EIA: Wyoming, GOM Lead NatGas Production on Federal, Indian Lands

Wyoming, the federal Gulf of Mexico (GOM), New Mexico and Colorado collectively accounted for 86% of total natural gas sales from production on federal and Indian lands during fiscal year (FY) 2013, according to a report by the U.S. Energy Information Administration (EIA).

Meanwhile, crude oil sales from production in the GOM made up 69% of production on federal and Indian lands in FY 2013. New Mexico, North Dakota and Wyoming were the next largest crude producers, with the latter two states hosting ramped-up production from the Bakken Shale.

In a “Today in Energy” brief released Tuesday, the EIA said Wyoming (8,393 trillion Btu) and the GOM (3,858 trillion Btu) together produced 73% of the federal and Indian lands fossil fuels total in FY 2013. New Mexico (1,403 trillion Btu), Colorado (872 trillion Btu) and Utah (733 trillion Btu) were the next largest production states.

Total fossil fuel production was 16,854 trillion Btu in FY 2013, a 6.7% decrease from the 18,066 trillion Btu produced in FY 2012.

The production figures were first reported on June 19 (see Shale Daily, June 20). The report marks the first time the EIA has compiled an annual production report and broken the data down by state.

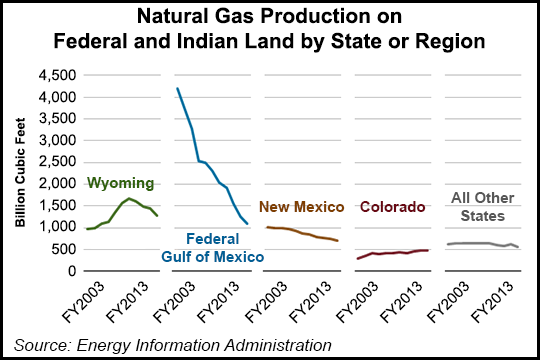

For the second consecutive fiscal year, Wyoming led all other states in gas production on federal and Indian lands, producing 1,275 Bcf during FY 2013. The GOM was a close second at 1,086 Bcf, followed by New Mexico (702 Bcf) and Colorado (468 Bcf). Total gas production was 4,082 Bcf, down 10% from the 4,535 produced in FY 2012.

Ten years ago, during FY 2003, gas production in the GOM totaled 4,194 Bcf, accounting for 59.2% of that year’s total production (7,082 Bcf). But gas production in the GOM has declined every year since. Elsewhere:

Wyoming began the decade at 965 Bcf in FY 2003, peaked at 1,672 Bcf in FY 2009, and has declined every year since;

New Mexico has seen a slow, steady decline every year for the decade, beginning at 1,005 Bcf in FY 2003; and

Colorado has trended upward over the decade, starting at 290 Bcf in FY 2003 and peaking at 485 Bcf in FY 2012.

The GOM continued to dominate crude oil production on federal and Indian lands, producing 447 million bbl in FY 2013. New Mexico was a distant second at 51 million bbl, but North Dakota has closed the gap to take the third spot (46 million bbl), followed by Wyoming (35 million bbl).

Crude oil production in the GOM was 531 million bbl in FY 2003, and has been in decline for most of the past 10 years, but it peaked at 584 million bbl in FY 2010. Wyoming’s crude oil production has been flat for the decade and was second only to the GOM until FY 2011, when New Mexico tied it at 35 million bbl. Since then, New Mexico has been second and Wyoming third.

According to the EIA, crude oil production in North Dakota has been increasing rapidly. The state started the decade at 6 million bbl in FY 2003 and nudged up to 8 million bbl in FY 2009. But production zoomed during the next three fiscal years, to 12 million, 19 million and 33 million bbl, respectively. After beginning the decade 26 million bbl behind New Mexico, North Dakota is now just 4 million bbl behind — leading to the possibility of North Dakota surpassing New Mexico for second place overall in FY 2014.

The EIA’s estimates are based on data provided by the U.S. Department of Interior’s Office of Natural Resources Revenue and include sales of production from federal lands, both onshore and offshore, and from Indian lands.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |