M&A | Infrastructure | NGI All News Access

Kinder Simplifying With Partnership Consolidation Deal

With its flagship master limited partnership (MLP) too large to grow revenue and investor distributions, Kinder Morgan Inc. (KMI) is abandoning the master limited partnership structure and consolidating its businesses into one corporate entity.

The combined company will have a lower cost of capital and be better suited for acquisitions and new infrastructure development, management said. The new KMI would be the largest energy infrastructure company in North America and the third-largest energy company overall with an enterprise value of about $140 billion.

Kinder Morgan Energy Partners LP (KMP) — the largest of the Kinder partnerships, Kinder Morgan Management LLC (KMR) and El Paso Pipeline Partners LP (EPB) are to have all of their outstanding equity securities acquired by KMI.

The MLP structure has served the Kinder companies well, KMI CEO Rich Kinder told financial analysts during a Monday morning conference call to discuss the deal. However, rolling everything up into a C-corp. means the combined company will have significantly lower cost of capital, positioning it well for a new era in the midstream infrastructure arena.

Besides the billions of dollars needed for new infrastructure to take further advantage of shale natural gas and oil supplies, Kinder said the sector is ripe for consolidation, and KMI will play a large role in that.

“This transaction dramatically simplifies the Kinder Morgan story, by transitioning from four separately traded equity securities today to one security going forward, and by eliminating the incentive distribution rights and structural subordination of debt,” Kinder said. “Further, we believe that KMI will be a valuable acquisition currency and have a significantly lower hurdle for accretive investments in new energy infrastructure. In the opportunity-rich environment of today’s energy infrastructure sector, we believe this transaction gives us the ability to grow KMI for years to come.”

During the conference call, Kinder highlighted how eliminating the incentive distribution rights paid by the partnerships to the general partner will significantly lower the combined entity’s cost of capital “…to pursue expansion and acquisition in a target-rich environment.”

There is great potential for consolidation among MLPs, he said, adding that there are more than 120 energy MLPs with a combined enterprise value of more than $875 billion. Some of these are takeout candidates. Additionally, there is predicted to be more than $640 billion of investment in energy infrastructure needed through 2035, Kinder said.

Trading in the Kinder companies went wild Monday. KMI shares closed up 9% at $39.37 after setting a new 52-week high of $42.49. KMP units closed up 17% at $94.12 after touching $98.67, also a new 52-week high. EPB units closed up nearly 21% at $40.56 after hitting $42.50, just shy of the 52-week high of $43.15. And KMR shares closed up nearly 24% at $95.42 after hitting $99.77, a new 52-week high.

The deal is worth about $71 billion: $40 billion in stock, $4 billion in cash and about $27 billion in debt.

KMP unitholders will receive 2.1931 KMI shares and $10.77 in cash for each KMP unit. This results in a price of $89.98 per unit, a 12% premium based on last Friday’s closing prices. This is a premium of 11.4% based on the July 16 closing price reference date used by the parties during the negotiation of the transaction.

KMR shareholders will receive 2.4849 KMI shares for each share of KMR. This results in a price of $89.75 per share, a 16.5% premium based on last Friday’s closing prices. This is a premium of 16% based on the July 16 reference date used by the parties in the negotiation. The parties negotiated consideration for KMR shares equal to the consideration for KMP units, using the July 16 reference date.

EPB unitholders will receive 0.9451 KMI shares and $4.65 in cash for each EPB unit. This results in a price of $38.79 per unit, a 15.4% premium based on last Friday’s closing prices. This is a premium of 11.2% based on the July 16 reference date used by the parties in the negotiation. Both KMP and EPB unitholders will be able to elect cash or KMI stock consideration subject to proration.

“All shareholders and unitholders of the Kinder Morgan family of companies will benefit as a result of this combination,” Kinder said. “Everyone will hold a single, publicly traded security — KMI — which will have a projected dividend of $2.00 in 2015, a 16% increase over the anticipated 2014 dividend of $1.72.

“We expect to grow the dividend by approximately 10% each year from 2015 through 2020, with excess coverage anticipated to be greater than $2 billion over that same period. This combined entity will be the largest energy infrastructure company in North America and the third-largest energy company overall with an estimated enterprise value of approximately $140 billion. Additionally, we will have a leading position in each of our business segments and operate in the rapidly growing North American energy infrastructure sector.”

Patrick Rau,NGI director of strategy and research, said the consolidation of Kinder Morgan into one entity will have repercussions on other financial products as well.

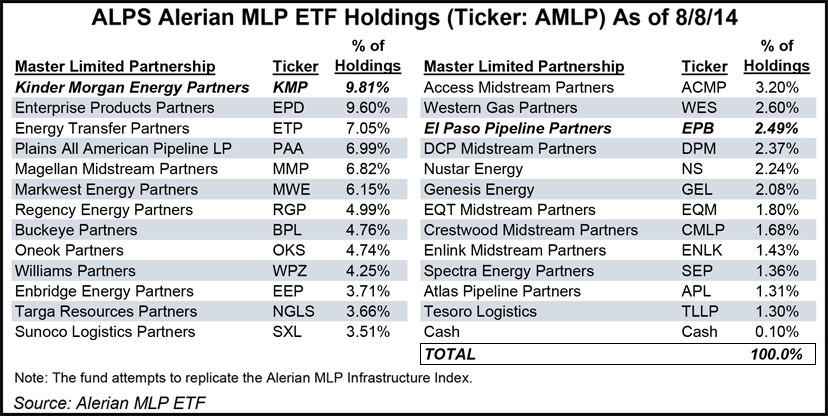

“Kinder Morgan Energy Partners and El Paso Pipeline Partners are both part of the Alerian MLP Infrastructure Index, and as of the close of trading last Friday, those two MLPs comprised 12.3% of ALPS Alerian MLP exchange traded fund,” Rau said. “The ALPS Alerian MLP ETF attempts to mimic the performance of the underlying Alerian MLP Infrastructure Index. These two MLPs will have to be replaced by Alerian if it wishes to keep the number of MLPs in its infrastructure index at 25. Fortunately for Alerian, many midstream MLPs have hit the market during the last few years, so it should have a number of replacement options.”

KMI said it has secured committed financing for the cash portion of the deal. The company has reviewed the proposed transaction with the rating agencies and expects the combined entity to have an investment-grade rating.

The transaction also provides significant tax benefits for KMI shareholders from depreciation deductions associated with the upfront purchase and future capital expenditures, Kinder said.

The combined Kinder Morgan entities own an interest in or operate about 80,000 miles of pipelines and 180 terminals. Kinder Morgan’s pipelines transport natural gas, gasoline, crude oil, carbon dioxide and other products, and its terminals store petroleum products and chemicals and handle such products as ethanol, coal, petroleum coke and steel.

Standard & Poor’s Ratings Services (S&P) affirmed its “BB” corporate credit rating on KMI and placed it along with the company’s “BB” senior unsecured debt rating on CreditWatch with “positive” implications. S&P affirmed its ratings on other Kinder companies as well.

“In certain aspects, we view KMI’s pro forma simplified structure as a C-Corp as supportive of credit quality because it creates a single corporate entity and eliminates the structural subordination of debt, as well as multiple layers of equity distributions to service the debt obligations,” S&P said in a note Monday.

“At the same time, we expect the new KMI to use the vast majority of its free cash flow (after maintenance-related capital spending) to pay dividends to equityholders each quarter, and hence would face similar financial constraints as a typical MLP. In terms of financial measures, we expect pro forma debt to EBITDA to be high, above 5.5x over the next few years before the company realizes cash flow from organic growth projects.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |