NGI Archives | NGI All News Access

Wyoming, GOM Produce Most Natgas on Federal, Indian Lands, EIA Reports

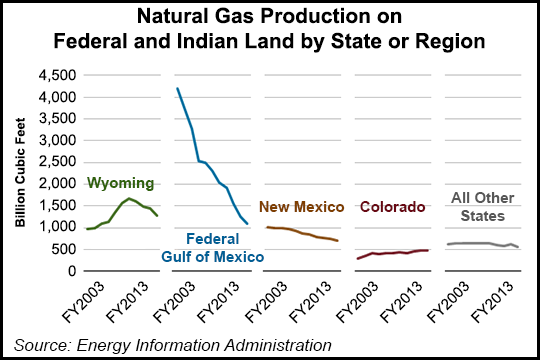

Wyoming, the federal Gulf of Mexico (GOM), New Mexico and Colorado collectively accounted for 86% of total natural gas sales from production on federal and Indian lands during fiscal year (FY) 2013, according to a report by the U.S. Energy Information Administration (EIA).

Meanwhile, crude oil sales from production in the GOM made up 69% of production on federal and Indian lands in FY2013. New Mexico, North Dakota and Wyoming were the next largest crude producers, with the latter two states hosting ramped up production from the Bakken Shale.

In a “Today in Energy” brief released Tuesday, the EIA said Wyoming (8,393 trillion Btu) and the GOM (3,858 trillion Btu) together produced 73% of the total federal and Indian lands fossil fuels in FY2013. New Mexico (1,403 trillion Btu), Colorado (872 trillion Btu) and Utah (733 trillion Btu) were the next largest production states.

Total fossil fuel production was 16,854 trillion Btu in FY2013, a 6.7% decrease from the 18,066 trillion Btu produced in FY2012.

The production figures were first reported in June, marking the first time the EIA has compiled an annual production report and segregated the data by state.

For the second consecutive year, Wyoming led all other states in gas production on federal and Indian lands, producing 1,275 Bcf during FY2013. The GOM was a close second at 1,086 Bcf, followed by New Mexico (702 Bcf) and Colorado (468 Bcf). Total gas production was 4,082 Bcf, down 10% from the 4,535 produced in FY2012.

In FY2003, gas production in the GOM totaled 4,194 Bcf, accounting for 59.2% of total production (7,082 Bcf). But gas production in the GOM has declined every year since. Elsewhere in gas production:

The GOM continued to dominate crude oil production on federal and Indian lands, producing 447 million bbl in FY2013. New Mexico was a distant second at 51 million bbl, but North Dakota has closed the gap to take the third spot (46 million bbl), followed by Wyoming (35 million bbl).

Crude oil production in the GOM was 531 million bbl in FY2003, and has been in decline for most of the past 10 years, but it peaked at 584 million bbl in FY2010. Wyoming’s crude oil production has been flat for the decade and was second only to the GOM until FY2011, when New Mexico tied it at 35 million bbl. Since then, New Mexico has been second and Wyoming third.

According to the EIA, crude oil production in North Dakota has been increasing rapidly. The state started the decade at 6 million bbl in FY2003 and nudged up to 8 million bbl in FY2009. But production zoomed during the next three fiscal years, to 12 million, 19 million and 33 million bbl, respectively. After beginning the decade 26 million bbl behind New Mexico, North Dakota is now 4 million bbl behind — leading to the possibility of North Dakota surpassing New Mexico for second place overall in FY2014.

The EIA’s estimates are based on data provided by the U.S. Department of Interior’s (DOI) Office of Natural Resources Revenue (ONRR), and include sales of production from federal lands onshore and offshore, and from Indian lands.

Last month, the DOI proposed amending regulations over how it determines the value, for royalty purposes, of oil produced on American Indian leases (see Daily GPI, June 19). If enacted, the department said the change could boost tribal royalties by $20 million annually. ONRR had conducted numerous meetings with tribal representatives and Indian mineral landowners to gain feedback on proposed changes to regulations governing Indian oil valuation.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |