Eagle Ford Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

PVA Expects Delays in 2H2014 Drilling Program

Penn Virginia Corp. (PVA) said it expects delays in its drilling program in 2H2014, and it expects those delays to have a slight impact on production, expected earnings and capital expenditures (capex) for the remainder of the year.

“Although well results continue to meet or exceed expectations, we anticipate delays in the timing of completions associated with our second half of 2014 drilling program, including those wells to be drilled with the recently added seventh and eighth drilling rigs,” PVA said Monday. “In addition, as a result of the delays, we now expect four (2.5 net) fewer wells will be turned in line in 2014, with those four wells now expected to be turned in line during the first quarter of 2015.”

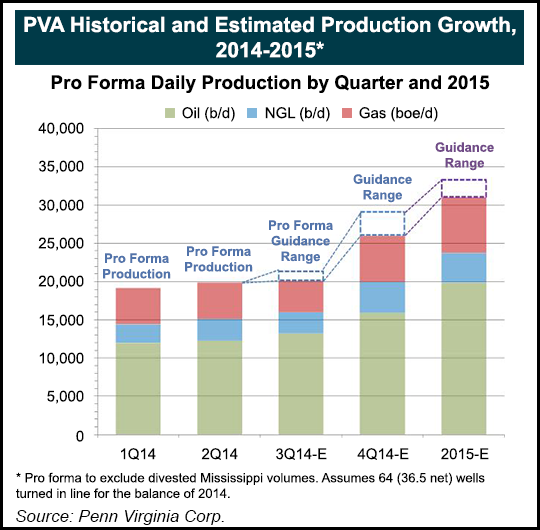

PVA, based in Radnor, PA, said 2H2014 production is now projected to range 23,400-25,500 boe/d. The company said it estimates 3Q2014 production to range 20,800-22,000 boe/d, and for 4Q2014 production to range 26,000-29,000 boe/d.

Last month, PVA estimated its production for the full-year 2014 would range 8.8-9.2 million boe. For 2H2014, it estimated production of 5.0-5.3 million boe.

At the end of July, PVA closed on the sale of its Mississippi assets to an undisclosed buyer for gross cash proceeds of approximately $73 million (see Shale Daily,June 2). The assets included horizontal wells targeting the Selma Chalk that had net production of about 11.9 MMcfe/d in 1Q2014, nearly 100% of which was natural gas.

“We now expect a 1-7% increase in production in the third quarter over the second quarter, and a 29-36% increase in production in the fourth quarter over the third quarter,” PVA said. “Our Eagle Ford production is expected to increase approximately 50-60% in the second half of 2014 over the first half, driven by continued well completions and anticipated strong well results.”

As a result of the reduced completions, PVA said capex during 2H2014 is expected to range from $380-420 million, down from $410-456 million. Meanwhile, adjusted EBITDAX [earnings before interest, taxes, depreciation, amortization and exploration expenses] for 2H2014 were expected to range from $210-245 million, down from $251-296 million.

The company also said it estimates total production for 2015 will be 35-45% higher than 2014, with oil production 45-60% higher than 2014. Capex is expected to range from $750-$800 million, with an adjusted EBITDAX that is 35-40% above 2014. “The preliminary estimates for full-year 2015 are meant to provide guidance only and are subject to revision as our 2015 budget is finalized,” PVA said.

Analysts were surprised by some of the developments and warned that PVA stock could suffer.

In a note Monday, Phillip Jungwirth and A.J. Donnell, analysts with BMO Capital Markets Corp., said PVA’s announcement that it would turn 36.5 net wells in line during 2H2014 was below their expectations (38.0 net), and the production range of 20,800-22,000 boe/d for 3Q2014 was below the consensus estimate of 24,400 boe/d, which BMO also held. The firm listed PVA stock as “market perform” with a target price of $10.00/share.

“While the cut to 3Q2014 guidance is a surprise, we had already anticipated a 4Q2014 miss, and updated 4Q2014 production of 26,000-29,000 boe/d is in line with our 27,400 boe/d estimate, but well below consensus of 29,600 boe/d,” Jungwirth and Donnell said. “In total, updated 2H2014 production guidance is 5.8% below our estimate and 9.5% below consensus estimates, and 2H2014 oil guidance is 5.7% below our estimate and 13.1% below consensus estimates.

“We think the magnitude of the miss…could cause concerns that reduced guidance is driven by more than timing of wells turned to sales…Bottom line, we think reduced guidance supports our view that decline rates are steeper than expected…and given uncertainty around ultimate recoveries and downspacing…, plus high financial leverage, we think a [merger and acquisition] scenario could be challenging.”

Analysts with Wells Fargo Securities LLC — David Tameron, Gordon Douthat, Brad Carpenter and Jamil Bhatti — voiced similar concern in a separate note Monday. Wells Fargo classified PVA stock as “outperform.”

“Updated guidance falls below our/consensus estimates as us/Street gave partial credit for PVA’s assertion that about 32,000 boe/d in 4Q2014 was feasible,” the analysts said. “Overall, shares could see weakness heading into PVA’s presentation next week at a competitor’s conference, when Street/investors should get more color on today’s release. Adjusting our model for updated guidance, our 2014 and 2015 [earnings per share] estimates move to -$0.21 and $0.19, [down] from -$0.08 and $0.26, respectively.”

Shares of PVA closed at $14.22/share on the New York Stock Exchange on Monday, down $0.05/share, or 0.35%, from the previous close.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |