North America Downstream Material, Labor Costs Seen Rising Over Next Six Months

Increasing investments in the North American petrochemical, pipeline and liquefied natural gas (LNG) sectors may boost costs and strain labor over the next six months, according to an analysis.

IHS Inc. and Procurement Executives Group’s Engineering and Construction Cost Index (ECCI) said in a new report that subcontractor labor costs and materials costs are expected to increase, based on a survey of 20 companies on June 2.

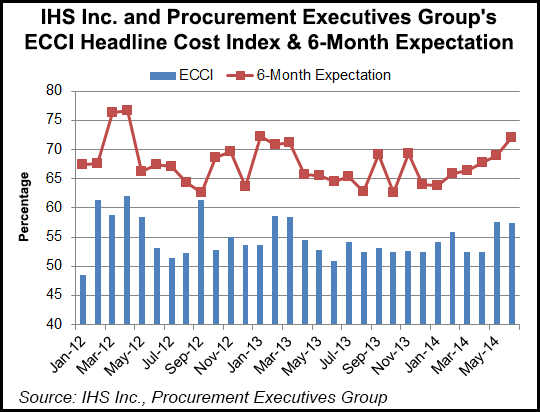

“Current construction costs rose for the 29th consecutive month in June,” researchers said. “The headline current ECCI registered 57.4% in June, a touch softer than the May reading. The current materials/equipment price index softened slightly to 57.6%, down 1.0% from the May reading.

“Nevertheless, for a second month, all 12 subcomponents remain at or above the neutral mark — the first time we have seen consecutive months of such uniformed movement since May 2012.”

The ECCI recorded a “noticeable split in the underlying detail between intermediate and finished products. Carbon steel pipe, ready-mix concrete and alloy steel pipe showed respectively the strongest upward monthly movements over May, while pumps and compressors, heat exchangers and transformers showed the strongest downward movements.”

The ECCI, introduced last November, tracks industry specific trends and variations, identifies market turning points for key projects, and is intended to act as an indicator for wage and material inflation specific to engineering, procurement and construction (EPC) firms.

“The current subcontractor labor index rose to 57% in June, up 1.9% from last month and the highest reading since February,” researchers said. “The strongest movements were recorded in the U.S. South and Western Canada.

“Respondents again expressed concern over tightness in skilled labor markets in these two regions — specifically referencing qualified welders and pipefitters. “

The six-month headline expectations index strengthened to 72.1% in June, the highest reading since January 2013, with both the materials/equipment and subcontractor labor subcomponents showing upward movements. The materials/equipment portion strengthened to 73.4%, the highest reading since February 2013, “with pockets of strength focused in alloy pipe, ready mix concrete, and fabricated structural steel.”

Expectations for subcontractor labor registered 69.1%, up 2.6% from May, driven by stronger expectations in the Midwest and South regions.

North America companies have more than $100 billion of downstream projects in the queue to build, including high-priced petrochemical and LNG export projects “located in isolated areas in Texas and Louisiana, straining the ability for local labor markets to satisfy demand.” British Columbia also has several LNG proposed export projects.

More pipelines also are being built, particularly in the oily Bakken Shale and gassy Appalachian Basin, to carry surplus to Gulf Coast and eastern/southeastern markets.

The ECCI is based upon data independently obtained and compiled by IHS from procurement executives representing leading EPC firms.

Each survey response is weighted equally for every $2 billion in spending in North America. Respondents are asked whether prices, either actual paid transactions or company-informed transactions this month were higher/lower/same for individual materials/equipment/subcontractor rates as the prior month. Respondents are then asked for their six-month pricing expectations among those subcategories.

The results are compiled into diffusion indexes, whereby a reading of more than 50 represents upward pricing strength and a reading below 50 represents downward pricing strength.

Companies surveyed include Bechtel Corp., Black & Veatch, CH2M Hill, Fluor Corp., Foster Wheeler USA Corp., McDermott International Inc., KBR, Peter Kiewit Sons Inc., SNC-Lavalin Inc., Technip USA Inc. and Wood Group Mustang.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |