NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Freeport Looking for More Onshore Buyers to Fund GOM Growth

Freeport-McMoRan Inc. is looking for more buyers for a considerable U.S. onshore portfolio that would help pay down debt and expand development in the Gulf of Mexico (GOM).

Executives spent close to an hour on Wednesday discussing second quarter results and laying out a strategic plan for the company. It also formerly rebranded itself, removing “Copper & Gold” from its title effective July 15. One big reason for the name change is a distinct turn to U.S. exploration and production (E&P), boosted last year after completing a friendly takeover of Plains Exploration & Production Co. and McMoRan Exploration Co. (see Daily GPI, Dec. 12, 2012).

Copper and gold remain a big part of the portfolio, but there’s growing strength in the E&P arm, FM O&G, helmed by Jim Flores. He joined Freeport CEO Richard Adkerson for a conference call to discuss quarterly results.

“We are chugging along quite nicely,” in the U.S. E&P business, Flores said. “Realizations continue to hold up real well, particularly in the Gulf of Mexico.” The onshore doesn’t hold the allure for Freeport that some producers have found, said Flores. That means more onshore sales to accumulate funding for the offshore.

Freeport in May paid $1.4 billion to Apache Corp. to buy a bundle of GOM assets (see Daily GPI, May 8). Meanwhile, it sold its Eagle Ford Shale portfolio to Encana Corp. (see Shale Daily, May 7).

“By the end of 2017, we see our assets producing as much in the Gulf of Mexico as the Eagle Ford assets had, once decline sets in there,” Flores said. “There’s going to be a lot more growth, a lot better margin, in the Gulf of Mexico.”

As Freeport continues to sell off its onshore assets, “Gulf of Mexico production will be growing much faster in the years to come…There’s a tremendous amount of upside..”

Freeport’s plans are to sell $4-5 billion more onshore assets to further reduce its debt. “At the same point in time, we are buying additional interests in the deepwater Gulf of Mexico to complement the portfolio in shallow water.”

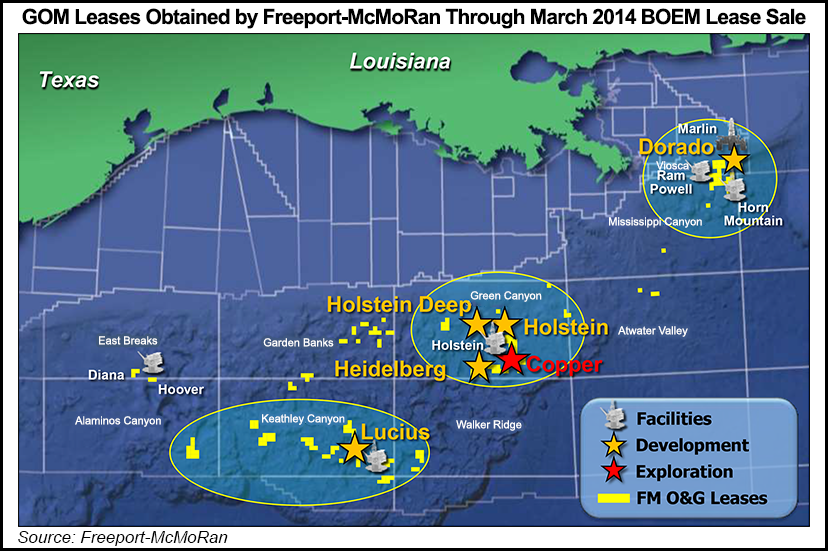

In the last two federal GOM lease sales, Freeport spent close to $500 million to acquire 20 leases, Flores noted.

“It’s doubled our resource potential,” said Flores. Freeport’s estimated reserves in the GOM over the past year have grown to around 6 billion boe from 3 billion boe.

The onshore property sales will bring in “billions,” while the GOM purchases likely would be in the “hundreds of millions…with a lot more potential going forward,” said Flores.

The Eagle Ford portfolio, for instance, had “good assets, but they don’t have the growth profiles that other assets have,” said Adkerson. “We see aggressive buyers paying good prices for them as we then focus on assets that have good growth potential…

“Our future oil and gas business will be built around the deepwater Gulf of Mexico and gas exploration play” in the shallow waters.

Flores said it’s an “all of the above balance sheet management” that’s driving the strategy to discard noncore properties. “It’s the mantra across all sectors of the business.” With a larger capital budget for the GOM, “we can manufacture more oil…The fact of the matter is, we are selling onshore oil assets in a premium market right now.”

Freeport posted stagnant profits in 2Q2014 on a global slowdown that cut into the company units that mine iron ore, copper and gold. Net profits were $482 million, flat from a year ago, with earnings declining to 46 cents/share from 49 cents. Revenue jumped 29% to $5.52 billion from a year ago, boosted by the U.S. exploration business.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |