully contracted under long-term commercial agreements with Trafigura.”

The deal is expected to close this month. During a presentation Wednesday to discuss the transaction, Smith said the Eagle Ford is, and is expected to remain, the largest contributor of domestic liquids production among all major U.S. basins, using data compiled by Wood Mackenzie Ltd. (see Shale Daily, June 6).

“U.S. condensate production is expected to grow by about 370,000 b/d to 1.8 million b/d in 2018, driven by growth in Gulf Coast condensate production,” Smith said, citing data from ESAI Energy LLC. Further, estimates put Eagle Ford condensate production at about 40% of total U.S. condensate production, he said.

Buckeye is gaining control of gathering assets that “lie in the heart of the Eagle Ford condensate window,” Smith said. They are adjacent to counties that currently account for about 40% of total Eagle Ford liquids production.

At the other end of the deal, the terminal at Corpus Christi is “economically advantaged” to handle Eagle Ford production, Buckeye said. “Corpus Christi is the closest key export point and has about three times more Eagle Ford pipeline takeaway capacity than Houston. Eagle Ford production is incentivized toward Corpus Christi due to lower pipeline tariffs than alternate destinations.” Additionally, Smith said the Corpus Christi Ship Channel is less congested than the Houston Ship Channel.

“This will be a premier export facility, and the assets have been designed and built with the kind of flexibility and optionality that trading companies like Trafigura strongly desire,” Smith said during his presentation. “It’s our view that regardless of what happens with any further relaxations or changes to the ban on crude oil exports, these facilities are prime, strategically located assets that will continue to be utilized to process and/or export crude and condensate, as well as multiple other products moving forward.”

The Corpus Christi facilities have five vessel berths including three deepwater docks, and upon completion of initial development phase, would offer 5.6 million bbl of liquid petroleum products storage capacity along with rail and truck loading/unloading capability.

A 50,000 b/d condensate splitter is under construction and anticipated to be completed by mid-2015, after which Buckeye Texas Partners would commence operations under a seven-year fixed-fee tolling agreement with Trafigura. In addition, three field gathering facilities with associated storage and pipeline connectivity would allow Buckeye Texas Partners to move Eagle Ford crude and condensate production directly to the terminal facilities in Corpus Christi.

Smith said Buckeye Texas Partners is expected to invest $240-270 million through the first quarter of 2016 for the additional infrastructure, which is expected to come online over the next nine to 18 months.

Buckeye Texas Partners would operate the facilities. Trafigura AG would have a 20% stake and retain commercial rights to use all of the assets. “Trafigura will continue to provide marketing and transportation solutions to the producing community and combined with our other splitter investment in Corpus Christi, we believe we are well positioned to provide maximum optionality to the market in South Texas,” said Trafigura AG’s Jeff Kopp, head of North America oil trading.

Trafigura AG is a unit of Trafigura Beheer BV, a commodity trader specializing in the oil, minerals and metals markets with operations in 58 countries.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |