Eagle Ford Shale | NGI All News Access

Denver-Based Hawkwood Enters East Texas Plays

In two separate deals, Denver-based Hawkwood Energy LLC has made its entry into the emerging East Texas Eagle Ford and Woodbine plays, acquiring producing and nonproducing assets in Brazos, Leon, Madison, and Robertson counties, TX.

Hawkwood bought Crimson Energy Partners III’s assets, which are located mostly in Brazos County. It also bought certain Encana Oil and Gas (USA) Inc. assets, which are mostly in Robertson County. The combined transactions include about 1,800 b/d of oil production and more than 50,000 “generally contiguous” net undeveloped acres. Terms were not disclosed.

“We are excited about the growing unconventional activity in the Eagle Ford and Woodbine, as well as the other long-term multi-pay opportunities the area has to offer,” said CEO Patrick Oenbring. “Hawkwood intends to invest significant capital and resources into the area to create substantial value for its investors.”

Activity in East Texas has been picking up over the last year or so, Hawkwood’s Peter Jeffe, head of business development, told NGI’s Shale Daily. He declined to discuss how much acreage in the region is going for or how many acres Hawkwood would eventually like to hold.

“I would just say we are actively expanding and interested in additional acquisitions in the area,” he told NGI’s Shale Daily. “…[O]verall the play is relatively immature, but the activity has seen a marked increase in the last year or so. And so all indications are this area will see continued increasing activity; it’s still early, but increasing substantially.”

In January GE Energy Financial Services and an affiliate of Vess Oil Corp. announced a deal to acquire 13,000 net acres in East Texas and associated production from the Woodbine formation from an EnerVest Ltd. affiliate for $108 million (see Shale Daily, Jan. 9).

Halcon Resources Corp. is active in the East Texas Eagle ford, which it calls its El Halcon play. Last year the Houston-based company reallocated capital from its Woodbine play in order to delineate El Halcon (see Shale Daily, June 11, 2013).

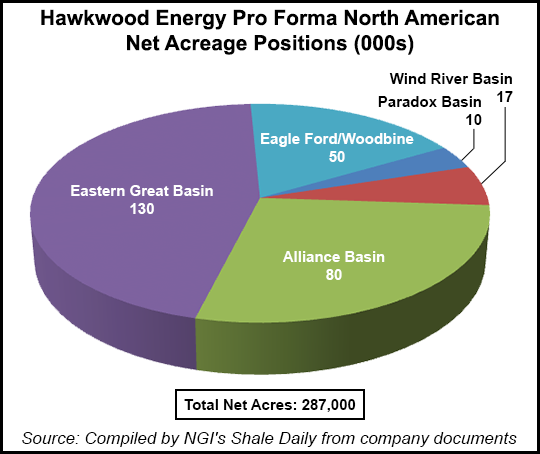

Hawkwood began operations in 2012 with a line-of-equity commitment of $315 million from lead investors Warburg Pincus and Ontario Teachers’ Pension Plan. The company is operating and investing in the Alliance Basin of Nebraska as well as in East Texas.

In January the company announced the acquisition of more than 200,000 net acres in the White River Valley region of the Eastern Great Basin in Nevada, giving it “a large and contiguous acreage position” over the Chainman Shale, a thick and organically rich member of the Mississippian-aged column. “The play is one of the few remaining large-scale shale plays in the United States that has seen little to no modern drilling and testing,” Hawkwood said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |