E&P | NGI All News Access | NGI The Weekly Gas Market Report

Encana Selling Gassy Bighorn Portfolio to Apollo Unit for $1.8B

Encana Corp. on Friday pulled the trigger on another big natural gas property in a $1.8 billion deal that would send the Bighorn portfolio in Western Canada’s Deep Basin to private equity’s Apollo Global Management LLC.

Apollo’s Jupiter Resources Inc., which is based in Calgary, as is Encana, would become the operator for around 360,000 acres and have interests in pipelines, facilities and service arrangements. The west-central Alberta leasehold had about 1.1 Tcfe of total net proved reserves at the end of 2013, 75% weighted to gas.

“Bighorn is a high quality asset that has not been receiving significant investment in 2014,” Encana CEO Doug Suttles said. “It should serve as an excellent foundational asset for Jupiter Resources.”

As it began to overhaul its strategy last year, Encana has been selling gas fields and buying oil property. Since the start of this year, the operator has agreed to sell $4.1 billion of assets, including its once prized Jonah gas field in Wyoming and gas-weighted land in East Texas (see Shale Daily, April 29; March 31).

In May, Encana used some of the proceeds from those sales to buy Eagle Ford Shale property in a $3 billion deal with Freeport-McMoRan Copper & Gold Inc., which by itself doubled oil production (see Shale Daily, May 7).

Encana added Bighorn to its portfolio in 2006 (see Daily GPI, April 27, 2006). Its original position covered close to 448,000 net acres in the Cretaceous-aged reservoirs within the Deep Basin.

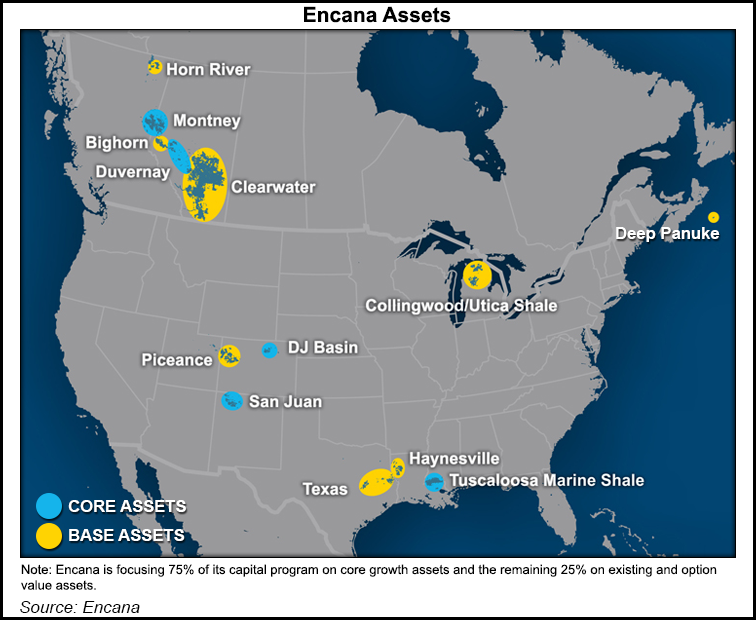

Suttles said the transaction “advances our strategy by unlocking value from our portfolio as we focus on developing our core growth plays and extracting additional value from our base assets.” Encana has reduced its capital spending to all but a handful of oil and liquids-rich plays: the Montney and Duvernay in Western Canada; the Denver Julesburg Basin in Colorado, the San Juan Basin and the Tuscaloosa Marine Shale. Eagle Ford was added to the priority list with the Freeport deal.

“We are very excited about the opportunity to actively develop the Bighorn assets, one of North America’s premier liquids-rich natural gas projects,” Jupiter CEO Simon Bregazzi said. “We are also very fortunate to have the support of Apollo, one of the world’s leading private equity investors with deep expertise in natural resources…”

Apollo had been working with Encana on the transaction for a few months. The New York-based private equity earlier this year committed $700 million to help fund U.S.-focused producer Zenergy LLC (see Shale Daily, June 5). In May it also provided $500 million to expand Canada’s CSV Midstream Solutions Corp.

The Bighorn deal is scheduled to close by the end of September. Encana plans to update its 2014 guidance in a second quarter earnings announcement on July 24.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |