Markets | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

FERC to Explore Centralized Trading Platform for Natural Gas

FERC Commissioner Philip Moeller plans to convene a meeting Sept. 18 “for interested parties to discuss ideas to facilitate and improve the way in which natural gas is traded, and to explore the concept of establishing a centralized trading platform for natural gas,” the Commission said Tuesday.

The meeting is to explore the concept of developing an electronic information and trading platform that would contain bids and offers for the purchase and sale of both commodity and capacity for receipt and delivery points across multiple pipeline systems, according to the Federal Energy Regulatory Commission (FERC).

“As natural gas-fired power plants become an increasingly larger share of the nation’s electricity mix, the manner by which the commodity is procured and transacted is of great interest,” FERC said in a notice announcing the meeting. “This meeting will address how natural gas is currently traded and discuss concerns regarding the lack of transparency and possible inefficiencies in trading the commodity, particularly during off-hours.”

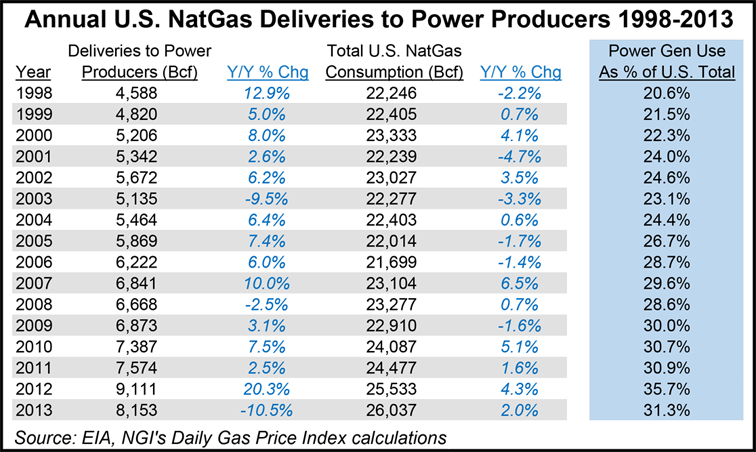

According to Energy Information Administration data and NGI’s calculations, natural gas as a fuel for power generation moved from 21% of the U.S. total in 1998 to nearly one-third of the total today.

“We welcome ideas from system operators and generation owners regarding the types of near real time flexibility (e.g., changing or confirming nominations) that would be most valuable to them in meeting contingencies that may require gas-fired generation to ramp on short notice, as well as ideas from pipeline operators and others regarding the physical and information requirements that would have to be met in order to provide such flexibility on a standardized basis,” the Commission added.

FERC said it also welcomes “ideas and discussion of current confirmation processes and how they might be accelerated, streamlined, and better coordinated across pipelines where necessary to support trading opportunities.”

It isn’t the first time FERC has expressed an interest in reconfiguring natural gas markets. Earlier this year FERC issued a notice of proposed rulemaking (NOPR) that would tackle the long-running and increasingly nettlesome issue of gas-power coordination by shaking up the natural gas day (see Daily GPI, March 20). The NOPR proposes a much earlier start to the gas day, starting the first day-ahead gas nomination opportunity for pipeline scheduling later, and modifying the current intraday nomination timeline to increase the number of intraday nomination cycles.

At a FERC technical conference held a few days later, Donald Sipe, an attorney with the law firm PretiFlaherty, who was added to the speakers list by Moeller, recommended that FERC “investigate and possibly order the implementation of an information trading platform for natural gas that looks somewhat like the RTO [regional transmission organization] trading platforms that you have for electricity, in the sense that you would have an operability region, you would take bids and offers for sale of capacity and commodity both, [and] you would have, if not a clearing mechanism, at least a central confirmation mechanism that would manage offers on a short-term basis. You would do this across utility footprints” (see Daily GPI, April 1).

The meeting, which is scheduled to be held from 2:00-4:45 p.m. on Sept. 18, would be at FERC headquarters in Washington, DC. It would not be webcast or transcribed. The meeting is open to all interested parties, and there is no registration fee. To participate, contact Jason Stanek, legal adviser to the commissioner, by Sept. 4 at (202) 502-8403, or e-mail jason.stanek@ferc.gov.

The meeting is Moeller’s follow-through on issues raised at the conference in April, a FERC spokesperson told NGI Wednesday. It isn’t clear if FERC Chairman Cheryl LaFleur or other commissioners will attend the meeting, the spokesperson said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |