Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

1 Bcf/d Transco Expansion Would Take Marcellus Gas to Northeast

Williams Partners LP is looking for capacity takers on a proposed expansion of its Transco pipeline that would add 1 Bcf/d of deliverability from the Marcellus Shale to Northeast markets.

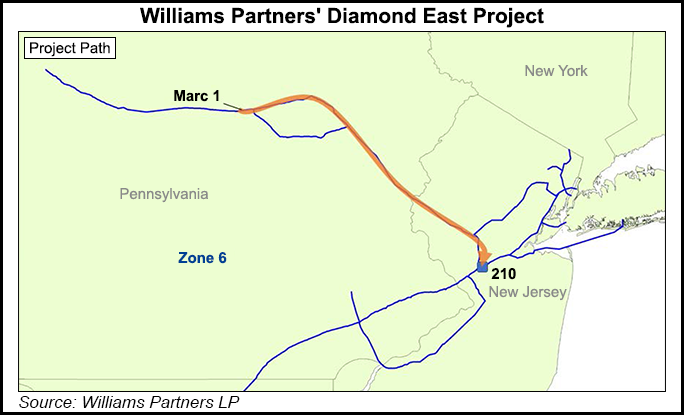

The Diamond East Project would be in service by mid-2018 and would take gas from receipt points along Transco’s Leidy Line in Lycoming and Luzerne counties in Pennsylvania to its Market Pool at Station 210 in Mercer County, NJ. From there, gas could flow to Transco’s Northeast market, including Pennsylvania, New Jersey and New York local distribution companies and power generators.

The primary firm transportation path under the project would begin at the existing Zone 6 Marc I interconnection with Central New York Oil and Gas Co. LLC in Lycoming County. Transco said it would entertain alternate receipt locations along the Leidy Line during the open season, according to a bulletin board posting.

Transco plans to offer expansion shippers a negotiated daily reservation rate “…in the low $0.40s to high $0.50s per Dth/d” for firm service, depending upon final project volume. Shippers requesting at least 250,000 Dth/d would receive anchor shipper status and could receive lower rates.

“Unlike competing projects designed to serve the New Jersey Market Pool, Diamond East is a cost-effective expansion along an existing Transco corridor,” said Rory Miller, senior vice president of Williams Atlantic-Gulf operating area.

Earlier this month, a group of utility/marketing companies proposed a new 100-mile pipeline to serve markets in New Jersey and Pennsylvania with Marcellus gas. The pipeline would begin in Luzerne County in northeastern Pennsylvania and end at Transco’s Trenton-Woodbury interconnection in New Jersey (see Daily GPI, Aug. 12).

“There are a lot of producers interested in getting access to new infrastructure out of the Marcellus while at the same time there’s tremendous market growth on Transco,” Transco General Manager Frank Ferazzi told NGI. “There’s a competing project out there that’s being sponsored by LDCs [local distribution companies], and so there’s presumably market growth behind that. But again, there’s producer interest in getting out of the basin to consuming markets, so we’re actually going to be courting both the LDCs and the producers at the same time.”

Ferazzi said Diamond could be sized according to demand and could end up being 500 MMcf/d or smaller, depending on what shippers want. He added that whatever size it comes out to be, it can be accomplished with fewer facilities than a greenfield project.

The Diamond expansion would consist of additional compression and selected pipeline loop segments along the existing Transco corridor. Although the final capacity, scope and cost of the project would be determined by the results of the open season, it is anticipated that the project will include about 50 miles of pipeline looping and horsepower additions at existing Transco compressor facilities. The cost is estimated to be $500 million to $800 million.

The open season runs through Sept. 23. For information, contact Jamie Taft, (713) 215-2404.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |