Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Chesapeake Raises Production Outlook Despite Lower Prices

Chesapeake Energy Corp. reported strong production gains in the second quarter, but failed to turn those into earnings gains as the prices it collected for natural gas, natural gas liquids (NGL) and oil declined.

CEO Doug Lawler said the company was staying the course, increasing its production outlook with its capital budget unchanged. It increased the midpoint of expected 2014 output by 10,000 boe/d, or 1.5%, management said Wednesday.

Production averaged 694,650 boe/d, a 13% jump from a year ago, adjusted for asset sales. Average daily production consisted of 113,400 bbl of oil, 84,300 bbls of NGL and 3.0 Bcf of natural gas. The average output increased across the board, with NGLs up 72%, oil production 12% higher and gas production 7% more than in 2Q2013.

The Oklahoma City operator now expects production to be 685,000-705,000 boe/d this year.

The production increases came as realized gas prices fell to $2.45/Mcf in the latest period from $2.62, while NGL prices fell to $21.03/bbl from $24.22. Oil prices also were lower year/year at $85.23 from $93.81. Natural gas as a percentage of production declined to 72% from 75% in 2Q2013, while NGLs rose to 12% from 8%, and oil was slightly below at 16% from 17%.

Chesapeake late last month had warned that gas pricing differentials in parts of the dry gas area of the Marcellus Shale between April and into July weakened relative to the Henry Hub benchmark and were “significantly higher than forecast” (see Daily GPI, July 29). Realized gas prices after gathering, transport, and basis in the northern region averaged $2.47/Mcf below Henry during 2Q2014, versus 18 cents/Mcf in 1Q2014.

At some delivery points, particularly at Dominion South, Texas Eastern Transmission Corp. M2, Tennessee Gas Pipeline Co. LLC Zone 4 and Transcontinental Gas Pipeline Co. Leidy, basis discounts were between 92 cents/Mcf and $2.32/Mcf.

The Marcellus North’s gas output is 29% of total company gas output.

CFO Nick Del’Osso said during a conference call the Marcellus region has “an oversupply of gas and insufficient demand in the nonwinter months,” which “accounted for the majority of the basis widening during the second quarter. The basis differentials in the Marcellus have generally deteriorated during the month of July.

“Looking ahead, we expect them to remain weak for the remainder of the third quarter before improving in the fourth quarter, when a seasonal weather demand should begin to take hold.”

Despite cost-cutting efficiency gains, net income was $145 million (22 cents/share), 68% below year-ago profits of $457 million (66 cents). Adjusting net income for sales, the oilfield services spinoff and one-time items, including lower commodity prices, profits were $235 million (36 cents/share) in 2Q2014, versus $265 million (51 cents) in 2Q2013.

The increase in production partially was attributable to “better production trends” in the first half of 2014, along with an increase in expected well completions in the second half of this year. Higher output also should result from divestitures, and the Powder River Basin (PRB) acreage swap announced in July with RKI Exploration & Production LLC (see Shale Daily, July 29).

“Chesapeake delivered solid organic production growth in the quarter while continuing to demonstrate capital discipline and efficiency,” Lawler said. “As a result, we are increasing our 2014 production outlook while leaving our capital budget unchanged. In the 2014 second half, we plan to connect approximately 35% more wells to sales than we connected in the first half of the year. As our pace of well connections accelerates, we expect our production growth trajectory will increase accordingly and we anticipate our year-end 2014 exit rate will exceed 730,000 boe/d.”

Operationally, the independent was able to pick and choose the areas that it wanted to ramp up production and where it could pull back. Its top performer was the PRB in Wyoming, with a 479% increase in output from a year ago and a 17% sequential increase. Average output was 11,000 boe/d net, weighted 51% to oil, 33% to natural gas and 16% to NGLs. On average three rigs were operating with 11 wells gross connected, compared to four rigs and 13 wells in sequentially. Average peak production rates of the 11 wells connected was 1,765 boe/d.

More rigs are to be added in the PRB early next year, with seven to nine rigs on average in operation throughout 2015, the company said.

During the second quarter, northern Marcellus output in Pennsylvania rose 12% year/year and was down 3% sequentially. Average output was 878 MMcfe/d net. Six rigs on average were operating, with 12 wells brought to sales, versus five rigs and 22 wells in 2Q2013. The average peak production rate of the 21 wells connected was 13.6 MMcfe/d. One hundred and twenty wells were awaiting pipeline connection or were in various stages of completion at the end of June.

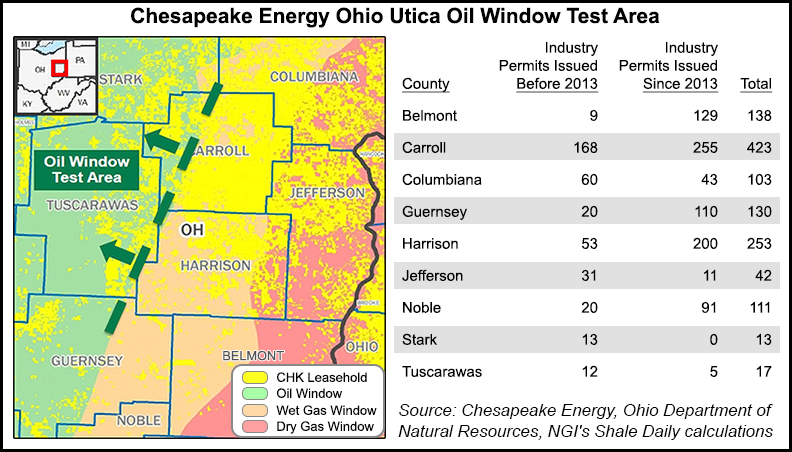

Utica Shale production in Ohio, Pennsylvania and West Virginia, averaged 67,000 boe/d net in 2Q2014, up 373% from a year ago and 34% higher than in 1Q2014. Most of the output was gas (60%), with 30% NGLs and 10% oil. An average of eight rigs were in operation with 48 wells completed, versus nine rigs a year ago and 47 wells connected. At the end of June, Chesapeake had 210 wells in the Utica awaiting pipeline connection or in various stages of completion.

In the Southern Marcellus in Pennsylvania and West Virginia, output averaged 58,00 boe/d net, up 67% from a year ago and 5% higher sequentially. Most of the output was gassy (57%), with NGLs comprising 34% and oil 9%. One rig was in operation and nine wells were connected, versus two rigs and 11 wells in 1Q2014. Chesapeake recently added a second rig in the area, where its primary objective is to delineate the dry Utica formation in the West Virginia Panhandle.

Eagle Ford Shale production in South Texas averaged 91,000 boe/d net in 2Q2014, adjusted for sales, representing a 15% gain year/year and a 4% increase sequentially. Close to two-thirds of the production was oil, 14% NGLs and 22% natural gas.

“Current field estimated production rates for the Eagle Ford are more than 101,000 boe/d during the final week of July as increased activity continues to drive higher production,” Chesapeake noted. An average of 22 rigs were running during the quarter, and 104 wells were connected to sales. That compares to the year-ago period when 18 rigs were running and 104 wells were connected. The average peak production rate of the 104 wells ramping up in 2Q2014 was 825 boe/d.

Midcontinent production from Oklahoma, the Texas Panhandle and Southern Kansas, averaged 98,000 boe/d net. About 47% of output was natural gas, with one-third of the oil, with 20% NGLs. Eighteen rigs on average were in operation, with 56 wells connected, versus year-ago numbers of 17 rigs and 52 wells.

The Haynesville Shale in northwestern Louisiana and East Texas saw net production — all gas — decline 26% year/year to 508 MMcfe/d, but output was 3% higher sequentially. An average of eight rigs were running in the latest period with 13 wells connected, versus seven rigs and seven wells in the year-ago quarter. The average peak production rate of the 13 wells on production in 2Q2014 was 12.6 MMcfe/d.

Also in the Haynesville, Chesapeake brought on production nine cross-unit lateral tests, which enabled it to increase lateral lengths by 17% and access resources that may have been undeveloped. The initial results were promising, and the company plans to monitor performance.

Chesapeake has less debt on its balance sheet following a number of strategic moves over the past few months. The producer completed the spinoff of its oilfield services business, now Seventy Seven Energy Inc., at the end of June (see Shale Daily, Aug. 4). That removed $1.1 billion of debt from the balance sheet. At the end of July Chesapeake paid $1.26 billion to repurchase more 1.06 million preferred shares of subsidiary CHK Utica LLC, retiring its “highest cost leverage instrument,” and eliminating $75 million in annual cash dividend payments. Chesapeake also received close to $675 million by selling assets, including compression assets to Exterran Partners LP (see Shale Daily, July 14).

By the end of the year, more than $700 million in properties is set to be sold including in southwestern Pennsylvania, South Central Oklahoma, and East and South Texas, as well as more compression assets, and miscellaneous real estate and equipment. Total capital expenditures in 2Q2014 were $1.315 billion, with drilling and completion (D&C) spend taking most of it. The spending levels were up 55% from the first quarter, primarily because of more activity, the company said.

Chesapeake spud a total of 324 wells (gross) and connected 275 to sales in 2Q2014, compared to 299 wells spud and 249 wells connected to sales in 1Q2014. In the second half of 2014, the company expects to connect to sales more than one-third more wells (35%) than in the first six months, with 40% more spent on D&C. Full-year capital spending remains at $5.0-5.4 billion.

Keeping a lid on costs generated big reductions for production expenses, and for general and administrative (G&A) costs. Average production expenses in the latest period were $4.46/boe, a decrease of 5% from a year ago. G&A expenses fell to $1.43/boe, down 17% year/year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |