NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

FMC, Four GOM Producers Collaborate on Deepwater Systems

A joint industry program is bringing together FMC Technologies Inc. and some of the biggest Gulf of Mexico (GOM) producers to develop standardized subsea production equipment for deepwater reservoirs.

Anadarko Petroleum Corp., ConocoPhillips and units of oil majors BP plc and Royal Dutch Shell plc would work with FMC to “meet the challenges” of producing oil and gas in reservoirs with pressures of up to 20,000 pounds/square inch and temperatures of 350 degrees F at the mudline.

“This agreement is a clear illustration of how leading companies with a common interest can come together to overcome the technological and economic challenges facing our deepwater industry,” said FMC CEO John Gremp.

“By working together collaboratively, we will continue to achieve technological innovations that will enable us to safely develop some of the world’s most promising fields and take a large step toward providing new oil and natural gas resources to consumers and superior returns to stakeholders.”

Improving equipment and systems for deepwater operations are a major challenge because operating costs are huge — but the payoff can be huge too. Most of the biggest projects in the GOM deepwater are developed through consortiums to reduce some of the equipment costs. The producers and FMC would work on systems to meet the technical challenges of high pressures and temperatures, and improve overall deepwater development by standardizing materials, processes and interfaces.

High costs have pushed many producers out of the picture. Former large offshore operators, including Apache Corp. and Devon Corp., sold their GOM interests to concentrate in the U.S. onshore.

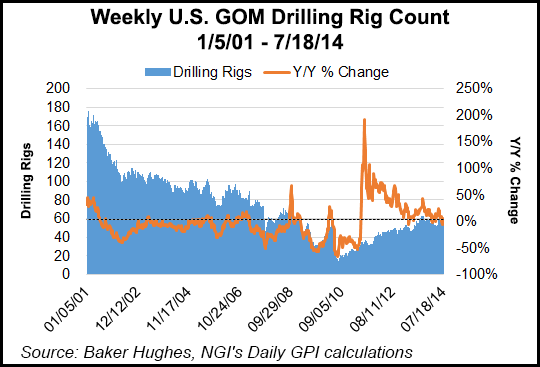

Analysts with Raymond James & Associates said the offshore market overall is in a downturn. They concentrated on the floater rig market in a note Monday.

“After a decade of good times, the deepwater drilling rig market is facing a multiyear down-cycle,” said analysts. “Historically, most offshore drilling cycles have been short-lived as there have usually been sudden demand shocks that tend to self correct relatively quickly…

“While many are calling for a 12-18 month downturn, we aren’t expecting normalized dayrates until beyond 2017. That said, the cycle will eventually turn upward and operators will find that the reserve potential of the offshore markets is far too alluring.” Analysts expect exploration and production activity, and capital spending increases, to follow “attrition in the rig market.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |