Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Eastern Losses Highlight Mixed Trading; October Makes It Over $4

Physical gas for delivery Friday was mixed in Thursday’s trading as both buyers and sellers scrambled to get their deals done prior to the release of government storage data.

Once again, New England and Mid-Atlantic points fell hard as near-term weather forecasts called for mild and temperate conditions. Broad market strength was unable to counter weakness, not only in the Northeast but also in the Gulf and Midcontinent. Overall, the market fell 10 cents.

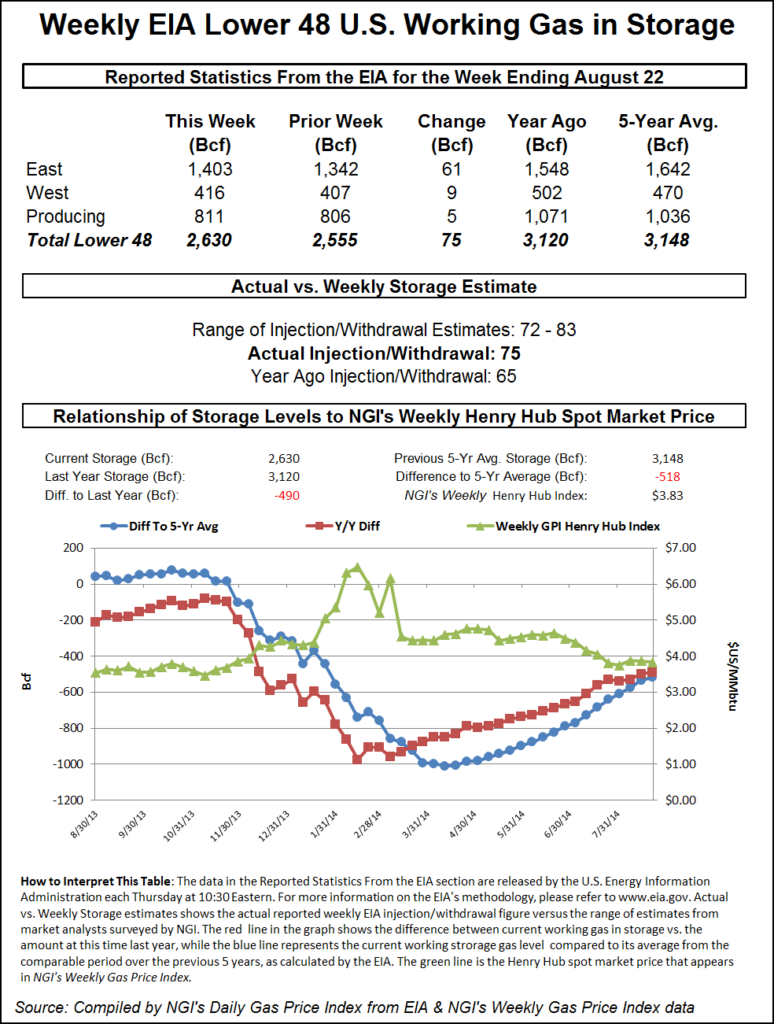

The Energy Information Administration (EIA) reported that working gas inventories rose by 75 Bcf to 2,630 Bcf. That was about 3 Bcf short of market expectations and was enough to fuel an advance that left the October solidly perched over the psychologically important $4 level. At the close, October was 4.1 cents higher at $4.044 and November had gained 3.2 cents to $4.101. October crude oil gained 67 cents to $94.55.

Northeast and Mid-Atlantic prices posted a second straight day of declines as weather conditions turned mild and pleasant. The National Weather Service in southeast Massachusetts said, “High pressure will build in with drier weather and less humidity for tonight [Thursday] and tomorrow. Hurricane Cristobal will continue to bring dangerous surf and rip currents to the Cape and Nantucket tomorrow. Pleasant late-summer weather will continue on Saturday. A front will slowly move across New England late Sunday and Monday, bringing scattered showers and thunderstorms.”

Temperatures Friday along the Eastern Seaboard were seen struggling to make it to seasonal norms. Forecaster AccuWeather.com predicted that Boston’s high of 82 degrees Thursday would plummet to 70 by Friday and recover somewhat to 76 by Saturday. The normal high in Boston is 78 this time of year. New York City’s Thursday high of 82 was expected to ease to 78 Friday and recover to 80 on Saturday. The normal late-August high in New York is 80. Washington, DC’s Thursday high of 87 was anticipated to slide to 83 Friday before bouncing back to 87 on Saturday. The seasonal high in Washington is 85.

Next-day gas headed for New York City on Transco Zone 6 dived 83 cents to $1.96, and deliveries on Tetco M-3 came in 62 cents lower at $2.01.

Northeast and Marcellus points weren’t too far behind. Parcels delivered to Algonquin Citygates shed 17 cents to $2.75, and gas on Iroquois waddington slid 11 cents to $3.84. Parcels on Millennium were seen 21 cents lower at $2.17.

Gas at Transco Leidy came in 27 cents lower at $1.96, and parcels on Tennessee Zone 4 Marcellus dropped 21 cents to $1.95.

Next-day prices at Midwest market points suffered nowhere near the same price pressure as the East. Next-day gas on Alliance was unchanged at $4.01, and gas at the Chicago Citygates was flat at $4.01. Michcon next-day gas changed hands at $4.05, also unchanged.

Gulf prices held steady as a major source of supply was expected to return to service. “SONAT’s South Section 28 Line has been returned to service, which will likely add about 180 MMcf/d of supply back into the Louisiana region and put downward pressure on SONAT basis,” said industry consultant Genscape. “SONAT began accepting nominations for the ID1 cycle on Aug. 25th, [but] SONAT declared a force majeure on the Line on June 17th after detecting a line leak. Affected points included: Sabine to SNG, Sea Robin to Erath, Section 28 to AMOCO, Lake Larose, Bayou Crook Chene, and Erath to South Section 28 Line.

“In the 14 days prior to the force majeure, flows averaged 180 MMcf/d, reaching as high as 227 MMcf/d on gas day June 17. Following the conclusion of repairs, flows are expected to return to pre-event levels. Since this work has been completed and these locations have returned to service, three locations (Erath — South Section 28 Line, Sea Robin — Erath, Bayou Crook Chene) have seen a start to return to normal service.

“In the 14-days prior to the force majeure SONAT basis averaged ($0.03). On the day of the force majeure, basis shot up to $0.04, then averaged even with Henry Hub through the duration of the event. With nominations starting to appear again, Wednesday’s trading sent SONAT basis back down to close at ($0.02),” the firm said.

Deliveries to Henry Hub added 3 cents to $4.02, and gas on Tennessee 500 L added 3 cents to $3.98. Deliveries to Transco Zone 3 added a penny to $3.99, and gas on Columbia Gulf Mainline was flat at $3.94. The Houston Ship Channel was down 2 cents at $4.00, and Katy was off 2 cents at $3.99.

The market has been confined to a trading range for the last several weeks, and traders were looking to see if the Thursday morning release of storage data by EIA would prompt a move out of the $3.75-4.00 zone. The Wednesday expiration of the September contract gave traders little insight.

Expectations were for a build in the 78 Bcf area, well above last year’s 65 Bcf increase and the five-year pace of 58 Bcf. Houston-based IAF Advisors calculated an 80 Bcf increase, and a Reuters poll of 27 traders and analysts revealed a 78 Bcf average with a range of 72-83 Bcf. Bentek Energy’s flow model saw a somewhat smaller 76 Bcf increase and attributes the decline from last week’s 88 Bcf entirely to increased power generation demand.

“Total U.S. demand increased 1.3 Bcf/d from the previous week, with power burn demand accounting for the entirety of the uptick. Burn rose to 28.5 Bcf/d on the week, the highest weekly power burn demand of the year,” the company said in a report.

The actual figure, 75 Bcf, had some traders skeptical. “We had heard from 78 Bcf to 80 Bcf or thereabouts, and I think the market will hold $4 initially, but I don’t think the market has a lot of strong support [above $4] at all,” said a New York floor trader. “If we settle above $4 that might have some significance, but if we trade back down then we are looking at a trading range of $3.75 to $4.25.”

Phillip Golden, director of risk and product management at EMEX, said the storage report was “relatively flat” versus market expectations of 76-80 BCF. “The market is up slightly, continuing [Wednesday’s] trend and suggesting that weather, rather than the storage report, is moving the energy market right now,” he said. “Due to recent movements in the market, the balance of calendar year 2014 is now at the high end of the EMEX’s expectations. However, as previously stated, EMEX believes there will be buying opportunities for consumers in the next six weeks, and businesses should be prepared to capture these dips in energy prices before winter arrives.”

While noting that 2014 remains the strongest injection season in the past six years, Golden added that injections going forward could fall off the record refill pace, thanks in large part to the recent heat wave striking much of the country. “With what appears to be a late-onset summer, the potential for injection numbers to remain flat or decline slightly week-over-week exists and would be contrary to historical norms,” he said.

Inventories now stand at 2,630 Bcf and are 490 Bcf less than last year and 518 Bcf below the five-year average. In the East Region 61 Bcf was injected, and the West Region saw inventories up by 9 Bcf. Inventories in the Producing Region rose by 5 Bcf.

This week’s consumption of electricity could also lead to a relatively thin build in next week’s report as well. The National Weather Service (NWS) for the week ended Aug. 30 predicts well above normal cooling requirements for major population centers. NWS calculates New England will endure 46 cooling degree days (CDD), or 24 more than normal, and the Mid-Atlantic will see 57 CDD, or 23 more than its seasonal tally. The greater Midwest from Ohio to Wisconsin should swelter under 68 CDD, or 34 more than its norm.

Forecaster NatgasWeather.com is looking for temperature patterns to prompt relatively lean storage builds for the next couple of weeks followed by plump increases going into the shoulder season. “The weather system moving through the central U.S. today will bring noticeable cooling and easing of demand, while the weather system departing the Northeast will also provide comfortable temperatures with highs in the 70s to lower 80s.

“The warm-up coming after this weather system departs is a bit tricky due to inconsistencies in weather models as they try to figure out exactly where cooler Canadian air will advance into the U.S. around Sept. 6-7th. There will be a noticeable blast of cooler temperatures over a big chunk of the U.S., but there is still uncertainty on how fast it will push into the eastern U.S.

“Next week’s build will also likely be in the 70 Bcf range and very well could be the last one below 80 Bcf for the remainder of the year. As long as there remains strong potential for cooler Canadian air to push into the northern U.S. for the second week of September, we expect the markets to have limited upside potential as the return of 100+ Bcf builds will be looming.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |