Marcellus | E&P | NGI All News Access | Utica Shale

REX Heeds ‘Go West’ Call, Files Zone 3 Project at FERC

For some time now, Rockies Express Pipeline LLC (REX) has heard the call from the Appalachian Basin: “Go West, Rockies pipeline.” REX recently filed with FERC for a project that would do just that, enabling Appalachian producers to access Midwest markets.

REX filed with the Federal Energy Regulatory Commission (FERC) for a project that would create 1,200,000 Dth/d of east-to-west firm capacity within the pipeline’s Zone 3.

“…Rockies Express proposes to meet new market demand for gas originating in the Appalachian Basin,” the pipeline said in its filing. “Since Rockies Express went into service, the gas markets have changed fundamentally, and the pipeline’s eastern terminus in Ohio is now at the center of a large and growing production basin. Consequently, Rockies Express is favorably located, with certain modifications, to receive gas in Ohio for delivery to markets and interconnected pipelines as far west as Illinois.”

Capacity would be available to move Appalachian gas from the Clarington Hub in Monroe County, OH, to an interconnect with Natural Gas Pipeline Co. of America (NGPL) in Moultrie County, IL.

“The Zone 3 East-to-West Project will utilize existing pipeline and certain compressor stations that are already certificated and in service, and will only require the specified changes to the Rockies Express system,” which are:

“Once these modifications are complete, the Rockies Express Zone 3 mainline will become bidirectional between the Clarington Hub located in Monroe County, OH, and the existing Natural Gas Pipeline Co. of America delivery interconnect located in Moultrie County, IL, which in turn will generate 1,200,000 Dth/d of firm east-to-west transportation capacity on this portion of the system.”

REX wants to go westward in order to carry Appalachian natural gas to Midwest markets. The blossoming of gas supply in the Appalachian Basin has made eastbound REX something of a dinosaur before its time (see Shale Daily, April 30). The pipeline’s Seneca Lateral is the pipeline’s first bite out of the westbound apple (see Daily GPI, June 18).

NGPL is working on a reversal of part of its Gulf Coast mainline to move gas south. The Kinder Morgan subsidiary said the expansion would increase its capability to flow up to 750,000 Dth/d of incremental volume from the REX interconnection at Moultrie, IL, to points south on its mainline, through the reversal of some existing lines (see Shale Daily, March 12).

REX could also feed a southbound project of Boardwalk Pipeline Partners LP’s Texas Gas, which is holding a binding open season through July 28 for its Northern Supply Access expansion, a project that would provide for receipts of Marcellus and Utica shale gas seeking markets in the Southeast and Gulf Coast. The binding open season follows a nonbinding offering earlier this year (see Shale Daily, March 28).

Texas Gas is offering 584,000 MMBtu/d of capacity from a combination of receipt points including Texas Eastern, Dominion, and REX at Lebanon, OH, and from REX at Smith Valley, IN. Potential receipt points with ANR Pipeline at Smith Valley and EQT Midstream at Lebanon may provide additional supply options. The projected in-service date is April 1, 2017.

In its FERC filing, REX said existing shippers’ eastbound service would not be affected by the changes it proposes as they would allow for an additional 1,200,000 Dth/d of east-to-west forward haul capacity in Zone 3. All shippers would benefit from enhancements proposed for the affected compressor stations, it said.

“…[T]he proposed modifications to the Rockies Express system will provide interconnected gas users and local distribution companies with the opportunity to diversify their gas supplies since the modified system will be able to receive gas from both the Rockies and Appalachian production regions,” REX said. “Further, the project is expected to result in additional throughput for interconnected pipelines in the Rockies Express Zone 3.”

Marcellus Shale gas has been finding a home in northeastern markets, REX said, but Utica Shale gas appears to be bound for the Midwest where would serve retail consumers, commercial users and new gas-fired power generation, which is expected to replace coal-fired plants.

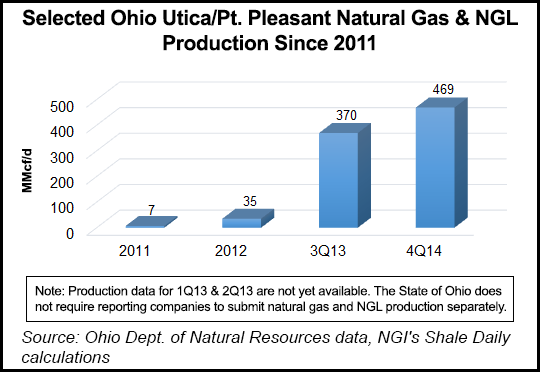

Natural gas and natural gas liquids (NGL) production out of the Utica/Pt. Pleasant has been on the upswing in recent years, surging to 459 MMcf/d in 4Q2014 from just 7 MMcf/d in 2011, according to Ohio Department of Natural Resources data.

REX said in the filing that it has binding commitments for the full 1,200,000 Dth/d from four shippers for 20 year terms. They are American Energy-Utica LLC (550,000 Dth/d), EQT Energy LLC (300,000 Dth/d), Gulfport Energy Corp. (175,000 Dth/d) and Rice Drilling B LLC (175,000 Dth/d).

The pipeline is proposing to apply its currently effective Part 284 transportation rates as the applicable recourse rates for the proposed capacity. “The Commission recently noted in a declaratory order that Rockies Express’s currently effective tariff rates for transportation under Rates Schedule FTS, which are stated as a zonal matrix, apply to east-to-west transportation within Zone 3,” the pipeline said (see Shale Daily, Dec. 2, 2013).

As production in the Marcellus and Utica climbs (see Shale Daily, April 25), multiple solutions for the takeaway capacity shortfall out of the Appalachia region have been proposed or are in the works. Kinder Morgan’s Tennessee Gas Pipeline has been providing capacity out of the region, too (see Daily GPI, April 22). Recently, TransCanada Corp.’s ANR secured almost 2 Bcf/d of firm commitments on its Southeast Main Line (see Shale Daily, March 31).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |