Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Cash, Futures Continue Downward; August Posts New Low

Spot gas for Friday delivery continued to sink in Thursday trading on double-digit declines in the Northeast and Eastern points along with a weak screen that set, in the words of one trader, “no rallying power at all.”

Only a few points escaped the price cleaver, but there were a couple of double-digit gains in the Marcellus. Overall, the spot market slid 8 cents.

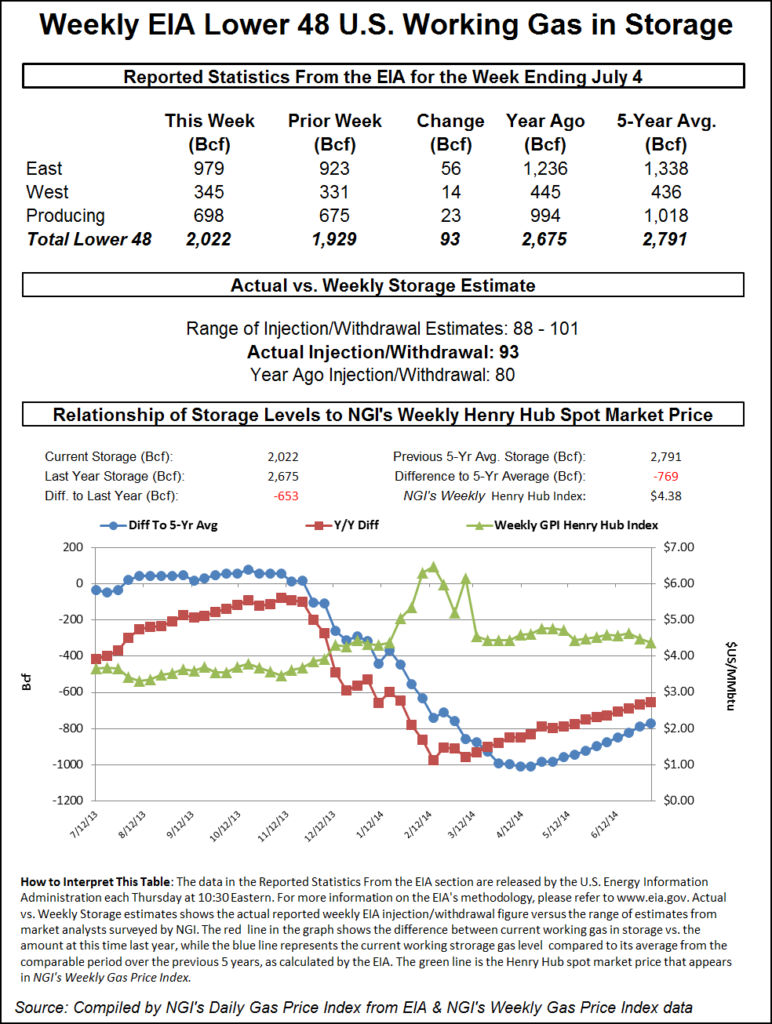

The Energy Information Administration (EIA) Thursday morning reported an increase in working gas inventories of 93 Bcf, about 3 Bcf more than what the market was expecting, but that was enough for the August contract to post a new low for the current down move at $4.114.

At the close, August settled 5.0 cents lower at $4.120 and September had declined 5.3 cents to $4.113. August crude oil added 64 cents to $102.93/bbl.

Traders attempting to play weather shifts could be growing frustrated as near-term forecasts in active Mid-Atlantic markets continue to hover around normal patterns.

“After the number of thunderstorms diminish into Friday, the weekend will bring fairly typical warmth and humidity for the middle of July around Washington, DC,” said AccuWeather.com meteorologist Alex Sosnowski. “High temperatures are forecast to be in the upper 80s to near 90 F Saturday and Sunday [and] only very widely separated storms are forecast this weekend with the greatest chance during the late afternoon and evening hours. Sunday is the more likely day for a downpour in the city.”

According to Sosnowski, some severe weather may be in the cards for early next week, but “there is the chance of a significant push of cool air during the middle and latter part of next week. Temperatures could stay in the lower 80s for a day or two later next week around the city, during what is the typically the hottest time of the year.”

AccuWeather.com predicted that Philadelphia’s high Thursday of 85 would slide to 87 Friday and hold into Saturday. The seasonal high is 87. Washington, DC was forecast to have its Thursday high of 87 dip a degree to 86 on Friday before rising to 89 Saturday; the norm is 89 this time of year. Richmond, VA was expected to see a high of 82 Thursday reach 84 Friday and 90 on Saturday. The normal in Richmond this time of year is 90.

Next-day power prices also softened, giving power buyers little incentive to purchase incremental gas volumes. IntercontinentalExchange reported next-day peak power at the New England ISO’s Massachusetts Hub fell $5.15 to $37.98/MWh, and peak Friday power at the PJM West terminal lost $1.75 to $38.54/MWh.

Gas for delivery Friday to New York City on Transco Zone 6 fell 61 cents to $2.34, and deliveries to Tetco M-3 shed 33 cents to $2.32.

Not far behind were the declines at New England locations. Deliveries to the Algonquin Citygates fell 21 cents to $2.75, and gas on Iroquois Waddington slipped 10 cents to $4.07. Friday packages on Tennessee Zone 6 200 L dropped 36 cents to $2.78.

The Marcellus proved to be one of the day’s positives. Gas on Transco Leidy added 34 cents to $2.31, and deliveries to Tennessee Zone 4 Marcellus rose 37 cents to $2.18.

Gas prices on the West Coast exhibited declines about in line with the national average. Malin fell 2 cents to $4.19, and parcels at the PG&E Citygates shed 3 cents to $4.79. At the SoCal Citygates, gas for Friday was seen at $4.74, down 3 cents, and at SoCal Border points gas changed hands at $4.44, down 2 cents. Gas on El Paso S Mainline skidded 3 cents to $4.58.

Summer’s power generation gas demand has finally caught up with gas injections, and industry pundits were calling for a storage build in the neighborhood of 90 Bcf, still well ahead of historical averages when the EIA released inventory data at 10:30 a.m. EDT. Last year, 80 Bcf was injected and the five-year average increase stands at 72 Bcf. An injection of 90 Bcf would indicate an incremental surplus of about 1 Bcf/d, according to studies.

Analysts at Tudor, Pickering, Holt & Co. saw the “expected injection of 90 Bcf closer to norms than we have seen recently on an absolute basis, but on hotter than normal weather, so implied oversupply continues. Cooling degree days (CDD) for the week of 77; plus-7 CDDs versus week’s historic norms and plus-14 versus the previous week.”

With the Fourth of July falling the day after reporting period, “this week’s calcs are more challenging than normal, but sequential math suggests about 80 Bcf on a week/week uptick in air conditioning-driven electric demand…a higher 90 Bcf print would suggest another 1 Bcf/d of incremental oversupply.”

IAF Advisors was looking for an increase of 90 Bcf, as was Stephen Smith Energy Associates. A Reuters poll of 22 industry traders and analysts revealed a sample mean of 92 Bcf with a range of 88-101 Bcf.

Bentek Energy’s flow model forecast a build of 88 Bcf, the first sub-100 Bcf build since early May. Total demand in the United States “showed little effect from any holiday weekend impact, with an uptick of 2.3 Bcf/d in power burn demand…as total population weighted cooling degree days rose from 67 to 81 week/week.”

At the release of the 93 Bcf figure and subsequent soft market response, a New York floor trader said it seemed as though “the market has broken down considerably and the market has fallen well below the $4.25 support area. We could see $3.75, and this market has no rallying power.”

Others saw continued downward pressure on prices as well. “The 93 Bcf net injection was slightly more than expected and more than the 72 Bcf five-year average,” said Tim Evans of Citi Futures Perspective.

“It was the 12th consecutive weekly injection larger than the five-year average. The build may not do too much more than reinforce the established bearish trend, but it does maintain downward pressure on prices.”

Inventories now stand at 2,022 Bcf and are 653 Bcf less than last year and 769 Bcf below the five-year average. In the East Region, 56 Bcf were injected and the West Region saw inventories up by 14 Bcf. Inventories in the Producing Region rose by 23 Bcf.

Looking out to the end of the injection season, consensus estimates calling for ending storage in the vicinity of 3.5 Tcf are off base, according to Phillip Golden, director of risk and product management at Houston-based Energy Markets Exchange. “This is the latest we have crossed the 2 Tcf barrier,” he told NGI. “The EIA came out with a report in March projecting a 3.5 Tcf ending inventory, but we need to average 83 Bcf for the rest of storage season, and if you look at injections historically that’s way above the norm.

“My projection is for 3.0-3.1 Tcf, and I don’t think we’ll make it to 3.5.”

From a pricing perspective, he said, “if you are at 3.0 or 3.1 Tcf, you will see $5.00 gas [peaks] especially if there is a call for winter temperatures below normal. At that point you are probably looking at prices screaming to $5.50.”

In the near term, the weather outlook is supportive of a strong power burn. Natgasweather.com, in a Thursday report said a “Canadian weather system with showers, thunderstorms and cooler temperatures will impact the Midwest and Northeast over the next few days. Over the southern and western U.S., high pressure continues to bring hot temperatures with highs warming into the 90s and 100s.

“After the weather system departs out of the Northeast, temperatures will again surge into the 80s and 90s over much of the northern U.S. as the ridge returns this weekend. Texas, the southern Plains, and the Southeast will also see temperatures warm several degrees above normal as upper 90s and 100s become widespread. The return of northern U.S. heat will be short lived as an even more impressive Canadian weather system weakens the ridge and brings below normal temperatures to the U.S. next week.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |