NGI Archives | NGI All News Access

California Continues to Gear Up for More Oil-by-Rail

Given the North American shale boom and global energy and political developments, California can expect continued sharp increases in the amounts of crude oil shipped by rail, top energy officials were told during a daylong California Energy Commission (CEC) workshop in Sacramento.

The CEC is holding a series of fact-gathering sessions on crude-by-rail (CBR) to include in the 2014 update of its Integrated Energy Policy Report (IEPR), which will go to the governor and state legislature.

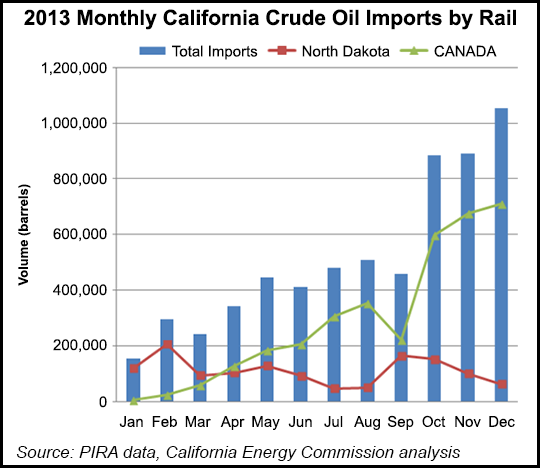

Compared to the first four months of 2013, CBR volumes are up by 90% this year, said Gordon Schremp, CEC senior fuels specialist, one of more than two dozen state, federal and industry energy and rail experts that made presentations during last week’s workshop. In 2012, 1.1 million bbl were moved by rail, and that jumped up to 6.3 million bbl moved by train last year. Through April this year, the total was 1.97 million bbl.

Schremp said the CEC is tracking five new projects in the state for building new rail terminal capacity to handle increased shipments — two in Northern California, two in Bakersfield in the south and one in central California in San Luis Obispo County.

“If all get permits, financing and construction and operate at full capacity, those terminals collectively will be able to handle a 23% increase in CBR shipments,” Schremp said.

One of the keys to rail terminal develop, according to Schremp, is the fact that there is no oil pipeline interconnection between Northern and Southern California. The state’s oil pipelines are controlled by a combination of common carrier and private companies.

“Kinder Morgan is the sole common carrier provider of petroleum product pipelines in the state, and transports the majority of transportation fuels through its system daily,” Schremp said. “Other private companies — Chevron, ExxonMobil, Shell and Tesoro — operate some proprietary systems or segments handling the balance of the transportation fuels.”

In Northern California the new CBR terminal facilities on the drawing board include Valero’s project in Benicia, CA, to process 70,000 b/d that could be built in a six-month time frame, and WesPac’s combined 50,000 b/d rail and 192,000 b/d marine terminal that has a 12-15-month development/construction timeframe. Along with rail connections, the WesPac facility would be tied to two pipelines connecting with four East San Francisco Bay refineries (Valero, Shell, Tesoro and Phillips 66).

Two crude handling rail terminals in the north — a Kinder Morgan site and one other facility — collectively handled 3,451 b/d last year, but they are permitted to handle more than 21,000 b/d.

Two new rail terminals are proposed in Bakersfield, collectively being able to handle up to 215,000 b/d — the Alon Crude Flexibility Project (150,000 b/d) and the Plains All American facility, now under construction (65,000 b/d). The Plains terminal should be operational before the end of the year, Schremp said.

Currently, Southern California has four crude rail receipt facilities — Bakersfield, Carson, Long Beach and Vernon — totaling 13,800 b/d of capacity.

A fifth new rail crude handling facility is planned for Santa Maria refinery in San Luis Obispo, with a planned capacity of 41,000 b/d. A revised environmental impact review is scheduled to be completed later this year with a 9- to 12-month construction time frame, said Schremp, who mentioned two other projects that have been proposed but are not currently active in permitting.

One of the added two is a project proposed by Questar to convert an idle natural gas pipeline to carry crude from a proposed rail offloading facility in the Southern California desert to refineries in the Los Angeles Basin.

Still in the West, but outside of California, Schremp identified up to a half-dozen proposed crude rail terminal projects in the Pacific Northwest, collectively totaling nearly 200,000 b/d in capacity.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |