NGI Archives | NGI All News Access

Bears Victorious In Snooze-Driven Weekly Trading

If last week’s national average price change of a 3-cent decline was uninspiring, the NGI Weekly National Spot Gas Average 6-cent decline to $3.60 for the week ending August 22 wasn’t much better.

Several regions of the country posted no change at all, and those proved to be the week’s greatest “gainers.” The biggest loser was California dropping 7 cents to average $4.18. Of individual market points Tennessee Gas Pipeline laid claim to the week’s greatest gainers and losers. Of actively traded points, gas on Tennessee Zone 4 Marcellus rose 21 cents to $1.84, the largest increase of any NGI point, and Tennessee Zone 5 200 L shed 19 cents to average $2.46 for the biggest loss.

Regionally East Texas fell 3 cents to average $3.86 and the Rocky Mountains came in 2 cents lower at $3.77.

The Midwest and South Texas both shed a penny to $3.95 and $3.81, respectively.

South Louisiana, the Midcontinent, and Northeast were all unchanged on the week at $3.85, $3.79, and $2.62, respectively.

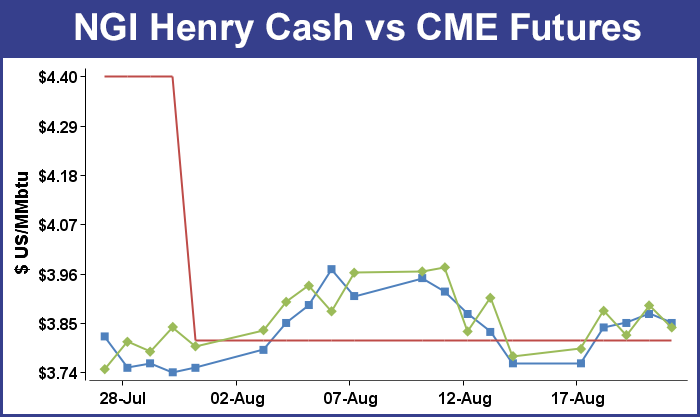

September futures on the week rose 6.4 cents to $3.840, and traders Thursday were able to disengage from the tedium of flip-flopping weather forecasts and concentrate on the 10:30 a.m. release by the Energy Information Administration of storage data for the week ending Aug. 15. The numbers were expected to show a continuation of the trend of above-normal injections as the industry attempts to remedy the effects of last winter’s polar vortex-driven drawdown of gas supplies. Prior to the report inventories stood at 2,467 Bcf, or 575 Bcf below the five-year average at this stage of the injection season. Expectations were that the report would show an increase of 80-plus Bcf, well above last year’s 58 Bcf and a five-year average of 48 Bcf.

Analysts at United ICAP predicted a build of 86 Bcf, and Bentek Energy calculated an increase of 84 Bcf utilizing its flow model. A Reuters poll of 25 traders and analysts revealed an average 83 Bcf with a range of 74-94 Bcf.

Bears needed to be careful what they wished for. The actual figure of 88 Bcf initially prompted lower prices. September futures fell to a low of $3.786 soon after the number was released and by 10:45 EDT Thursday September was holding $3.803, down 2.0 cents from Wednesday’s settlement.

“This number kind of took the steam off the upside,” said a New York floor trader. “[Technical] Support is currently at $3.75, and below that $3.50. Resistance is at $4.00,” he said.

Tim Evans of Citi Futures Perspective sees a possible supply shift. “The 88-Bcf build was more than expected, and suggests a weakening of the supply/demand balance, with bearish implications for the rate of injections to follow in the weeks ahead. It’s possible that supply has increased.”

Inventories now stand at 2,555 Bcf and are 500 Bcf less than last year and 535 Bcf below the 5-year average. In the East Region 65 Bcf were injected and the West Region saw inventories up by 49 Bcf. Inventories in the Producing Region rose by 14 Bcf.

By the end of the day Thursday, however, traders had decided that a change in short term weather forecasts to a warmer outlook held greater relevance and September had advanced 6.6 cents to $3.889 and October was up 7.0 cents to $3.930.

Analysts were generally surprised by Thursday’s advance in the face of a bearish storage injection.

“[Thursday’s] bearish response to the larger-than-expected 88 Bcf storage injection proved short-lived as the market appeared to revert focus back toward some current hot temperature trends that appear sustainable through about month’s end,” said Jim Ritterbusch of Ritterbusch and Associates. “While we had expected the much cooler eight-14 day forecast to weigh on values following a bearish storage figure, such was not the case. Although the initial response to the EIA figure approximated 10 cents, this week’s lows were never challenged. Although we look for an eventual violation of the July-August double bottom, this market appears poised for a re-test of our expected resistance at the 3.95 area.

“While it is apparent that some sequential downsizing of storage injections will be seen during the next couple of EIA releases in the process of stalling the dynamic of ‘deficit contraction in large chunks,’ we continue to see a strong production pace as capable of offsetting occasional bullish weather developments. With the approach of the shoulder period, we will look for values to settle into a comparatively narrow range. We have defined low side parameter as existing at the $3.65 area. On the upside, down trend line violation helped to facilitate [Friday’s] gains and could also accommodate a stretch of our high side parameter with nearby futures making another run at the $4 mark. But sustaining a $4 handle will prove problematic short of a major storm event.”

Looking further out, some see a significant increase in seasonal demand. “Our analysis suggests that a number of factors will contribute to a dramatic increase in seasonal demand, potentially exceeding the ‘price’ buffer afforded by existing U.S. storage capacity,” said Teri Viswanath, director of commodity strategy for natural gas at BNP Paribas, New York in a Friday report to clients.

In her view “accounting for variations in the weather, seasonal demand (that is the difference between summer and winter demand) has been increasing over the last decade. Looking ahead, the early retirement of ‘peak-shaving’ coal units will likely amplify this trend. More than 20 GW of coal-fired generation is scheduled for retirement by the end of 2015. Nearly 70% of this capacity is located in the Midwest and Mid-Atlantic states and prone to high utilization during the winter months.

“What’s more, seasonal demand will rise significantly as new LNG export terminals are commissioned during the next three years. Most of LNG importing countries lack indigenous supplies and have an increasing need for the fuel during winter months — a development that will ramp seasonal demand.”

The only major storm event on the horizon Friday was the load-killing effects of a tropical depression near the East Coast. The National Hurricane Center in its 4:50 p.m. EDT Friday report said that the organization of the shower and thunderstorm activity associated with a small area of low pressure located north of the Virgin Islands was increasing, but conditions were expected to be more conducive for development when the disturbance moves near or over the southeastern Bahamas. The system still lacks a well defined circulation. A tropical depression or tropical storm was likely to form over the weekend or by early next week. NHC said the likelihood of the pattern turning into a tropical storm in the succeeding 48 hours was 70%, in the succeeding five days, 80%.

In Friday’s trading physical gas for weekend and Monday delivery fell as a few firm points in the Gulf Coast and Midwest failed to stem the tide of selling in the East, Great Lakes, Midcontinent, Rockies and California.

In the East, forecasts calling for mild temperatures and the possibility of load-bashing rain as well as declines in power load were enough to keep prices under pressure. The overall market dropped 12 cents. Futures slumped, with the September contract falling 4.9 cents to $3.840 and October dropping 4.7 cents to $3.883. October crude oil fell 31 cents to $93.65/bbl.

Weekend temperatures at a number of East Coast locations looked as though they would struggle to make it to seasonal norms. Forecaster Wunderground.com predicted that the high in New York City Friday of 76 degrees would rise to all of 77 Saturday with the possibility of showers and thunderstorms. Monday’s high was seen reaching 83, one degree above the seasonal norm. Philadelphia’s 80 degree high Friday was anticipated to slump to 75 Saturday but reach 83 as well on Monday, also one degree above the mid-August norm. Washington, DC’s 80 maximum on Friday was seen slipping to 79 Saturday with a greater than 50% chance of showers. Monday’s forecast high of 84 was 2 degrees off the seasonal high.

The National Weather Service in Washington, DC, said, “An area of low pressure will move along a stalled frontal boundary across the Middle Atlantic States late today [Friday] and tonight. The front will push southwest as a cold front Saturday, [and] high pressure will build south from New England into the middle Atlantic this weekend into early next week.”

Power load was forecast to decline in both New England and New York. New England ISO predicted maximum load Friday of 17,040 MW would fall to 14,910 MW Saturday and rise to 15,510 MW Sunday. ISO New York calculated that peak load Friday of 22,282 MW would slide to 19,619 MW Saturday and 19,365 MW Sunday.

WSI Corp. in its Friday morning outlook said, “Scattered showers and thunderstorms continue along a wavy stationary frontal boundary [Friday] – Saturday. Sunshine returns Sunday-Tuesday as high pressure becomes more prevalent over the region. Temperatures run above normal in the west with highs in the 80s and 90s and below normal in the east, especially near the coast, with highs in the 70s and 80s. Trending warmer in the east as well early next week. Total precipitation runs between 0.25-1.00 inches with locally heavier to 1.50-2.00 [inches] in the West.”

WSI said to expect “weak wind power generation…right through the weekend with relatively benign output forecast (mostly peaking between 1-2 GW). The recent and anticipated wet weather over the next couple of days will lead to elevated streamflow and favorable hydro prospects throughout the forecast period.

“The six-10 day forecast is not as warm over the northeast quadrant of the nation. It is also not quite as warm over the Northwest.”

Weekend and Monday gas headed for New York City on Transco Zone 6 shed 51 cents to $1.86 and deliveries to Tetco M-3 skidded 48 cents to $1.87.

Gas on Transco Leidy fell 16 cents to $1.83, and deliveries to Tennessee Zone 4 Marcellus shed 21 cents to $1.79. Buyers on Columbia Gas TCO saw their prices fall 2 cents to $3.90, but on Dominion South weekend and Monday packages fell 25 cents to $2.00.

Prices at points serving Southern California markets dropped as El Paso Natural Gas Co. Friday morning lifted a force majeure effective for cycle three of Friday’s gas day that had been in place on its Havasu Lateral (L1104) in the western portion of Arizona. The force majeure was enacted Wednesday afternoon following the discovery of a leak on the line. The force majeure took capacity on the line from 650 MMcf/d to zero for the evening cycle of Thursday’s gas day. The lateral serves Southern California demand.

Gas on El Paso S Mainline shed a stout 21 cents to $4.14, and deliveries to SoCal Border were seen off 8 cents to $4.05. Gas at the SoCal Citygates fell 16 cents to $4.29.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |